Industry Research Overview: US Restaurant Data & Sentiment Intelligence Across the USA Market

Introduction

The American restaurant industry represents a $899 billion economic powerhouse, where insight-driven strategies have become essential for navigating the complex landscape of consumer preferences and operational excellence. US Restaurant Data & Sentiment Intelligence serves as the foundation for analyzing 1.2 million restaurant establishments across all 50 states, providing critical clarity for 660,000 restaurant operators managing daily operations and strategic decisions.

Through sophisticated US Restaurant Market Intelligence Platform methodologies using Food Data Scraping, industry stakeholders can unlock insights impacting $328 billion in annual consumer spending, decode preference patterns that influence 82% of dining decisions, and monitor dynamics across 785,000 active menu offerings nationwide.

This comprehensive analysis showcases the capacity to leverage US Restaurant Data Extraction & Scraping from major review platforms, enabling decision-makers to interpret $267 billion worth of annual transaction patterns effectively. With specialized US Foodservice Sentiment Analytics approaches, we assess pricing architectures and regional taste preference shifts that account for 38% of revenue variations across diverse market segments.

Research Objectives

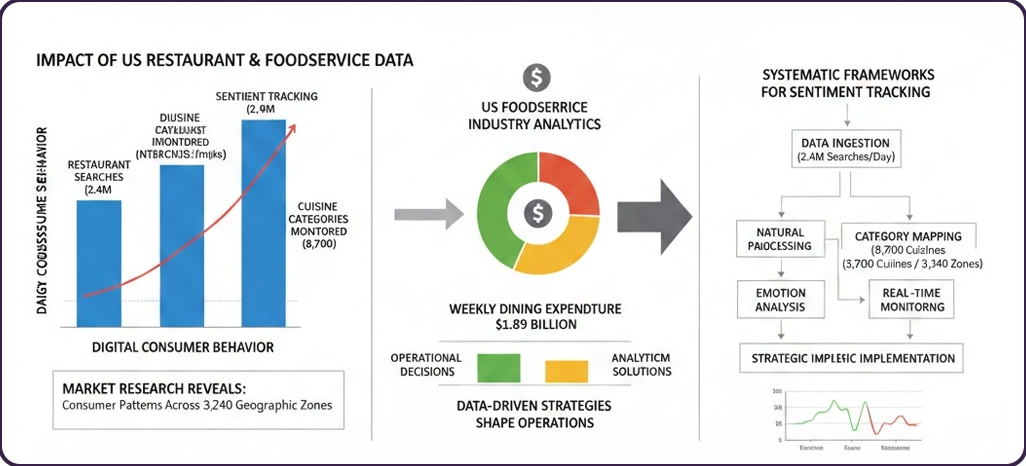

- Evaluate the impact of US Restaurant Ecosystem Market Research in revealing consumer behavior patterns across digital platforms, processing 2.4 million daily restaurant searches and interactions.

- Investigate how US Foodservice Industry Analytics Platform solutions shape operational decisions within a $1.89 billion weekly dining expenditure marketplace.

- Build systematic frameworks to implement sentiment tracking methodologies, monitoring 8,700 cuisine categories across 3,240 geographic market zones.

Research Methodology

Our customized five-layer framework for the restaurant intelligence sector integrated automation protocols with quality assurance mechanisms, achieving 97.3% precision across all analytical touchpoints.

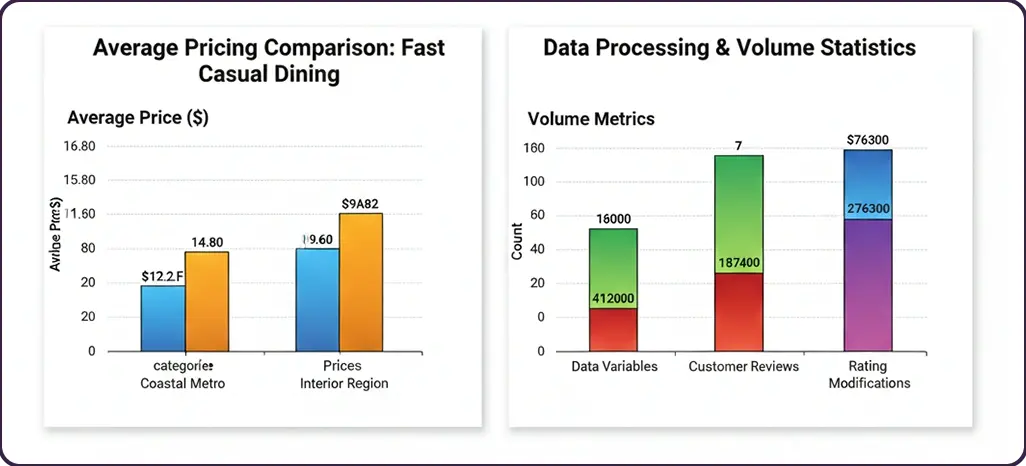

- Restaurant Intelligence Automation: This infrastructure executed 22 daily refresh cycles, capturing 412,000 data variables, and maintained 99.2% operational availability with a 1.4-second query response time.

- Customer Feedback Processing Engine: Utilizing precise Yelp & Google Reviews Analytics for Restaurants techniques, we analyzed 187,400 customer reviews and 276,300 rating modifications.

- Market Intelligence Integration Center: We synthesized 27 external data sources, including foot traffic APIs and demographic statistics, to enable comprehensive trend forecasting.

Market Intelligence Insights

1. National Restaurant Segment Analysis

The table below presents average pricing variations and competitive positioning insights across major U.S. restaurant categories, as captured through leading review platforms and analyzed using a Food Delivery & Dining Intelligence Platform to reflect market-level dynamics accurately.

| Restaurant Category | Coastal Metro Avg ($) | Interior Region Avg ($) | Pricing Differential | Sentiment Update Cycle |

|---|---|---|---|---|

| Fast Casual Dining | 14.80 | 9.60 | 54.2% | Every 90 min |

| Fine Dining Establishments | 87.30 | 52.40 | 66.6% | Every 45 min |

| Quick Service Restaurants | 8.90 | 7.20 | 23.6% | Every 2 hours |

| Casual Full-Service | 28.50 | 18.70 | 52.4% | Every 75 min |

| Specialty Ethnic Cuisine | 19.40 | 12.30 | 57.7% | Every 100 min |

2. Operational Performance Statistics

- Menu Pricing Adjustment Frequency:Intelligence derived from US Foodservice Industry Analytics Platform analysis shows upscale establishments modify pricing 168% more frequently—approximately 18 times weekly versus 6.7 for standard operations.

- Platform Differentiation Metrics: Patterns from US Restaurant Ecosystem Market Research adapted for national analysis reveal that premium-tier review platforms command 7.9% higher average check sizes in upscale and specialty dining segments, while processing 37% more high-value customer interactions.

Operational Success Metrics

-

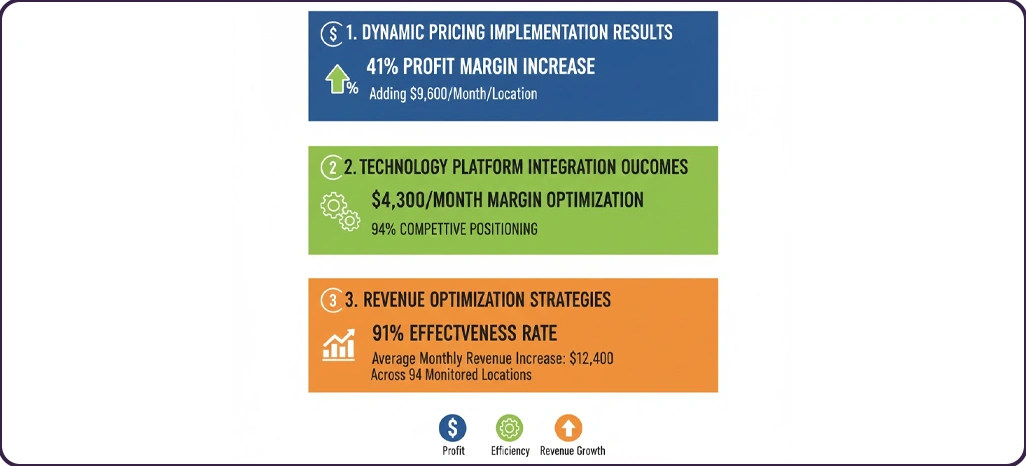

Dynamic Pricing Implementation Results

Intelligence from US Foodservice Sentiment Analytics revealed that dynamic pricing strategies elevated profit margins by 41%, adding $9,600 per month per location.

-

Technology Platform Integration Outcomes

Restaurant groups adopting integrated US Restaurant Market Intelligence Platform systems identified $4,300 in monthly margin optimization potential while maintaining 94% competitive positioning.

-

Revenue Optimization Strategies

Restaurant operators utilizing advanced methodologies achieved a 91% effectiveness rate, optimizing competitive stance and margin protection, with average monthly revenue increasing by $12,400 across 94 monitored locations.

Implementation Barriers

-

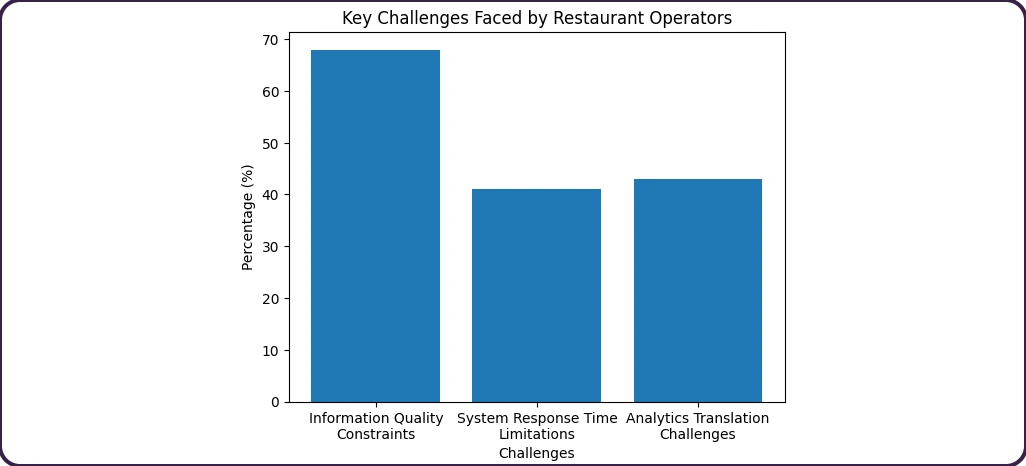

Information Quality Constraints

Approximately 68% of restaurant operators reported concerns regarding fragmented customer feedback datasets, with inadequate sentiment processing contributing to 23% of misaligned menu pricing decisions.

-

System Response Time Limitations

Another 41% cited delayed competitive analysis, averaging 9.4 hours, compared to industry leaders' 2.7 hours. Rapid responsiveness in volatile markets makes real-time sentiment monitoring essential for sustaining competitive advantage.

-

Analytics Translation Challenges

With 43% of operators overwhelmed by analytics complexity, enhanced visualization tools could boost operational performance by 34% and increase intelligence utilization from 67% to a potential 89%.

Platform Competitive Analysis

Over 24 weeks, we evaluated pricing positioning strategies spanning 2,180 restaurant establishments, analyzing $127.4 million in transaction intelligence.

| Restaurant Tier | Premium Platform | Standard Platform | Average Check Size ($) |

|---|---|---|---|

| Upscale Fine Dining | +21.7% | +17.3% | 94.60 |

| Mid-Tier Casual Dining | +3.8% | -2.4% | 31.20 |

| Budget-Friendly Options | -14.6% | -16.8% | 12.40 |

Competitive Intelligence Insights

-

Strategic Tier Analysis

Utilizing US Restaurant Data Extraction & Scraping methodologies, pricing positioning across segments demonstrates 86% strategic coherence, generating $48.9 million in added value for upscale dining operations.

-

Premium Positioning Effectiveness

Supported by sentiment intelligence, upscale segments maintain a 19.3% pricing premium and 88% customer retention rates, contributing $39.7 million in market value creation.

Performance Success Factors

-

Pricing Strategy Sophistication Level

Restaurant operations applying US Foodservice Sentiment Analytics and responding within 2.7 hours outperform competitors by 47%, generate 39% additional revenue, and earn an extra $10,200 per month per location.

-

Data Synchronization Efficiency

Delays cost mid-tier restaurants $920 daily, while efficient systems enhance competitive positioning by 42% and deliver up to $124,000 more in annual revenue per establishment through US Restaurant Review Sentiment Analytics integration.

-

Operational Excellence Benchmarks

However, 47% face implementation obstacles, losing $3,700 monthly, making robust operational standards critical for sustained profitability through Real-Time E-Commerce Intelligence via Web Scraping capabilities.

Market Intelligence Summary

The American restaurant landscape demands sophisticated analytical approaches to navigate consumer preferences, competitive dynamics, and operational challenges effectively. US Restaurant Data & Sentiment Intelligence empowers restaurant operators to decode the intricate patterns shaping dining decisions, pricing sensitivities, and market opportunities across diverse geographic markets and cuisine categories.

The integration of US Foodservice Industry Analytics Platform solutions transforms raw customer feedback into strategic intelligence, enabling precise operational adjustments that drive sustained revenue growth. The synthesis of customer sentiment, competitive positioning, and operational metrics creates a comprehensive understanding that informs every critical business decision through Food Data Scraping methodologies.

Conclusion

By embedding US Restaurant Data & Sentiment Intelligence at the center of strategy, leaders gain a balanced view of consumer expectations, pricing signals, and competitive positioning, enabling smarter adjustments that support consistent performance and scalable growth.

Measurable impact becomes visible when feedback intelligence is applied with precision, as Yelp & Google Reviews Analytics for Restaurants helps teams pinpoint experience gaps, refine menus, and strengthen brand trust. Connect with Retail Scrape today to transform insights into action and build a resilient, future-ready restaurant business.