What Expedia UK Hotel Data Scraping Shows About 40% Demand Trends in UK Hotel Markets?

Introduction

The UK hotel industry is undergoing a measurable shift driven by changing traveler behavior, flexible booking patterns, and heightened price sensitivity. Domestic travel, short-stay tourism, and regional business travel are no longer following pre-pandemic demand curves. Instead, hotel operators and investors are witnessing demand fluctuations of nearly 40% across major and secondary UK cities, creating a pressing need for data-backed clarity.

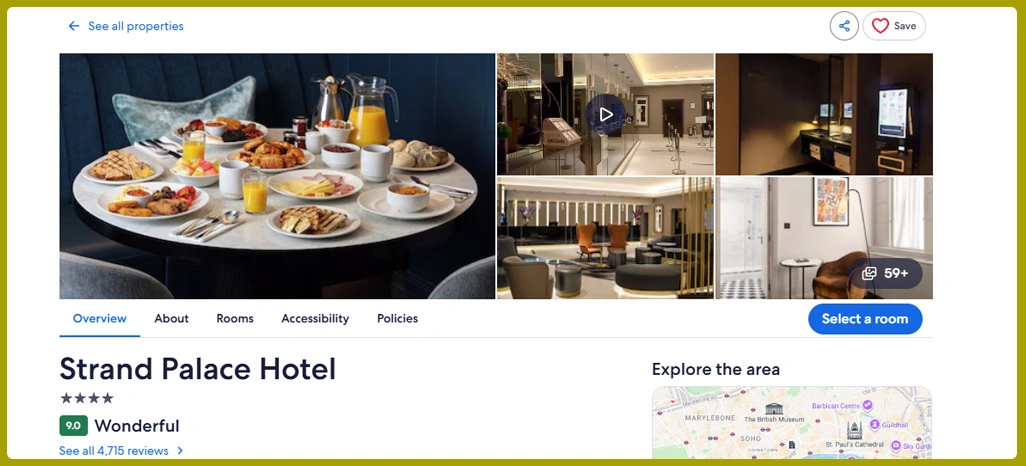

Online travel platforms now act as real-time mirrors of traveler intent, price elasticity, and occupancy momentum. Among these platforms, Expedia’s UK marketplace reflects booking behaviors across budget, mid-range, and premium hotel segments. When systematically collected and analyzed, this data reveals emerging demand corridors, rate compression patterns, and competitive pricing gaps that are otherwise invisible through traditional analysis.

This blog explores how Expedia UK Hotel Data Scraping uncovers demand signals shaping UK hotel markets. The following sections break down how demand trends are identified, validated, and translated into actionable market insights using statistically supported evidence and comparative city-level data.

Understanding City-Level Demand Movement Patterns

Demand variability across UK hotel markets is rarely uniform, making city-level analysis essential for accurate market interpretation. Through UK Hotel Market Data Scraping, analysts can observe how availability, booking intensity, and room pricing shift across locations, revealing demand pressure points that traditional reports often miss.

Advanced crawling supported by Web Scraping Tools for UK Hotel Data enables continuous monitoring of hotel listings across major and secondary cities. When availability tightens alongside incremental rate increases, it reflects authentic demand growth rather than short-term promotional tactics. Conversely, stable pricing with rising availability often signals demand softening. Such contrasts allow stakeholders to differentiate between sustainable growth and temporary fluctuations.

City-level demand signals become clearer when structured into comparable metrics, as shown below:

| City | Occupancy Change (%) | Rate Adjustment (%) | Demand Classification |

|---|---|---|---|

| London | +37 | +22 | Strong |

| Manchester | +33 | +16 | Moderate-Strong |

| Edinburgh | +40 | +25 | Strong |

| Birmingham | +28 | +14 | Moderate |

When combined with Travel Data Scraping UK, these indicators help hotels anticipate demand cycles earlier, refine inventory allocation, and optimize staffing plans. Continuous tracking also supports Using OTA Data Scraping for UK Travel Insights, allowing market participants to validate trends across platforms rather than relying on isolated datasets.

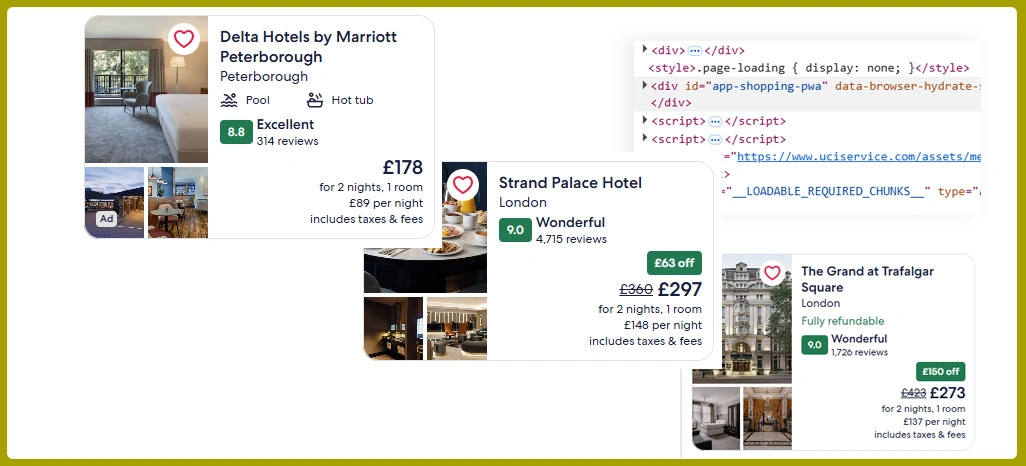

Evaluating Competitive Pricing and Market Signals

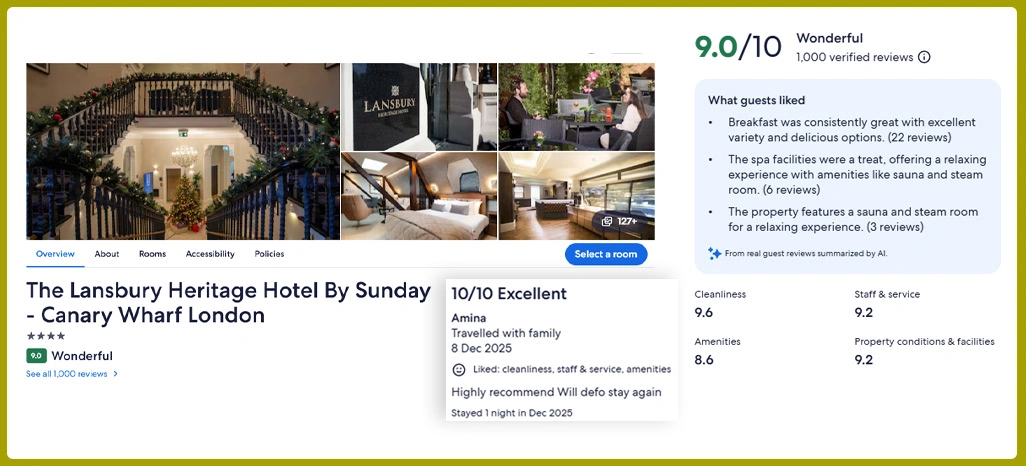

Pricing behavior offers a direct reflection of market confidence and traveler willingness to pay. By analyzing Expedia Hotel Pricing Data UK, stakeholders can observe how frequently rates change, the magnitude of adjustments, and the timing of price shifts relative to demand surges. These patterns help distinguish strategic pricing from reactive discounting.

Access to structured Expedia Datasets enables comparison of weekday and weekend pricing, identification of compression periods, and detection of cities where pricing growth outpaces occupancy. Such discrepancies often indicate speculative pricing rather than genuine demand strength. Understanding this difference is critical for maintaining competitive positioning without eroding margins.

The following table highlights pricing dynamics across selected UK destinations:

| City | Average Weekend Rate (£) | Average Weekday Rate (£) | Price Stability |

|---|---|---|---|

| London | 212 | 176 | Volatile |

| Bristol | 169 | 143 | Stable |

| Leeds | 154 | 132 | Moderate |

| York | 181 | 148 | Volatile |

Incorporating Expedia UK Hotel Pricing Data for Market Analysis allows revenue teams to define realistic price ceilings, identify underpriced inventory, and benchmark against comparable properties. When aligned with OTA Hotel Data Scraping, pricing intelligence becomes more reliable, as cross-platform validation reduces data bias.

Analyzing Traveler Behavior for Forecast Accuracy

Traveler behavior metrics provide critical insight into future market stability. Through Hotel Data Extraction for Market Analysis, analysts can examine booking windows, cancellation preferences, and stay duration trends to understand how travelers plan their trips. Short booking windows often indicate spontaneous demand, while longer lead times reflect planned leisure or corporate travel.

Using structured endpoints via Expedia API Data Scraping, these behavioral attributes can be collected consistently across regions. Rising refundable booking ratios may signal traveler uncertainty, while extended stay durations often align with experiential or leisure-driven demand. These indicators improve forecasting accuracy by revealing intent rather than just completed transactions.

Behavior-driven patterns across UK cities can be compared as follows:

| City | Avg. Booking Window (Days) | Refundable Share (%) | Avg. Stay Length |

|---|---|---|---|

| Bath | 25 | 62 | 2.7 nights |

| Liverpool | 17 | 53 | 2.1 nights |

| Oxford | 28 | 64 | 2.8 nights |

| Newcastle | 16 | 48 | 1.9 nights |

By deploying an Expedia UK Listings Scraper, these metrics can be tracked longitudinally, improving demand predictability across seasons. When combined with UK Hotel Demand Forecasting Using Expedia Data, hotels gain a forward-looking perspective that supports smarter inventory planning, pricing decisions, and long-term investment strategies grounded in traveler behavior rather than assumptions.

How Retail Scrape Can Help You?

Extracting meaningful intelligence from travel platforms requires precision, scale, and consistency. When applied strategically, Expedia UK Hotel Data Scraping enables businesses to move beyond surface-level insights and access structured market intelligence that reflects real traveler behavior.

Key benefits include:

- Automated tracking of rate changes across multiple cities.

- Continuous monitoring of availability and demand shifts.

- Structured historical datasets for trend comparison.

- City-level segmentation for granular analysis.

- Custom dashboards for pricing and occupancy signals.

- Scalable data pipelines for enterprise use.

By combining domain expertise with advanced scraping architecture, we ensure data accuracy, compliance, and actionable depth. This approach allows organizations to integrate Travel Data Scraping UK seamlessly into their existing analytics workflows without operational friction.

Conclusion

Market volatility in the UK hotel sector requires more than reactive decision-making. By embedding Expedia UK Hotel Data Scraping within analytical frameworks, businesses gain the ability to interpret demand shifts with precision and confidence. These insights directly support UK Hotel forecasting, enabling stakeholders to anticipate demand surges, mitigate pricing risks, and allocate resources strategically.

As travel patterns continue to evolve, data-driven clarity becomes a competitive necessity rather than an advantage. Integrating tools with Using OTA Data Scraping for UK Travel Insights empowers hotels and analysts to translate raw listings into sustainable growth strategies. Connect with Retail Scrape today to turn real-time hotel data into smarter market decisions.