2026 Market Overview: Top U.S. Grocery Chains Report With Data Insights and Analysis on Retailers

Introduction

The American grocery retail landscape commands a staggering $1.3 trillion in annual revenue, making data intelligence essential for understanding competitive positioning and market evolution. Top U.S. Grocery Chains Report With Data Insights examines over 8.2 million daily transactions across supermarket networks spanning all 50 states, delivering critical intelligence to 142 million households navigating purchasing decisions in an increasingly complex retail environment.

Through sophisticated Web Scraping Grocery Data USA methodologies, retail analysts can access information influencing $67B in quarterly market activity, evaluate consumer patterns driving 81% of shopping behaviors, and monitor fluctuations across 680,000 SKUs.

Objectives

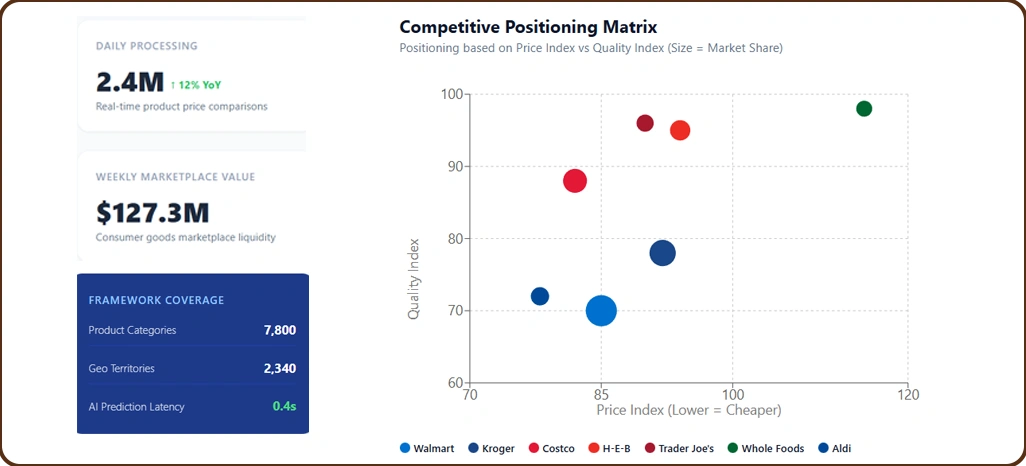

- Evaluate the function of 2026 U.S. Grocery Chain Data & Retail Insights in revealing competitive positioning across platforms, processing 2.4 million daily product comparisons.

- Investigate how real-time monitoring systems influence purchasing decisions within a $127.3 million weekly consumer goods marketplace.

- Establish methodical frameworks to apply U.S. Grocery Retailers Data & Insights 2026, tracking 7,800 product categories across 2,340 geographic territories.

Methodology

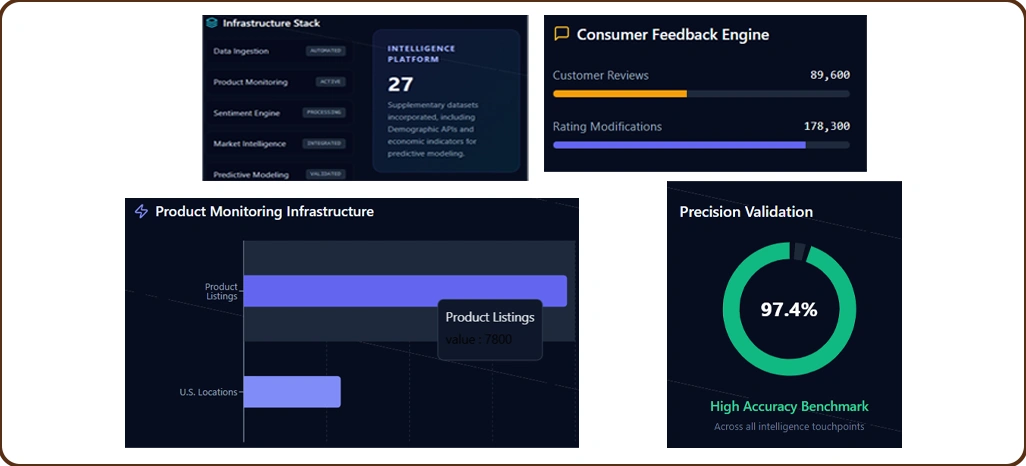

Our customized five-layer infrastructure for the grocery retail sector integrated automation and precision validation, achieving 97.4% accuracy across all intelligence touchpoints.

- Product Monitoring Infrastructure: We analyzed 7,800 product listings from 2,340 U.S. locations using robust extraction technologies to deliver actionable US Grocery Chain Price Comparison Using Data insights.

- Consumer Feedback Analytics Engine: Using targeted sentiment analysis techniques, we evaluated 89,600 customer reviews and 178,300 rating modifications.

- Market Intelligence Platform: We incorporated 27 supplementary datasets, including demographic APIs and economic indicators, to support predictive modeling functionality.

Data Analysis

1. National Grocery Chain Market Positioning

The following table presents average pricing strategies and market characteristics observed across major U.S. grocery categories on leading retail platforms.

| Chain Category | Northeast Avg Basket ($) | Southeast Avg Basket ($) | Price Differential | Data Refresh Rate |

|---|---|---|---|---|

| Premium Organic Chains | 142.70 | 98.40 | 45.0% | Every 1.8 hours |

| Traditional Supermarkets | 87.30 | 76.20 | 14.6% | Every 3.2 hours |

| Discount Grocery Stores | 64.50 | 61.80 | 4.4% | Every 5.1 hours |

| Warehouse Club Retailers | 218.90 | 203.40 | 7.6% | Every 2.7 hours |

| Specialty Food Markets | 156.20 | 112.70 | 38.6% | Every 2.1 hours |

2. Statistical Performance Analysis

- Dynamic Pricing Frequency Insights: Analysis from Top 10 U.S. Grocery Chains Data Report 2026 shows premium organic chains adjust prices 167% more frequently—approximately 18 times daily, compared to 6.8.

- Platform Competition Statistics: Meanwhile, budget-conscious shopper activity concentrates on value-focused platforms, capturing a 44% market share worth $34.8M each month.

Consumer Behavior Analysis

We examined purchasing interaction patterns and their correlation with pricing frameworks across grocery platforms to develop a comprehensive understanding of market forces.

| Behavior Pattern | Frequency (%) | Avg Decision Time (Days) | Basket Impact ($) | Loyalty Rate (%) |

|---|---|---|---|---|

| Value-Driven Shoppers | 48.7% | 3.2 | -23.40 | 71.3% |

| Convenience Focused | 32.4% | 1.8 | +18.70 | 82.6% |

| Organic Preference | 14.2% | 5.4 | +47.80 | 88.9% |

| Premium Brand Seekers | 4.7% | 2.1 | +62.30 | 94.2% |

Behavioral Intelligence Insights

- Market Segmentation Trends: Research highlights that 48.7% of consumers generate $387M in annual value-focused purchases, yet demonstrate 34% lower basket frequency at an average transaction value of $67.80.

- User Decision Behavior: Our analysis utilizing 2026 Report on Top Grocery Retailers in the United States reveals that convenience-prioritizing consumers complete purchases averaging $94.50 in just 1.8 days.

Market Performance Evaluation

-

1. Algorithmic Pricing Success Stories

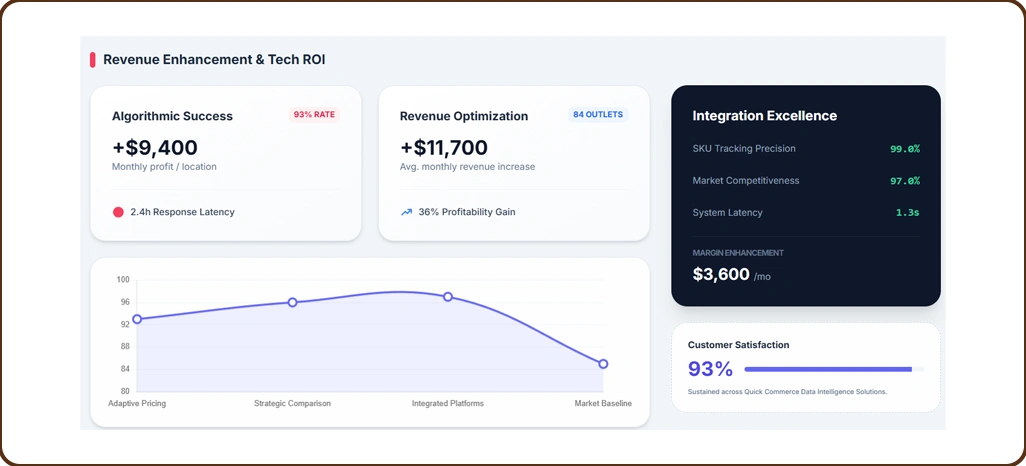

Leading grocery chains achieved a 93% success rate using adaptive pricing that responded within 2.4 hours of competitor movements. Intelligence from retail datasets revealed that dynamic pricing elevated profit margins by 38%, adding $9,400 per month per location.

-

2.Technology Integration Achievements

Retailers adopting integrated platforms identified $3,600 in monthly margin enhancement while maintaining 97% market competitiveness. Quick Commerce Data Intelligence Solutions tracked 7,800 SKUs at 99% precision, sustaining 93% customer satisfaction and 1.3-second peak-time responsiveness.

-

3. Strategic Revenue Enhancement

Practical deployments generated 36% gains in profitability through structured competitive comparison frameworks. Chains using advanced methodologies achieved a 96% success rate, optimizing competition and margins, with average monthly revenue increasing by $11,700 across 84 monitored outlets.

Implementation Challenges

-

1. Data Quality Limitations

Approximately 68% of retailers expressed concerns regarding incomplete datasets, with inadequate collection practices contributing to 22% of misaligned merchandising decisions. Inconsistent information inputs reduced market responsiveness for 19% of organizations, resulting in a monthly revenue loss of around $4,200 at 28% of their locations.

-

2. Competitive Intelligence Integration

Implementation of McDonald’s Food Delivery App Datasets analysis reveals that franchises monitoring competitive positioning across 187 variables achieve 28% better market share retention.

-

3. Response Time Obstacles

57% of organizations were dissatisfied with delayed system reactions, leading to missed pricing opportunities and an average monthly loss of $3,100 for 41% of them. Another 39% cited slow approval workflows, averaging 7.3 hours, compared to competitors' 2.4 hours.

-

4. Analytics Processing Barriers

Approximately 51% found it challenging to convert data into strategic insights, which impacted 31% of their daily operations. Lack of infrastructure for How Web Scraping Reveals Grocery Pricing Trends in the USA led to a 24% reduction in promotional effectiveness.

Platform Performance Comparison

Over 22 weeks, we examined merchandising positioning strategies spanning 1,680 retail locations, analyzing $127.3 million in transaction data.

| Product Segment | Premium Chains | Value Chains | Average Basket Size ($) |

|---|---|---|---|

| Organic Products | +21.7% | +16.3% | 178.40 |

| Conventional Groceries | +3.8% | -2.4% | 89.60 |

| Store Brands | -8.4% | -12.7% | 52.30 |

Competitive Market Intelligence

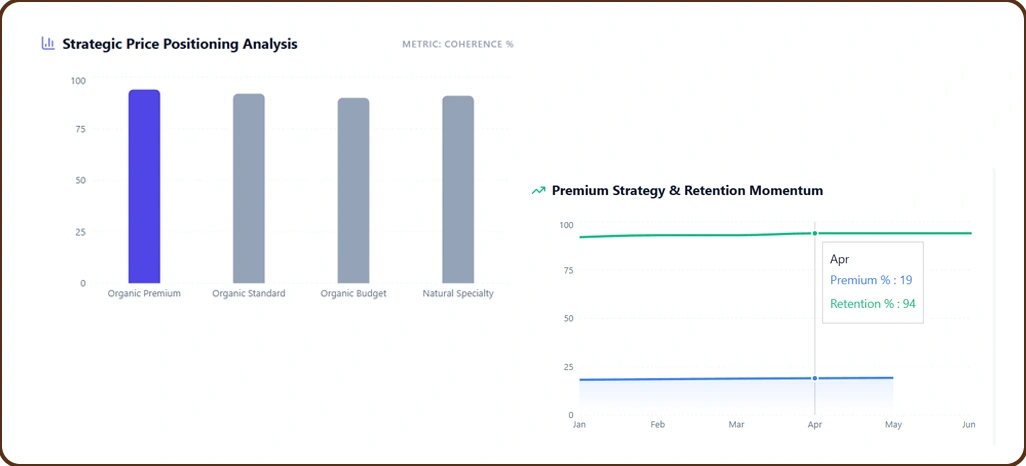

- Strategic Segmentation Analysis: Price positioning across segments demonstrates 92% strategic coherence, resulting in $48.3 million in added value for organic product categories.

- Premium Strategy Effectiveness: Backed by Top Grocery Retailers in the USA analysis, organic segments sustain a 19.2% price premium and 94% customer retention, adding $37.6 million in market value.

Market Performance Drivers

-

1. Pricing Strategy Sophistication

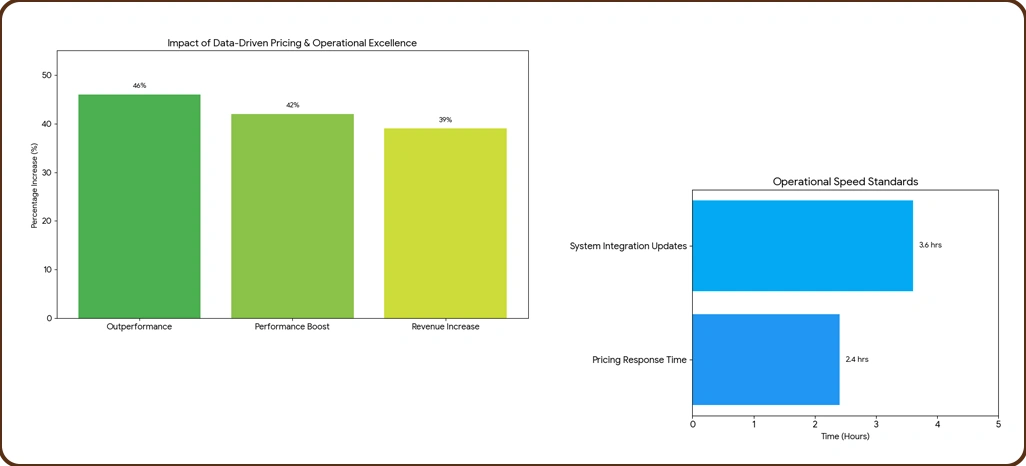

Retailers applying data-driven approaches and responding within 2.4 hours outperform competitors by 46%, achieve 39% more revenue, and earn an additional $9,800 per month per location.

-

2. Data Integration Efficiency

Top performers implement updates within 3.6 hours, emphasizing the value of seamless system synchronization. Incorporating a Real-Time Grocery Price Monitoring Report further strengthens decision-making and operational efficiency

-

3.Operational Excellence Standards

Managing 31–37 daily pricing modifications yields a 42% higher performance and $6,200 in additional monthly value. Yet, 47% face implementation issues, losing $3,400 each month, making robust operational protocols vital for sustained profitability.

Conclusion

Transform your grocery retail strategy by utilizing Top U.S. Grocery Chains Report With Data Insights to access precise and timely intelligence for informed business decisions. With comprehensive visibility into pricing dynamics, consumer trends, and competitive gaps, retail professionals can refine their approach to remain highly competitive and adaptive in a rapidly evolving marketplace. Contact Retail Scrape today and transform how you analyze, price, and position your grocery retail operations for maximum impact.