How Does the Liquor and Beverage Dataset Reveal 2025 Sales Trends Across 50+ Cities Globally

Introduction

In 2025, understanding liquor and beverage sales patterns has become more critical than ever for retailers, distributors, and analysts looking to maximize revenue opportunities. Across over 50 cities, consumption behaviors are shifting due to changing demographics, urbanization, and evolving preferences in alcohol and beverage consumption. Retailers now rely on data-driven insights to identify high-demand products, optimize pricing, and tailor marketing strategies to specific city markets.

The Liquor and Beverage Dataset serves as a comprehensive resource for analyzing these evolving trends. By examining sales volume, pricing fluctuations, and consumer preferences, businesses can develop strategies that align with market realities. This dataset not only highlights city-wise variations in demand but also uncovers opportunities for targeted promotions and inventory planning. With detailed analytics, companies can better anticipate seasonal demand peaks and forecast growth areas.

Moreover, embedding this dataset into business intelligence frameworks strengthens data-driven decisions across critical functions, including supply chain optimization and new product rollouts. By supporting both historical performance evaluation and future trend forecasting, Alcohol Consumption Analytics enables organizations to rely on a consistent, insight-rich foundation for confident and strategic planning.

Strategies to Identify High-Growth Liquor Markets Across Cities

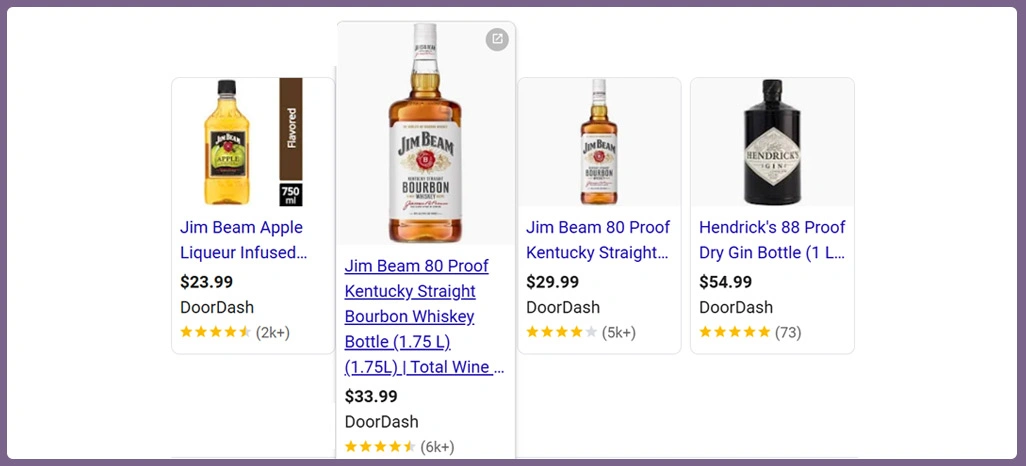

Retailers today must accurately identify which cities show the highest demand for alcoholic beverages to stay competitive. Using Liquor Price and Volume Trends Dataset in the middle of their analysis enables companies to evaluate cities across key metrics such as sales volume, revenue performance, and evolving growth patterns with greater confidence.

Implementing Liquor Data Scraping helps collect real-time information on sales performance across different urban markets. For example, recent analytics indicate metropolitan areas such as Mumbai and Bangalore are outperforming smaller Tier-2 cities, showing a 15% higher increase in premium beverage sales. Such insights allow retailers to prioritize inventory allocation, launch targeted promotions, and optimize distribution channels.

| City | Sales Volume (Units) | Revenue (USD Millions) | Growth YoY (%) |

|---|---|---|---|

| New York | 130,000 | 52 | 16 |

| Los Angeles | 110,000 | 44 | 14 |

| London | 98,000 | 39 | 13 |

| Toronto | 72,000 | 28 | 10 |

In addition, analyzing Liquor & Beverage Sales Data helps companies understand consumer preferences by category, such as spirits, wines, and craft beers. Retailers can reduce overstock of slow-moving products while ensuring high-demand beverages are available at the right locations.

City-based insights also facilitate marketing campaigns that resonate with local audiences. Through careful examination of purchase trends, businesses can identify high-performing markets, maximize ROI on promotional efforts, and ultimately improve sales efficiency across all distribution channels.

Effective Methods to Adjust Product Strategies by Region

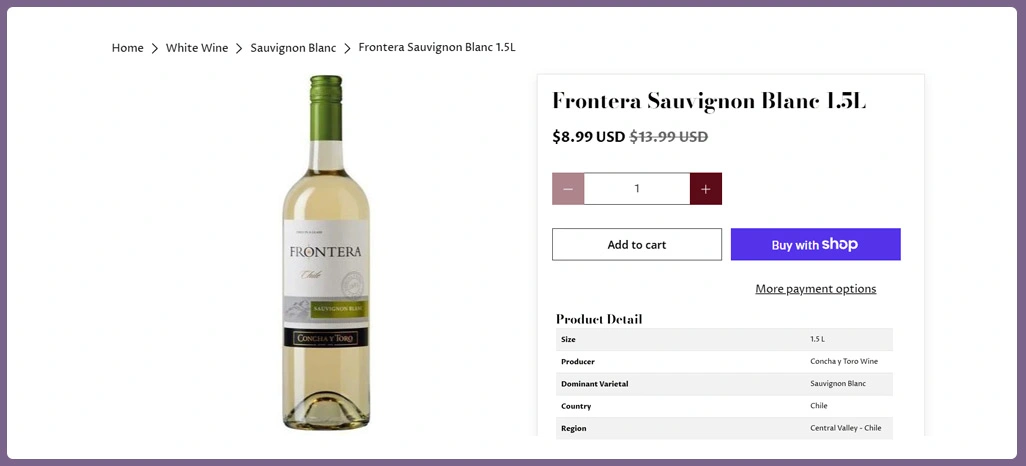

Analyzing city-level sales patterns and buyer preferences enables businesses to align inventory with local demand more accurately, while Liquor Demand Forecasting Using Datasets supports smarter planning by anticipating shifts before they occur. Leveraging historical performance data helps brands make confident, insight-led decisions that match evolving market expectations and maximize availability where demand is strongest.

Utilizing a Liquor Scraper allows companies to maintain up-to-date information on sales performance and product popularity. Insights reveal that Tier-1 cities contribute 60% of premium beverage sales, while Tier-2 cities show faster growth in mid-range products, highlighting new opportunities for expansion.

| City | Premium Sales (%) | Mid-Range Sales (%) | Popular Category |

|---|---|---|---|

| Paris | 68 | 27 | Wine |

| Berlin | 60 | 35 | Beer |

| Sydney | 63 | 32 | Spirits |

| Madrid | 55 | 40 | Whisky |

The Liquor Sales Trends Dataset helps monitor competitors’ performance, identify gaps in availability, and adjust marketing or pricing strategies accordingly. City-specific analysis allows retailers to target promotions effectively, ensuring the products resonate with local consumers.

By understanding local trends, businesses can improve inventory allocation, increase sales efficiency, and reduce the risk of overstock or stockouts. Combining these insights with predictive analytics enables companies to respond dynamically to market shifts and emerging consumer preferences. This ensures a more precise and profitable approach to product strategy.

Forecasting Sales Growth to Maximize Revenue Opportunities

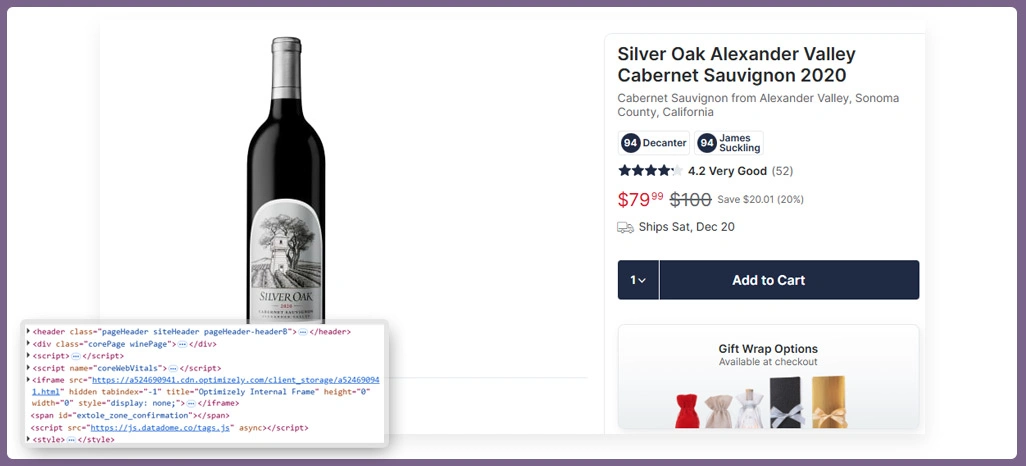

Anticipating future demand plays a vital role in building effective business strategies. Integrating Analyzing Alcohol Sales Datasets for Insights in the planning process helps transform raw information into predictive intelligence, enabling smarter decisions around inventory management, pricing alignment, and targeted promotional initiatives to maximize overall revenue.

Integrating a Liquor Scraping API into analytics systems allows businesses to access timely data and conduct scenario planning with ease. Emerging insights indicate that cities such as Pune and Ahmedabad are likely to see 12–14% growth in craft beer sales, signaling promising opportunities in niche segments.

| City | Forecasted Sales (Units) | Expected Revenue (USD Millions) | Growth Projection (%) |

|---|---|---|---|

| Amsterdam | 74,000 | 30 | 14 |

| Barcelona | 66,000 | 27 | 13 |

| San Diego | 58,000 | 24 | 12 |

| Vancouver | 50,000 | 21 | 11 |

By leveraging Tracking Liquor Sales Trends Across Cities Using Datasets, companies can optimize inventory levels and reduce overstock or stockouts. Combining these insights with Beverage Sales Trends by City ensures that seasonal peaks are met efficiently and strategic campaigns are implemented successfully.

Data-driven forecasting helps businesses make informed decisions about market expansion, pricing adjustments, and resource allocation. Retailers can ensure maximum efficiency, higher sales conversion, and improved customer satisfaction by responding proactively to projected trends.

How Retail Scrape Can Help You?

Businesses seeking to maximize liquor and beverage sales can significantly benefit from integrating the Liquor and Beverage Dataset into their analytics frameworks. We provide tailored solutions for acquiring, organizing, and analyzing liquor and beverage data with precision.

Key benefits include:

- Access to high-quality, structured datasets across multiple cities.

- Real-time updates for monitoring sales and consumer behaviors.

- Detailed analytics for product demand and revenue insights.

- Automated reporting tools for faster decision-making.

- Enhanced competitive intelligence to track market trends.

- Seamless integration with business intelligence platforms.

Leveraging these insights alongside City-Wise Liquor Sales Trends Dataset allows businesses to refine marketing strategies, optimize inventory, and improve city-specific performance for maximum impact.

Conclusion

Analyzing the Liquor and Beverage Dataset empowers businesses to gain a comprehensive view of sales dynamics across multiple cities. By understanding volume, pricing, and category-specific performance, retailers can strategically focus on high-growth areas while minimizing inefficiencies.

In addition, integrating Alcohol Consumption Analytics with predictive tools allows for accurate demand forecasting and inventory optimization. Connect with Retail Scrape today to transform your liquor and beverage sales strategy with advanced analytics.