How UK Grocery APIs Explained for Real-Time Retail Data Drive 30% Faster Pricing Insights in UK Stores?

Introduction

UK grocery retailers are moving faster than ever, and pricing changes are happening multiple times a day across major supermarket chains. With frequent promotional updates, regional price differences, and rapid inventory shifts, businesses can no longer depend on outdated spreadsheets or delayed retail reporting.

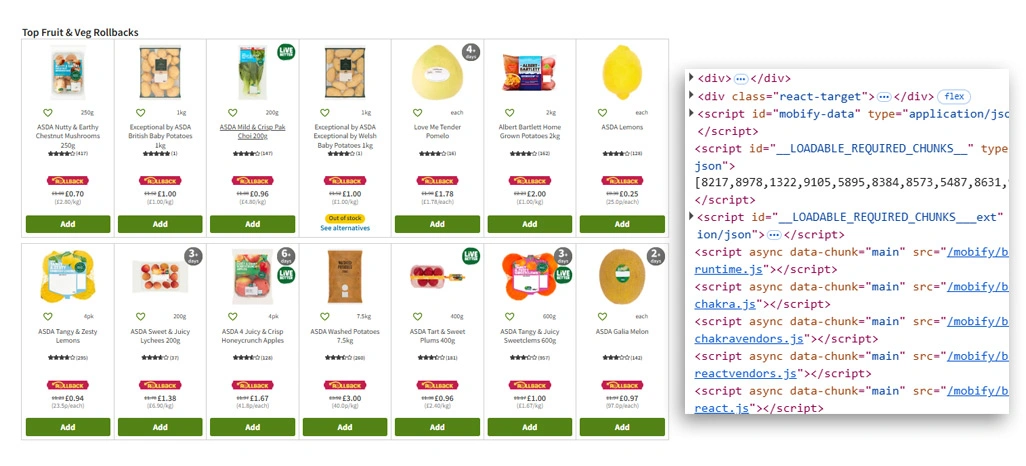

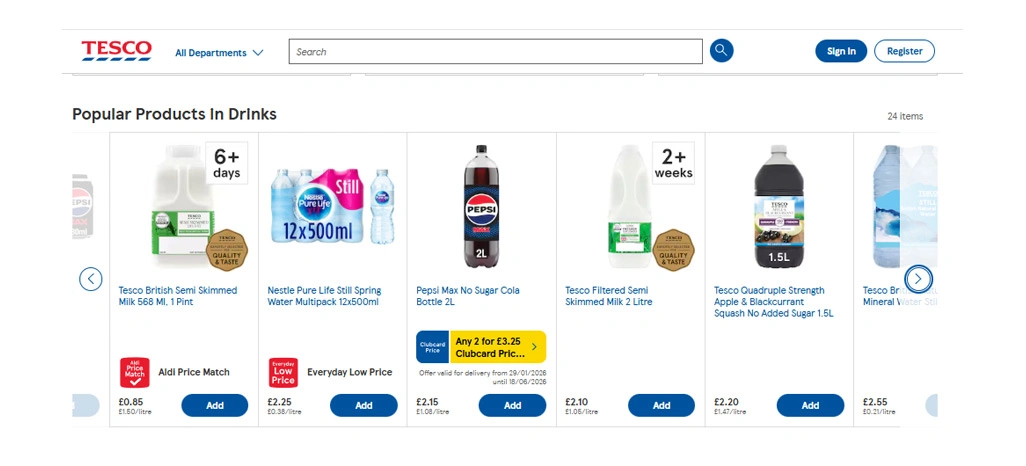

This is where Web Scraping vs Grocery APIs in the UK becomes a serious discussion. While scraping provides broad coverage across platforms, APIs are becoming a structured method for pulling consistent, near real-time data. For example, Tesco Aldi ASDA Real-Time Grocery APIs are becoming critical sources of data for tracking product listings, monitoring promotions, and understanding store-level shifts.

As pricing competition intensifies, UK Grocery APIs Explained for Real-Time Retail Data is no longer just a technical topic—it’s a strategic advantage that impacts forecasting, dynamic pricing, and operational planning across the UK grocery ecosystem.

Accelerating Competitive Decisions Through Instant Data Feeds

UK grocery pricing shifts rapidly due to flash promotions, loyalty pricing models, seasonal discounts, and competitor-driven markdowns. This is where Tesco Aldi ASDA Real-Time Grocery APIs become a strong solution for businesses aiming to monitor live price changes without manual store checks.

When teams build automated pricing dashboards, they can refresh product rates hourly or even within minutes, reducing pricing reaction time by nearly 25%–35% in fast-moving categories like beverages, snacks, and ready meals. This structured approach also supports better planning during high-demand sales periods, where even a small delay can impact margin and campaign success.

To strengthen this process, companies often implement Grocery Scraping API solutions to ensure continuity when endpoints are limited or when regional pricing feeds require additional support. Modern retail analytics is also becoming more transparent through UK Grocery Pricing Transparency Using Data APIs, helping businesses compare offers across supermarkets with more reliability.

Real-Time Pricing Data Collection Comparison:

| Monitoring Method | Refresh Frequency | Data Reliability | Strategic Benefit |

|---|---|---|---|

| Manual Store Checks | Weekly | Medium | Slow competitive response |

| Spreadsheet Price Logs | Daily | Medium | Limited promotional insights |

| API-Based Retail Feeds | Hourly / Real-time | High | Faster pricing adjustments |

| Hybrid API + Automation | Real-time + backup | Very High | Maximum coverage consistency |

This structured model helps brands make quicker pricing changes while reducing delays in competitor benchmarking. In addition, decision-makers are increasingly investing in API-Driven Grocery Market Intelligence UK because it enables large-scale product monitoring across cities, store formats, and fulfillment zones.

Reducing Stock Uncertainty with Live Updates

Many products appear listed online, yet are unavailable at the store level due to high demand, delivery slot limitations, or replenishment delays. A stronger system built around Real-Time Stock and Price Data UK Supermarkets allows businesses to track availability shifts faster and improve fulfillment decisions.

Retail datasets are also improving because retailers are investing in structured product feeds. Many analysts highlight How Tesco Shares Real-Time Grocery Data as a major step toward better inventory visibility across locations. Similarly, How Aldi Provides Product Data via API shows how simplified product endpoints can support fast listing updates and more accurate stock status reporting.

At the same time, businesses still rely on Grocery Data Scraping when API feeds provide limited availability fields or fail to show location-based differences. This hybrid method supports deeper store-level insights and reduces missing product visibility.

Stock Monitoring Approaches and Performance:

| Stock Tracking Method | Visibility Level | Typical Delay | Business Risk |

|---|---|---|---|

| Manual Store Verification | Low | 1–3 Days | High |

| Retail Partner Reports | Medium | 12–24 Hours | Medium |

| Automated Stock Feeds | High | Real-time | Low |

| Multi-Store Availability Monitoring | Very High | Minutes | Very Low |

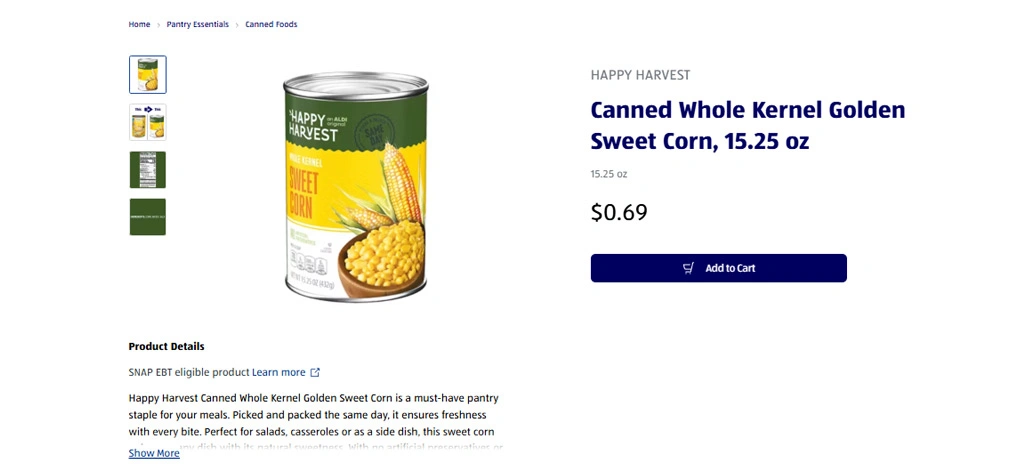

The retail market is also evolving with models such as How ASDA Enables Data Access for Retailers, making it easier to monitor product availability patterns and improve regional distribution planning.

Strengthening Market Position with Price Intelligence

UK supermarkets compete aggressively, and pricing shifts happen continuously due to promotions, supplier adjustments, and demand-driven category changes. Brands that rely on delayed price monitoring often miss key discount periods, leading to weaker campaign planning and reduced competitive impact.

Many organizations also rely on structured product feeds influenced by How ASDA Enables Data Access for Retailers, which allows smoother product-level monitoring and easier category comparisons. When combined with stable reporting systems, this approach improves SKU matching and reduces errors caused by inconsistent product naming conventions.

However, data reliability is still a challenge when endpoints are restricted or return incomplete promotional fields. That is why companies integrate Web Scraping API systems alongside retail feeds to maintain uninterrupted coverage and ensure pricing continuity across regions.

Competitive Price Monitoring Impact:

| Competitive Factor | Traditional Monitoring | Automated Monitoring | Business Result |

|---|---|---|---|

| Price Change Detection | Slow | Immediate | Faster competitor response |

| Promotion Visibility | Limited | High | Better campaign planning |

| SKU Matching Accuracy | Medium | High | Stronger category insights |

| Regional Price Comparison | Weak | Strong | Improved targeting strategy |

| Trend Forecasting | Low | High | Smarter pricing decisions |

This competitive approach is becoming a necessity for organizations that want consistent visibility across supermarket pricing ecosystems. Using Tesco Aldi ASDA Real-Time Price Tracking, businesses can monitor how quickly one retailer reacts to another’s discount strategy and which categories are experiencing the fastest markdown cycles.

How Retail Scrape Can Help You?

This becomes even more valuable when working with UK Grocery APIs Explained for Real-Time Retail Data, as it supports automation and improves refresh stability. Using a dedicated Grocery Price Scraper, businesses can also reduce manual monitoring and streamline reporting accuracy across regions.

We Offers:

- Automated extraction pipelines for large product catalogs.

- Daily and hourly refresh scheduling for key categories.

- Clean structured datasets for analytics and reporting.

- SKU matching support across multiple retailers.

- Regional availability monitoring for fulfillment planning.

- Custom integrations for internal BI systems.

We support businesses aiming for API-Driven Grocery Market Intelligence UK by delivering stable data workflows that align with real-time retail monitoring needs.

Conclusion

A structured data approach based on UK Grocery APIs Explained for Real-Time Retail Data supports better forecasting, smarter campaign planning, and faster competitive decision-making across UK grocery markets.

As more retailers strengthen data accessibility models such as UK Grocery Pricing Transparency Using Data APIs, businesses that build real-time intelligence systems will operate with higher accuracy and fewer blind spots. Contact Retail Scrape now to start building real-time grocery intelligence for your UK retail strategy.