What Does the Starbucks Store Count in the USA Indicate About Franchise Density & State-Wise Trends?

Introduction

The rapid expansion of global coffee brands has reshaped how consumers experience food and beverage retail. Tracking the Starbucks Store Count in the USA is no longer just a brand metric—it has become a meaningful indicator of regional economic potential, commercial foot traffic, and consumer purchasing behavior.

Meanwhile, areas with fewer outlets may indicate untapped market opportunities, regulatory barriers, or lower customer frequency. Retail analysts and investors frequently ask questions like How Many Starbucks Stores Are in the USA because store growth directly reflects real-world demand and competitive positioning.

For brands planning market entry, franchise planning, or expansion decisions, analyzing Starbucks store presence can highlight which states are saturated and which are still scalable. This blog breaks down state-wise trends, density patterns, and strategic insights using store count analysis supported by statistics and structured comparisons.

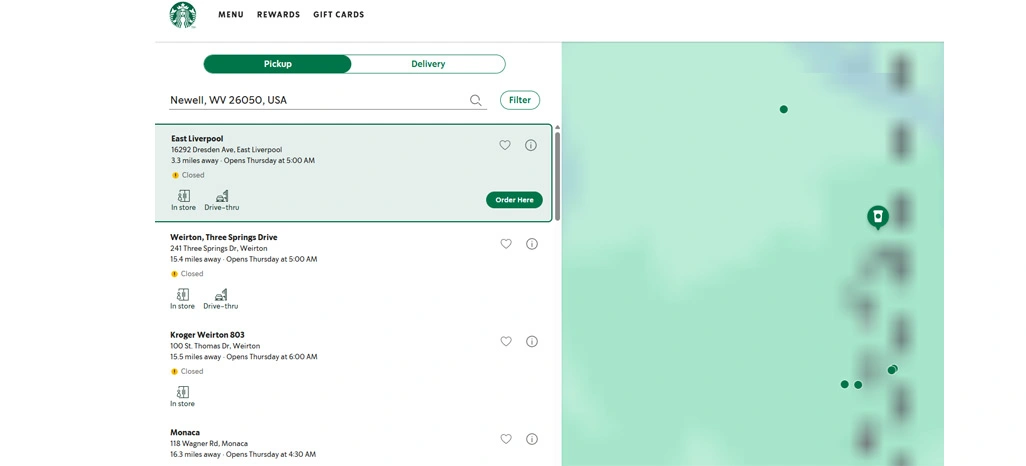

Mapping Regional Store Presence for Better Planning

Many analysts begin with How Many Starbucks Stores Are in the USA because store presence directly reflects commercial activity, customer density, and premium product demand. When teams Analyze Starbucks Store Distribution Using Web Scraping, they can identify which states are highly saturated and which ones still offer room for expansion.

Store clustering is often influenced by tourism activity, metro development, population volume, and commuter traffic. This is why Starbucks Store Growth Statistics USA is frequently used to interpret whether Starbucks is strengthening its dominance in key states or expanding into newer commercial zones.

Data-driven teams often rely on Starbucks Store Distribution USA Analysis to map store concentration and evaluate which regions show consistent outlet expansion. High-density states like California and Texas indicate mature demand, while medium-density states may offer better entry points for new brands that want to compete without heavy market saturation.

Sample State-Wise Store Concentration Insights:

| Stock Issue Type | Operational Challenge | Potential Sales Loss |

|---|---|---|

| Sudden Localized Shortages | Delayed restocking | 12–22% |

| Manual Inventory Checks | Human error | 10–18% |

| Warehouse-Specific Stock Gaps | Inconsistent availability | 15–25% |

| Hyperlocal Demand Surges | Missed revenue | 18–30% |

Understanding these patterns is also helpful when answering How Many Starbucks Stores in America, but the real value comes from comparing store distribution with economic signals such as housing development and retail leasing growth.

Understanding Competitive Positioning Through Store Comparisons

Coffee retail competition across the USA has become increasingly intense, and Starbucks continues to expand while adapting its store formats. Many analysts use Coffee Chain Store Count Comparison to evaluate how Starbucks competes against brands like Dunkin’, Dutch Bros, and regional coffee chains.

Using Starbucks Locations Data Scraping, businesses can track store openings, closures, and location shifts across major states. This type of analysis helps identify whether Starbucks is focusing more on city centers, suburban zones, or highway-driven commuter routes.

When analysts Web Scrape Starbucks Data, they can also map competitive overlap, meaning locations where multiple coffee chains operate within close distance. Retailers often want to Extract Starbucks Location Data Automatically because manual monitoring fails to keep up with frequent location updates.

Competitive Expansion Strategy Snapshot:

| Brand Category | Expansion Strategy Type | Primary Market Strength |

|---|---|---|

| Starbucks | Premium clustering model | Metro and high-income suburbs |

| Dunkin’ | Franchise-driven scaling | Affordable high-volume corridors |

| Dutch Bros | Youth-focused expansion | Drive-thru and fast-service markets |

| Tim Hortons | Regional mix strategy | Northern market segments |

| Local cafés | Community loyalty growth | Neighborhood-based competition |

Competitive mapping also helps brands assess which states Starbucks dominates and where competitors still have stronger presence. The goal is not just to measure store totals, but to understand strategic positioning, customer access, and market readiness.

Using Location Intelligence to Predict Growth Zones

Store presence data becomes far more valuable when combined with geographic intelligence and demographic insights. Businesses that build structured Starbucks Data Collection can detect which states Starbucks prioritizes and which regions show slower expansion activity.

By analyzing Starbucks USA Outlets Web Scraping Data, brands can identify where Starbucks is strengthening its supply chain presence and operational coverage. Expansion into new counties often reflects confidence in local workforce availability, purchasing power, and long-term commercial stability.

In many cases, Starbucks expansion patterns reflect broader retail movement. If Starbucks increases outlet presence in a specific metro area, other food chains and convenience brands often follow. This is why store footprint tracking is widely used as a benchmark for consumer behavior forecasting.

Store Footprint Insights for Market Strategy:

| Store Pattern | What It Suggests | Strategic Business Use |

|---|---|---|

| High density | Mature market saturation | Focus on differentiation strategy |

| Medium density | Balanced market demand | Best entry opportunity |

| Low density | Untapped retail potential | Expansion targeting |

| Rapid growth | Emerging customer demand | Early-stage investment planning |

| Flat trend | Stable market maturity | Improve operational efficiency |

| Relocation growth | Shifting consumer movement | Adjust store placement strategy |

Retail teams can also use this data to evaluate whether a region is saturated, balanced, or still underserved. Such analysis supports smarter decisions for franchise entry, pricing strategy, and product positioning.

How Retail Scrape Can Help You?

Market expansion decisions become more accurate when businesses work with real-time location intelligence rather than outdated reports. By analyzing the Starbucks Store Count in the USA, brands can identify high-density zones, growth-focused states, and competitive hotspots that influence store performance.

What we supports:

- Automated outlet monitoring across states and cities.

- Real-time tracking of new store openings.

- Competitive mapping for high-demand retail zones.

- Location clustering insights for franchise planning.

- Structured datasets for business dashboards.

- Custom delivery formats for analytics teams.

By integrating our solutions, businesses can also streamline reporting and improve decision-making speed. If you need advanced tracking through Web Scraping API, we ensure scalable extraction and clean datasets that support long-term market evaluation.

Conclusion

Store count analysis is more than just a retail metric—it is a direct reflection of demand, consumer lifestyle trends, and commercial maturity across regions. When brands evaluate the Starbucks Store Count in the USA, they gain clarity on which states are oversaturated, which markets are rapidly growing, and where future retail investments may deliver better returns.

If your team needs to track expansion movements and validate market potential using Starbucks Locations Data Scraping, we can support you with reliable datasets and scalable extraction solutions. Contact Retail Scrape today to build smarter retail strategies powered by real-world location intelligence.