How Middle East E-commerce Data Scraping Helps Track 29% Monthly Pricing Variations Across GCC?

Introduction

The GCC online retail ecosystem has been witnessing dynamic fluctuations, with monthly pricing variations reaching up to 29% across key markets. Businesses operating in the UAE, Saudi Arabia, and Qatar face the challenge of understanding these shifts to maintain competitive positioning and profitability. By implementing Middle East E-Commerce Price Monitoring, retailers can gain actionable insights into how product prices move across different e-commerce platforms, helping them optimize pricing strategies efficiently.

Middle East E-commerce Data Scraping enables businesses to systematically collect product pricing, availability, and promotional data across multiple platforms. These insights are particularly crucial for retailers managing cross-border operations where pricing patterns in the UAE E-Commerce Pricing Trends often differ significantly from those in Saudi Arabia or Qatar.

This structured approach ensures that organizations are not just reacting to price changes but proactively making informed decisions to drive revenue growth. Furthermore, as GCC online markets expand, understanding granular pricing behavior is essential for tailoring regional strategies and meeting the demands of increasingly informed consumers.

Understanding Price Variations Across Multiple Online Retail Platforms

Tracking price fluctuations in GCC online retail markets requires a structured and data-driven approach. Retailers often face difficulties in understanding sudden spikes or drops in product prices across multiple platforms, which can affect sales and margins. Businesses require an efficient method to collect, compare, and analyze pricing information to make informed decisions quickly.

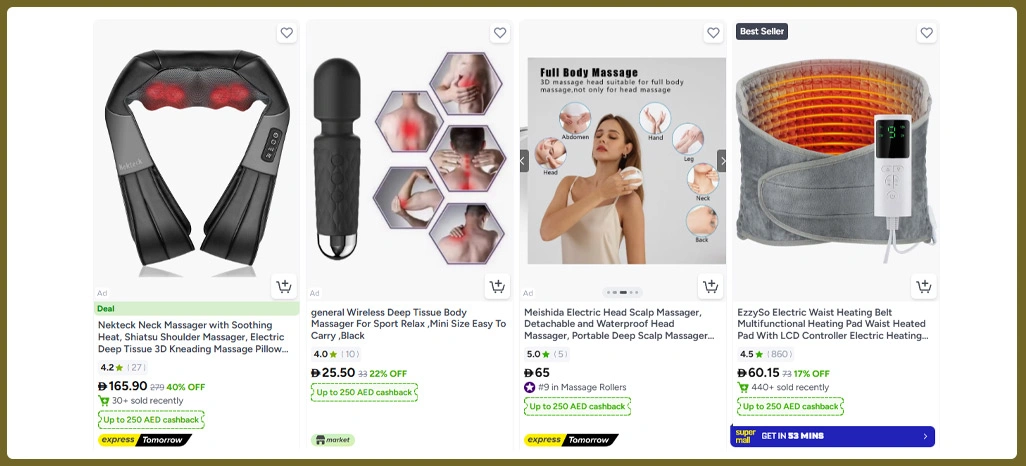

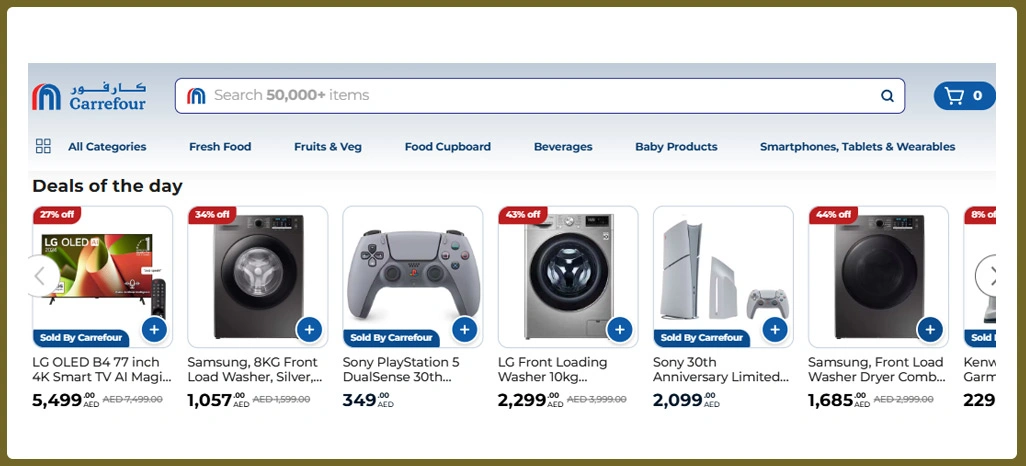

Using Web Scraping E-Commerce Dataset, organizations can extract structured data from various e-commerce platforms, enabling them to understand market dynamics more clearly. This includes tracking stock availability, discount campaigns, and product pricing patterns across major UAE platforms like Noon, Carrefour UAE, and Amazon.ae. The collected data allows retailers to detect anomalies, identify seasonal trends, and benchmark against competitors.

| Retail Platform | Average Monthly Price Change | Stock Availability Rate | Observed Trend |

|---|---|---|---|

| Noon UAE | 22% | 88% | Moderate fluctuation with frequent sales |

| Amazon.ae | 30% | 92% | High variation during festive periods |

| Carrefour UAE | 18% | 95% | Stable pricing with minor promotions |

Additionally, insights gained from E-Commerce Data Scraping Middle East help businesses tailor marketing strategies, optimize inventory, and improve revenue outcomes. By analyzing the data, companies can determine which products require price adjustments, when to launch promotions, and how to remain competitive in the fast-evolving GCC e-commerce space.

Adopting this structured methodology ensures that retailers are not merely reactive but can proactively plan pricing and promotional strategies based on accurate and up-to-date market data. Such a comprehensive approach improves efficiency, reduces errors, and fosters more strategic decision-making.

Improving Decision-Making Through Continuous Platform Analysis

Retailers operating across UAE, Saudi Arabia, and Qatar often struggle with fragmented pricing information, making it difficult to implement effective strategies. To maintain a competitive edge, businesses need continuous monitoring and analysis of multiple e-commerce platforms. Doing so allows them to anticipate competitor moves, understand consumer behavior, and optimize pricing policies.

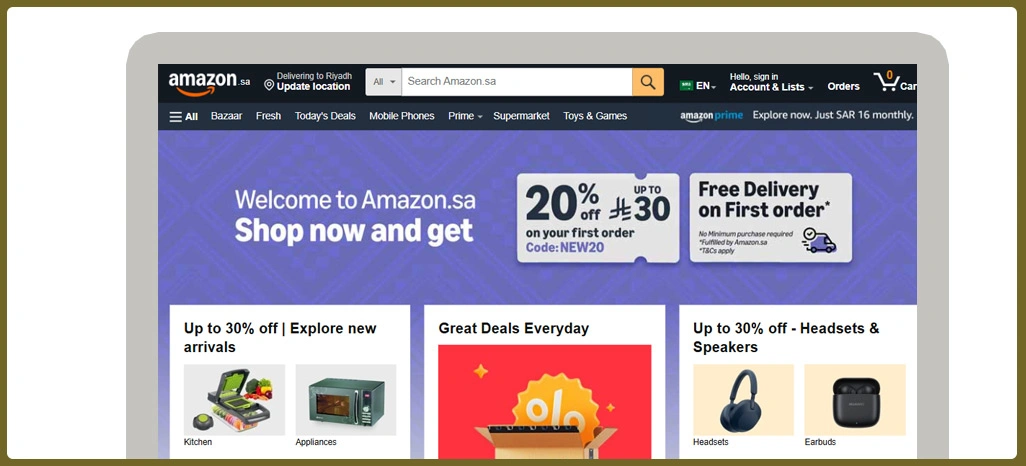

By integrating Web Scraping for Ecommerce Platforms, companies can systematically collect data on product listings, promotions, and stock changes across the market. This helps uncover trends in E-Commerce Market Trends GCC and provides clarity on how market dynamics vary between regions. Understanding these trends is crucial for aligning inventory management, marketing campaigns, and pricing strategies to meet consumer expectations.

| Competitor | Platform Monitored | Price Adjustment Frequency | Promotional Activity |

|---|---|---|---|

| Carrefour SA | Online Store | Weekly | Frequent bundle offers |

| Amazon.sa | Amazon Platform | Bi-weekly | Discount campaigns during holidays |

| Lulu Hypermarket | Online Portal | Monthly | Seasonal sale campaigns |

This structured analysis helps businesses benchmark their pricing strategies, allocate resources efficiently, and improve sales performance. Insights from competitor analysis allow for smarter promotional planning and better anticipation of market shifts.

By leveraging these insights, retailers can maintain consistent profitability and operational efficiency. Additionally, using Qatar Online Retail Insights further strengthens understanding of regional variations, ensuring that businesses can implement targeted strategies and improve overall decision-making effectiveness in the GCC markets.

Using Pricing Insights for Strategic Business Optimization

Maintaining effective pricing strategies across multiple GCC markets is critical for retail success. Small fluctuations can have a significant impact on revenue, making it necessary to collect and analyze pricing information systematically. Businesses that operate in UAE, Saudi Arabia, and Qatar require insights into competitor behavior and consumer demand to optimize pricing.

By employing Pricing Intelligence Uae & Saudi, retailers can detect competitor pricing changes, evaluate promotional effectiveness, and monitor stock levels. Synthesizing this data allows for more accurate pricing adjustments, ensuring competitiveness while maximizing margins. Real-time insights enable businesses to respond to market conditions promptly, optimizing revenue and reducing the risk of losses.

| Region | Average Price Variation | Promotional Activity Rate | Key Insights |

|---|---|---|---|

| UAE | 25% | High | Frequent short-term discounts |

| Saudi Arabia | 28% | Moderate | Mid-season adjustments prevalent |

| Qatar | 29% | Low | Stable pricing with occasional promotions |

These actionable insights allow retailers to adjust inventory, launch promotions effectively, and align pricing with regional trends. By integrating this data into business strategies, companies ensure competitive positioning without sacrificing profit margins.

Strategically leveraging these insights through Saudi Arabia Ecommerce Analytics fosters smarter decision-making, boosts operational efficiency, and drives long-term growth in competitive online markets. Organizations can confidently manage pricing and promotions across the GCC while anticipating future trends.

How Retail Scrape Can Help You?

Businesses seeking to streamline their pricing strategies can benefit immensely from our solutions. By integrating Middle East E-commerce Data Scraping into your operations, you can automate data collection, monitor pricing trends, and enhance decision-making.

We offer a range of services to optimize your e-commerce strategy:

- Real-time monitoring of product pricing

- Automated competitor price comparison

- Dynamic stock level tracking

- Analysis of promotional campaigns

- Generation of actionable pricing reports

- Identification of high-demand product categories

Furthermore, our approach ensures data accuracy, minimizing manual errors and maximizing operational efficiency. Insights drawn from Qatar Online Retail Insights further strengthen your ability to understand regional market dynamics, ultimately enabling smarter retail decisions across multiple platforms.

Conclusion

In today’s rapidly evolving online retail environment, understanding pricing patterns across GCC markets is vital. Through Middle East E-commerce Data Scraping, businesses can access reliable, real-time pricing data to optimize strategies and maintain profitability.

Moreover, insights derived from Competitor Price Tracking Middle East allow brands to benchmark performance, predict market shifts, and implement responsive pricing adjustments. Connect with Retail Scrape today to transform your e-commerce pricing strategy and drive measurable results.