What Zepto and Blinkit Quick Commerce Data Shows About a 37% Surge in India’s Fast-Moving FMCG Items?

Introduction

India’s quick commerce landscape has undergone a substantial transformation, driven by an unexpected acceleration in the way consumers buy household essentials, snacks, beverages, OTC products, and daily-use categories. The most notable change is the surge of approximately 37% in the FMCG segment, driven by a mix of affordability, availability, and instant doorstep delivery convenience.

These insights have become even more valuable as businesses and brands begin to rely on accurate ordering patterns, fulfillment speed, and regional consumption shifts. By analyzing zepto and blinkit data, companies can pinpoint micro-trends such as day-part consumption, replenishment cycles, and product bundling preferences. With Quick Commerce Data Scraping, these patterns are now accessible at scale, allowing brands to foresee demand fluctuations with strong precision.

This blog breaks down the surge through three problem-solving sections, highlighting buying behavior changes, category-level demand spikes, and the evolving role of data in strategic FMCG decisions. The detailed breakdown of Zepto and Blinkit Quick Commerce Data allows retailers, analysts, and FMCG brands to position themselves strategically in India’s hyper-growth quick commerce environment.

Tracking India’s Shifting Demand Patterns Across FMCG Categories

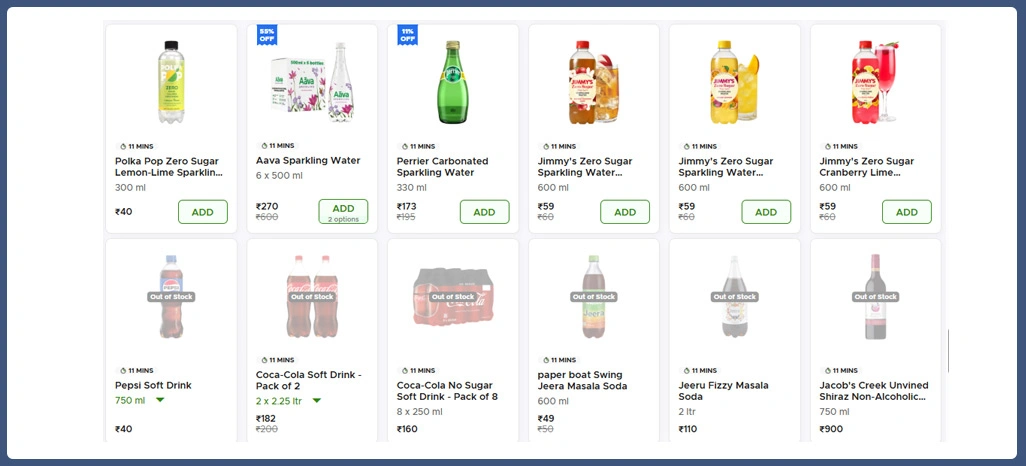

India’s fast-evolving FMCG environment has reshaped how brands interpret consumption cycles, especially within metros and Tier-1 cities where delivery-driven buying behavior dominates. As analysts examine these patterns, they rely heavily on structured insights supported by a Quick Commerce Dataset, which helps identify how demand fluctuates across beverages, snacks, daily essentials, and personal care items.

These structured insights are further shaped by broader signals reflected in Quick Commerce Fmcg Trends India, highlighting how digital-first consumers are redefining urgency-driven buying. Brands now utilize these granular datasets to predict procurement needs, improve inventory allocation, and refine distribution routes in high-velocity delivery clusters. Observations such as evening beverage spikes, early-morning dairy demand, and late-night snack orders reveal clear behavioral patterns.

Below is a refined snapshot of emerging FMCG consumption patterns in India:

| Category | Avg. Weekly Spike (%) | Strongest Regions | Peak Buying Time |

|---|---|---|---|

| Beverages | 41% | Tier-1 Urban | Evening |

| Snacks | 33% | Metro Clusters | Late Night |

| Personal Care | 29% | Metro + Tier-1 | Morning |

| Dairy & Essentials | 38% | Urban Zones | Early Morning |

These consolidated insights provide category managers and FMCG planners with real-world indicators to understand rapid shifts in purchasing psychology. They also align with consumption signals associated with Top-Selling Grocery and Fmcg Products in India, giving brands a clearer view of where consumer attention is moving within India’s dynamic FMCG landscape.

Understanding Consumer Drivers Behind India’s FMCG Acceleration

As consumers adapt to fast delivery services, patterns emerging from comparative purchase behaviors—such as those observed across platforms included in Zepto vs Blinkit Product Trends—highlight how small pricing differences, discount patterns, and availability windows can shift demand instantly.

These preference shifts are further supported by broader macro-insights linked to Quick Commerce Consumer Trends India, offering clarity into motivations behind high-frequency purchasing. Urban consumers, especially younger demographics, demonstrate heightened responsiveness to promotions and time-bound offers. As digital environments become more intelligent, these motivators amplify across regions and categories.

Below is a table illustrating leading purchase motivators and their impact levels:

| Motivator | Influence Score (1–10) | Strongest Category | Dominant Buyer Type |

|---|---|---|---|

| Fast Delivery | 9.5 | Beverages | Students & Professionals |

| Discounts | 8.7 | Snacks | Urban Shoppers |

| Stock Availability | 8.2 | Daily Essentials | Family Buyers |

| Pack Size Options | 7.9 | Personal Care | Household Planners |

This understanding of motivators also reflects evolving behaviors that influence Fastest-Selling Fmcg in India, revealing how modern customers prefer digital-first buying experiences driven by instant access and convenience.

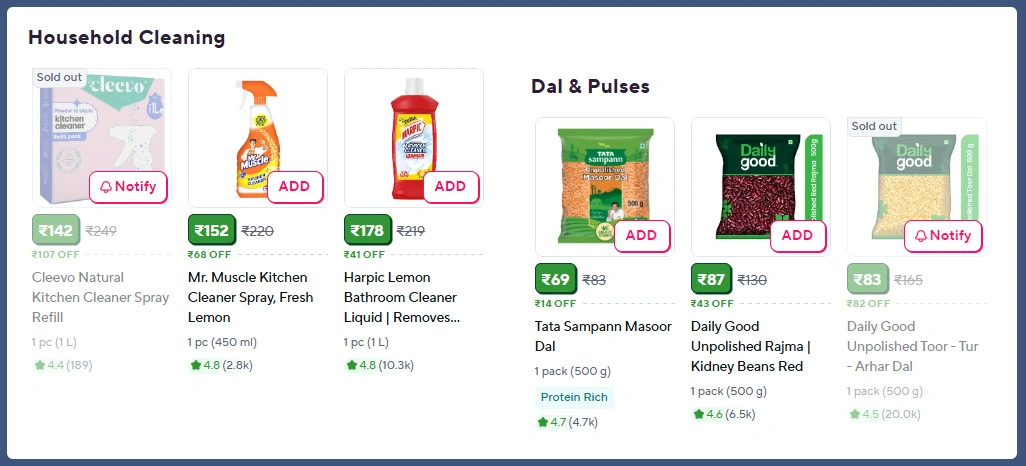

Assessing Category Performance for Strategic FMCG Planning

Evaluating category-level performance is essential for brands aiming to align production schedules, promotional planning, and inventory distribution with fast-shifting consumer needs. Granular insights, supported by automated extraction systems like Web Scraping Quick Commerce Platforms, help businesses study SKU-level velocity, identify regional purchase variations, and understand substitution patterns when preferred brands are unavailable.

With advanced measurement systems such as Fmcg Product Performance Analytics, organizations track real-time category growth and reorder cycles across beverages, snacks, household supplies, dairy, and personal care. Such measurements also align with consumption signals derived from Real-Time Fmcg Consumption Data, enabling brands to adjust stock planning and product visibility strategies for better performance.

Below is a category performance snapshot reflecting monthly growth and reorder frequency patterns:

| Category | Monthly Growth (%) | Reorder Interval | Urban Demand Score |

|---|---|---|---|

| Snacks | 42% | 3–4 Days | 9.1 |

| Dairy & Breakfast | 37% | 2–3 Days | 9.4 |

| Beverages | 39% | 2–4 Days | 8.9 |

| Household Supplies | 32% | 5–6 Days | 7.7 |

These aligned insights reflect broader market directional changes connected to Quick Commerce Market Analysis, revealing how data-backed interpretation helps brands anticipate demand shifts, reduce stockouts, and better position products across digital retail channels. Additionally, automated collection methods such as Zepto Grocery Delivery Data Scraping support continuous visibility into evolving category trends.

How Retail Scrape Can Help You?

As businesses increasingly adopt data-backed FMCG decision-making, analyzing the deeper layers of findings from Zepto and Blinkit Quick Commerce Data becomes crucial. We support brands, research teams, and enterprises with structured data pipelines that break down product availability, pricing shifts, discount variations, and zone-wise consumer behavior.

We help businesses by offering:

- Accurate category-level trend identification.

- SKU-wise availability monitoring.

- Cross-platform pricing and promotions comparison.

- Seasonal and festival-driven demand pattern tracking.

- Consumer purchase cycle mapping.

- Zone-wise delivery behavior evaluation.

With powerful data support systems, businesses can stay aligned with FMCG shifts taking place across the digital retail chain. These solutions also help companies analyze patterns similar to Blinkit Grocery Datasets, offering an enriched outlook on consumer behavior, product cycles, and market opportunities aligned with Quick Commerce Market Analysis.

Conclusion

The rise of instant delivery platforms has reshaped how India consumes daily essentials and fast-moving categories. With the insights found within Zepto and Blinkit Quick Commerce Data, brands can decode shifting market patterns and respond with informed product, pricing, and placement strategies.

The availability of micro-level insights related to Top-Selling Grocery and Fmcg Products in India shows the strength of hyperlocal platforms in shaping urban purchase cycles. As consumption continues evolving, brands need reliable data intelligence systems to build solid, future-ready FMCG strategies. Want structured FMCG insights for your brand? Contact Retail Scrape today.