What Grubhub vs Doordash vs Postmates Comparison Reveals About 4 Key Metrics Across the UK & Canada?

Introduction

Food delivery platforms have transformed how customers in the UK and Canada order meals, groceries, and quick-service items. But while users often assume these apps offer the same value everywhere, the reality is much more complex. When comparing platforms across two countries, differences appear in delivery coverage, restaurant partnerships, service speed, and customer pricing structures.

In today’s fast-changing delivery economy, even minor shifts in service fees, delivery charges, and promotional strategies can influence customer behavior. A detailed Price Comparison across major platforms shows that the same food order can cost significantly more depending on the app, region, and time of day.

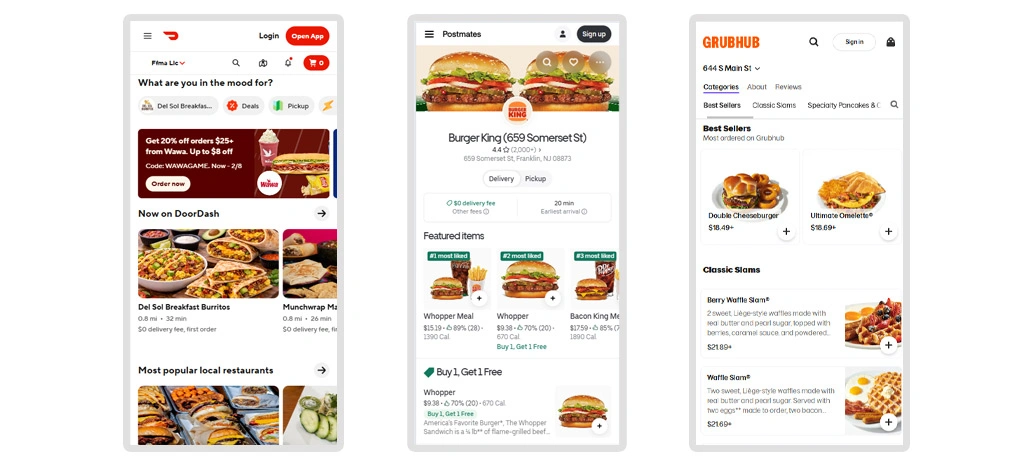

A detailed Grubhub vs Doordash vs Postmates Comparison also reveals how consumer experience varies based on availability, partner reach, and delivery performance. This blog breaks down four key metrics and highlights what the numbers reveal about platform competition across the UK and Canada.

Measuring Platform Reach Through Restaurant Listing Depth

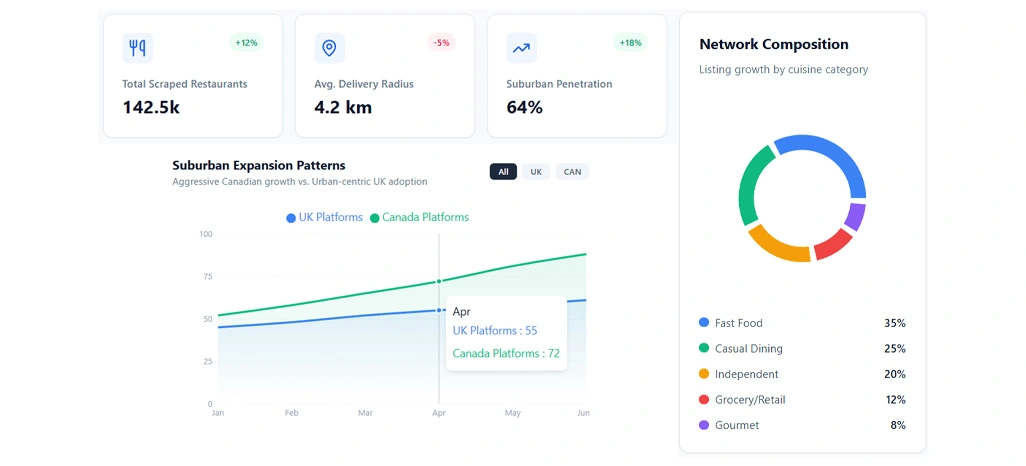

Delivery platforms succeed or fail based on how widely they operate and how many restaurant partners they can onboard in each city. In both the UK and Canada, this reach is not evenly distributed. Major metro areas naturally show stronger delivery app penetration, while suburban zones depend heavily on courier availability and restaurant density.

A structured Food Delivery App Comparison UK & Canada highlights how UK delivery adoption remains highly city-focused, while Canadian delivery platforms expand aggressively into suburban neighborhoods due to higher dependency on app-based ordering. This creates a competitive advantage for platforms that can maintain a consistent restaurant network beyond central urban hubs.

Businesses monitoring expansion patterns can also understand which cities offer the highest growth potential. Using Food Data Scraping, analysts can track restaurant listing growth, cuisine distribution, and service-area expansion without relying on platform claims.

Coverage and Restaurant Network Snapshot:

| Metric | UK Market Trend | Canada Market Trend |

|---|---|---|

| City Coverage | Very high | Very high |

| Suburban Reach | Moderate | High |

| Restaurant Density | High in metro areas | High in metro + suburbs |

| Independent Listings | Strong | Strong |

| Chain Partnerships | High | Very high |

Market Expansion Indicators:

| Factor | UK | Canada |

|---|---|---|

| Restaurant Listing Growth | 8% yearly | 11% yearly |

| Expansion Speed | Medium | Fast |

| Multi-platform Listings | High | Very high |

| App Ordering Dependence | Medium-high | High |

Evaluating Fee Structures and Customer Cost Patterns

Even when customers see the same restaurant listed across multiple apps, the final payable amount can vary due to service fees, delivery charges, promotional discounts, and peak-hour pricing adjustments. A detailed review of Doordash vs Grubhub vs Postmates in Canada shows that Canadian pricing tends to fluctuate more frequently due to demand surges, weather-based delivery challenges, and competitive discounting.

In contrast, the UK market often maintains more stable pricing, especially within major city zones. With Compare Grubhub Postmates and Doordash Using Web Scraping, businesses can track delivery charges in real time across cities, ensuring they are not relying on outdated app fee structures.

This also helps identify where one platform is undercutting competitors and where customers are paying higher convenience premiums. This comparison becomes even more valuable when analyzing How Grubhub Compares With Postmates and Doordash, since fee structures often reflect a platform’s long-term strategy to grow user adoption or maximize per-order revenue.

Delivery Fee Range Comparison:

| Platform | UK Delivery Fee Range | Canada Delivery Fee Range |

|---|---|---|

| Grubhub | £1.99 – £4.99 | CAD 2.99 – CAD 7.99 |

| Doordash | £2.49 – £5.49 | CAD 3.49 – CAD 8.49 |

| Postmates | £1.49 – £4.49 | CAD 2.49 – CAD 7.49 |

Customer Pricing Behavior Overview:

| Cost Element | UK Pattern | Canada Pattern |

|---|---|---|

| Service Fee Stability | High | Medium |

| Peak-Hour Price Shifts | Limited | Frequent |

| Subscription Adoption | Medium | High |

| Promotional Frequency | Medium | High |

Tracking Delivery Speed and Service Reliability Trends

Fast delivery alone is not enough to build customer loyalty. What truly matters is reliability—consistent arrival times, low cancellation rates, accurate order handling, and stable courier availability. These factors directly influence app ratings, restaurant performance, and consumer trust.

In Canada, weather conditions and longer suburban travel routes can significantly affect delivery times. In the UK, dense urban congestion creates different challenges, especially during peak lunch and dinner hours. Using a Web Scraping API for Food Delivery Data, businesses can track estimated delivery windows, courier availability fluctuations, and delivery performance across cities.

A strong set of Canada Food Delivery Market Insights also shows that customers in Canada tend to prioritize order accuracy and dependable delivery scheduling, particularly during winter seasons. This data becomes even more meaningful when analyzing Food Delivery Availability and Pricing Comparison UK Canada, since delays and cancellations often influence how customers perceive value, even if delivery fees appear competitive.

Average Delivery Time Estimates:

| Region Type | UK Average Delivery Time | Canada Average Delivery Time |

|---|---|---|

| Urban Areas | 25–38 minutes | 28–42 minutes |

| Suburban Areas | 35–55 minutes | 40–60 minutes |

| Peak Hours | +10 to 15 minutes | +12 to 18 minutes |

Reliability and Performance Signals:

| Metric | UK Trend | Canada Trend |

|---|---|---|

| Late Delivery Frequency | Moderate | Moderate-high |

| Cancellation Rate | Low-moderate | Moderate |

| Courier Availability | High in cities | High but seasonal drops |

| Customer Complaints | Medium | Medium-high |

How Retail Scrape Can Help You?

Many businesses struggle to understand why one platform performs better than another across different regions. With Grubhub vs Doordash vs Postmates Comparison, we help brands turn scattered platform data into structured insights that support better decisions.

We Helps You Track:

- Restaurant listing expansions across locations.

- Delivery time variations by city and hour.

- Service fee changes and platform commission patterns.F

- Promotional offers frequency tracking.

- Customer review trend monitoring.

- Competitive platform positioning across regions.

With this data foundation, businesses can perform Food Delivery Competitive Analysis Using Scraped Data to measure platform strength, forecast consumer demand, and improve regional performance strategies.

Conclusion

The delivery market in the UK and Canada is not shaped by branding alone—it is driven by coverage reach, delivery reliability, pricing structure, and restaurant network density. A detailed Grubhub vs Doordash vs Postmates Comparison proves that platform performance differs greatly across cities, and businesses that rely only on surface-level assumptions risk losing market share.

For brands that want to act on real insights, Food Delivery App Comparison UK & Canada becomes a valuable lens to identify gaps in service quality, improve pricing alignment, and strengthen competitive positioning. Contact Retail Scrape today to start building data-driven strategies for food delivery success.