How The Whiskey Exchange Dataset Analysis Reveals 63% Shifts in Premium vs Regular Buyer Behaviour?

Introduction

The alcohol retail landscape is undergoing significant changes, and understanding consumer behavior has become more crucial than ever. Recent insights show that premium whiskey buyers are increasingly diverging from regular customers in terms of purchasing patterns, preferences, and price sensitivity. Data reveals that over 63% of buyers now display distinct tendencies in how they select premium versus standard whiskey products, highlighting the need for precise segmentation and tailored offerings.

These changes are not just limited to pricing preferences; customer loyalty, brand awareness, and product ratings also play a pivotal role. Advanced data analytics can provide actionable insights into how premium buyers prioritize quality over cost, while regular consumers may focus on value and accessibility.

For liquor retailers, leveraging these datasets offers an opportunity to refine product placements, optimize promotional strategies, and even forecast future demand. The Whiskey Exchange Dataset Analysis serves as a rich resource for understanding consumer segments, creating targeted campaigns, and ensuring that both premium and regular buyer groups are catered to effectively in today’s competitive market.

Examining Shifts in Consumer Spending Across Whiskey Segments

Understanding evolving consumer behavior is essential for liquor retailers aiming to capture both premium and regular buyer groups effectively. Recent analysis highlights that high-end buyers are increasingly diverging from standard customers in their purchase preferences, contributing significantly to overall revenue. Insights from The Whiskey Exchange Buyer Behavior Analysis reveal that 63% of transactions now show a preference for higher-priced products, emphasizing the need for careful segmentation.

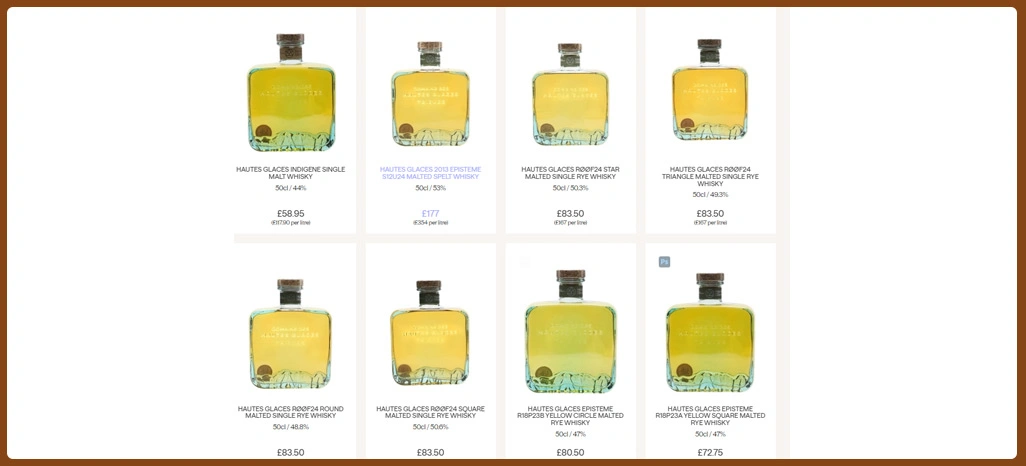

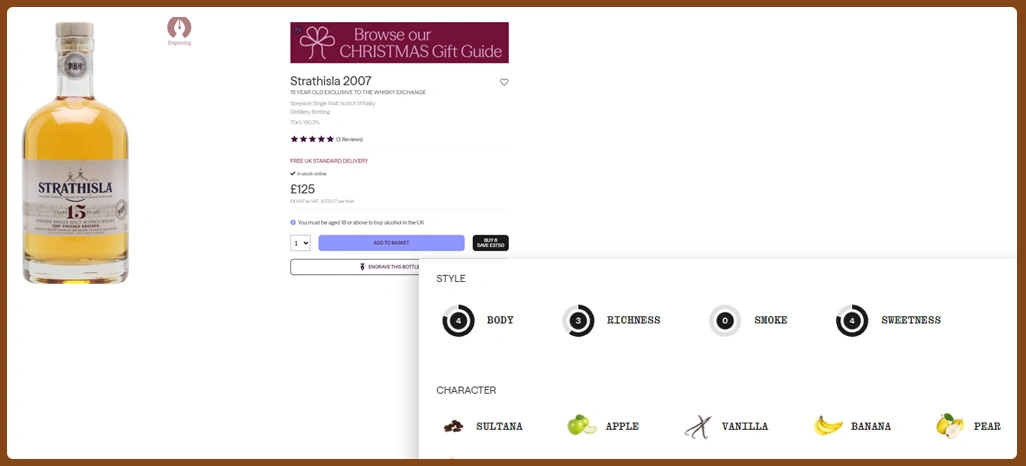

Detailed examination of purchase data shows that premium buyers often prioritize limited-edition releases, heritage brands, and expert ratings, while regular buyers focus more on affordability, deals, and accessibility. Customer Segmentation in Liquor Brands demonstrates that these behavioral distinctions go beyond simple price differences, influencing brand loyalty, purchase frequency, and seasonal buying patterns.

| Buyer Segment | Average Spend | Purchase Frequency | Preferred Brands |

|---|---|---|---|

| Premium Buyers | $210 | 6 times/year | Rare Malts, Limited Editions |

| Regular Buyers | $85 | 8 times/year | Standard Labels, Blends |

Advanced insights from The Whiskey Exchange Liquor Data Scraping also indicate that premium buyers are less sensitive to discounts but respond strongly to exclusivity, while regular buyers are more influenced by promotions and volume-based offers.

By integrating these observations into marketing and inventory strategies, retailers can tailor campaigns, optimize shelf space, and plan promotions that cater to the right audience at the right time, ensuring better engagement across both buyer segments.

Using Data Analytics to Predict Buyer Preferences and Demand

Analyzing purchase data provides clear visibility into high-value customers and their product choices. By studying Premium the Whiskey Exchange Buying Patterns vs Mass-Market Brands, retailers can detect preferences for brand exclusivity, pricing trends, and seasonal buying behaviors. Analyzing Whiskey Consumer Segments Using Datasets further enhances understanding by highlighting what motivates different consumer groups and how repeat purchases correlate with product ratings.

For instance, the Liquor Price and Rating Dataset shows that premium buyers are drawn to limited releases and high-scoring bottles, while regular buyers prioritize discounts and popular blends. Applying Liquor Scraping API allows retailers to monitor trends in real time, making it easier to anticipate shifts in consumer demand and adjust inventory accordingly.

| Dataset Metric | Premium Buyers | Regular Buyers |

|---|---|---|

| Average Rating Preference | 4.8/5 | 3.9/5 |

| Purchase Motivation | Brand Exclusivity | Price & Availability |

| Repeat Purchase Rate | 72% | 45% |

Insights derived from Whiskey Pricing and Demand Trends Dataset support strategic decision-making, helping brands optimize pricing, plan seasonal promotions, and identify high-value buyers. Leveraging these analytics allows retailers to prioritize product offerings and design campaigns that resonate with the unique preferences of each segment, ultimately driving sales growth and customer satisfaction.

Implementing Technology to Enhance Whiskey Sales Strategies

Advanced techniques in digital tracking enable retailers to collect valuable behavioral insights from multiple sources. By understanding How the Whiskey Exchange Brands Identify High-Value Customers, companies can create more targeted promotions and inventory strategies that appeal to premium buyers while maintaining relevance for regular consumers.

Integrating How Alcohol Brands Analyze Whiskey Datasets for Insights provides a comprehensive understanding of purchase frequency, product preference, and pricing sensitivity.

| Data Source | Monitored Metric | Frequency | Insight Type |

|---|---|---|---|

| Wine Retailers | Price Changes | Daily | Competitive Benchmarking |

| E-commerce Platforms | Product Availability | Weekly | Inventory Planning |

| Review Sites | Ratings & Comments | Continuous | Consumer Feedback |

| Social Channels | Mentions & Trends | Weekly | Marketing Strategy |

Using Web Scraping Services, retailers can dynamically monitor competitor offerings, track customer sentiment, and adjust marketing tactics efficiently. This approach ensures that both high-value and regular customers are served effectively, improving engagement and driving sales. By combining historical and real-time data, companies gain the intelligence required to enhance product placement, design loyalty initiatives, and align inventory with shifting market demand.

How Retail Scrape Can Help You?

For liquor brands and retailers, gaining a clear understanding of consumer segments is critical. The Whiskey Exchange Dataset Analysis can be leveraged with advanced scraping solutions to uncover hidden trends, optimize pricing, and fine-tune marketing campaigns.

Our services include:

- Real-time data tracking for all whiskey categories.

- Detailed insights into buyer segments and purchase behavior.

- Comparative analysis of premium versus standard products.

- Identification of trending products and seasonal preferences.

- Comprehensive rating and review extraction.

- Predictive modeling for demand forecasting.

By integrating these capabilities with Premium vs Regular Whiskey Consumers, brands can make informed decisions that enhance customer engagement, improve product allocation, and maximize revenue potential.

Conclusion

Understanding buyer behavior through The Whiskey Exchange Dataset Analysis offers a significant competitive advantage. Premium and regular whiskey consumers now display markedly different purchasing tendencies, with a 63% shift emphasizing the importance of targeted marketing, inventory optimization, and dynamic pricing.

Leveraging insights from The Whiskey Exchange Buyer Behavior Analysis, retailers can refine strategies to increase customer retention, predict future trends, and ensure high-value customer engagement. Start using Retail Scrape today to transform your whiskey data into actionable business intelligence and drive tangible growth.