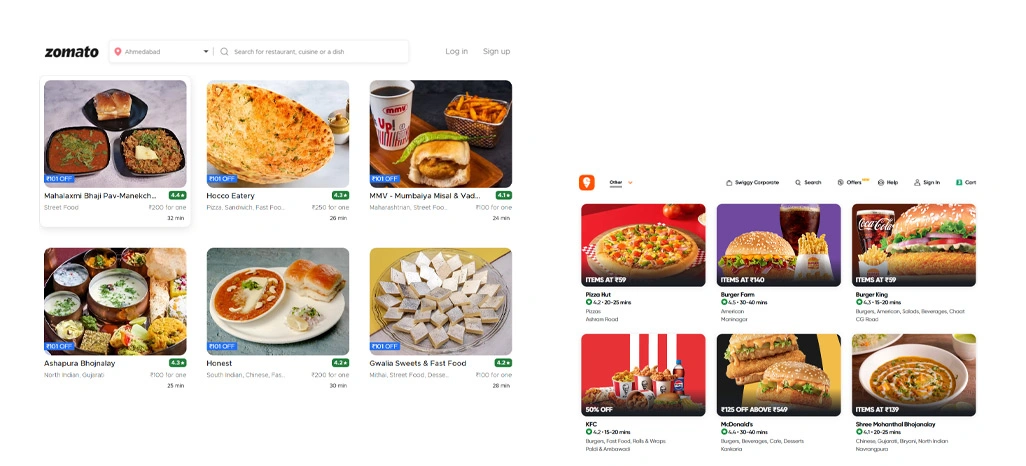

How Zomato vs Swiggy Restaurant Price Intelligence Exposes 42% Restaurant Pricing Differences at Scale?

Introduction

Food delivery platforms have transformed how customers compare food options, but they have also created a silent pricing battleground for restaurants. With thousands of outlets listing the same cuisines, combos, and meal categories, even a ₹10 difference can influence ordering decisions.

Many restaurant brands assume that Zomato and Swiggy maintain similar pricing structures, but the reality is far more complex. This is why modern restaurants and food chains increasingly rely on Zomato vs Swiggy Restaurant Price Intelligence to understand where pricing mismatches happen and how those mismatches affect conversions.

In large metro cities, customers often compare the same dish across both platforms before placing an order. This blog breaks down how price intelligence reveals a 42% pricing difference trend across restaurants, and how data-backed pricing strategies help restaurants win in this competitive delivery market.

Identifying Platform-Wise Price Gaps in Listings

Restaurants operating on multiple food delivery platforms often experience pricing inconsistencies that directly influence customer decisions. This is why brands increasingly focus on Zomato vs Swiggy Restaurant Pricing Analysis to understand where differences occur and how frequently they impact conversions.

In many metro cities, studies indicate that nearly 40% to 45% of restaurants have at least a few items priced differently across both platforms. To manage such gaps effectively, brands adopt Zomato Pricing Data Scraping for structured extraction of menu prices, add-ons, and combo rates across thousands of listings.

In addition, brands can also monitor customer behavior to see which pricing variations result in cart abandonment or reduced order frequency. A structured dataset also helps restaurants make timely corrections before customers begin comparing the same menu item across platforms.

Below is a sample snapshot of how pricing mismatches appear in common restaurant listings:

| Menu Item | Platform A Price (₹) | Platform B Price (₹) | Gap (%) | Business Outcome |

|---|---|---|---|---|

| Paneer Butter Masala | 240 | 260 | 8.3% | Lower order intent |

| Veg Biryani | 180 | 195 | 8.3% | More drop-offs |

| Chicken Burger | 150 | 165 | 10% | Higher switching |

| French Fries | 99 | 110 | 11.1% | Reduced add-on sales |

| Cold Coffee | 120 | 130 | 8.3% | Lower upsell success |

Such insights make it easier for restaurants to plan pricing adjustments while maintaining consistency and customer trust.

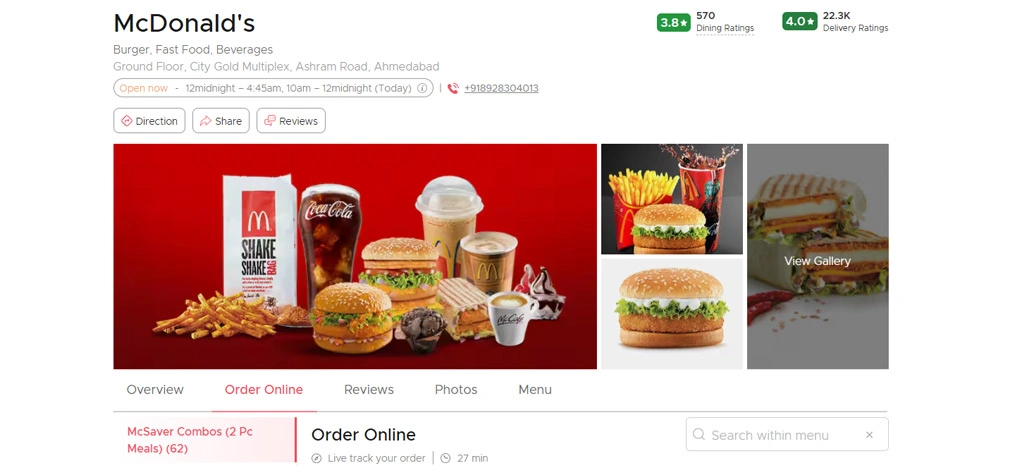

Competitor Benchmarking to Improve Pricing Accuracy

Customers frequently compare similar cuisines and menu items before placing orders, which means even a small price mismatch can shift demand instantly. Many restaurant chains now evaluate Which Platform Offers Better Restaurant Price Intelligence Zomato or Swiggy to determine where competitor tracking can be more effective.

Competitor monitoring becomes highly valuable when restaurants build a system for How Restaurants Track Competitor Prices on Swiggy and Zomato. This approach allows brands to evaluate nearby restaurant pricing trends, bestseller pricing shifts, and category-level changes. By applying Swiggy Pricing Data Scraping, businesses can monitor thousands of competitor listings, track pricing changes in real time, and measure the frequency of competitor discounts.

Research indicates that restaurants actively tracking competitor prices adjust their menu pricing nearly 2 to 3 times more often than restaurants relying on manual review. Additionally, competitor benchmarking highlights whether a restaurant is overpriced or underpriced compared to similar cuisine providers, improving both competitiveness and margin strategy.

Below is a structured example of competitor pricing benchmarking:

| Cuisine Category | Competitor Avg Price (₹) | Restaurant Price (₹) | Position | Recommended Move |

|---|---|---|---|---|

| North Indian Thali | 220 | 250 | Premium | Improve combo value |

| Chinese Noodles | 160 | 140 | Budget | Raise margin slightly |

| Pizza (Medium) | 310 | 340 | Premium | Add bundle offers |

| Burger Combo | 180 | 170 | Competitive | Maintain pricing |

| Biryani (Single) | 210 | 230 | Premium | Reduce extra charges |

A detailed Data-Driven Comparison of Zomato and Swiggy Pricing ensures restaurants remain aligned with the market while still protecting profitability.

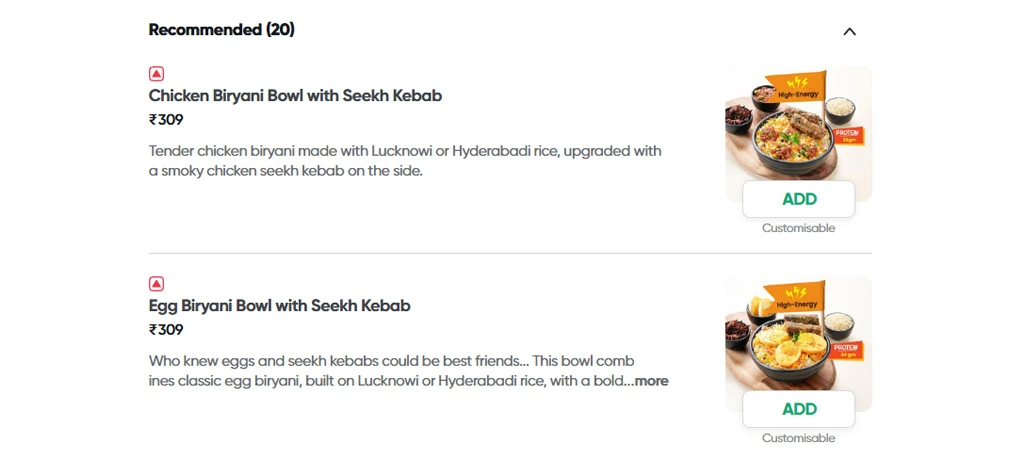

Scalable Menu Monitoring for Multi-Outlet Growth

Cloud kitchens, franchise outlets, and multi-city chains often face menu mismatches, where the same item appears at different rates across locations and platforms. This is why many brands implement workflows to Compare Zomato and Swiggy Prices and identify where mismatched pricing is reducing customer confidence.

Restaurants with hundreds of menu items across multiple outlets must track thousands of price points that change frequently due to promotions, demand fluctuations, and competitor movements. This is where automated pricing systems based on How Brands Use Food Delivery Pricing Data Scraping become essential.

Brands using Food App Price Intelligence Zomato Swiggy models also analyze category-level trends such as add-ons, beverages, and combos, helping them optimize pricing strategies for higher profitability. When restaurants implement Zomato vs Swiggy Menu Price Comparison Using Data, they reduce pricing mismatches significantly and improve customer repeat ordering behavior.

Below is a sample of category-level menu variation tracking:

| Menu Category | Common Price Difference | Higher Priced Platform | Risk | Optimization Plan |

|---|---|---|---|---|

| Combos | 10% to 18% | Platform B | Conversion drop | Align combo pricing |

| Beverages | 5% to 12% | Platform A | Add-on decline | Standardize markups |

| Desserts | 8% to 15% | Platform B | Cart abandonment | Add bundle pricing |

| Add-ons | 6% to 14% | Platform A | Margin mismatch | Rebuild add-on pricing |

| Snacks | 9% to 16% | Mixed | Brand inconsistency | Apply centralized rules |

This approach ensures restaurants can maintain consistent pricing logic while improving growth performance across platforms.

How Retail Scrape Can Help You?

With structured data collection and analytics, Zomato vs Swiggy Restaurant Price Intelligence becomes a measurable strategy that supports smarter menu planning, better profit margins, and consistent customer experience across platforms.

Key Ways We Support Restaurant Pricing Teams:

- Collects menu pricing data across platforms in bulk.

- Detects price mismatches and outlier menu items quickly.

- Tracks city-wise and outlet-wise pricing changes.

- Builds competitor benchmarking insights for category pricing.

- Monitors promotional shifts and pricing frequency patterns.

- Provides structured dashboards and export-ready datasets.

We also support restaurants seeking How Brands Use Food Delivery Pricing Data Scraping to build automated pricing intelligence systems for long-term profitability.

Additionally, our solutions measure Dynamic Pricing Impact on Food Delivery Platforms to help restaurants respond to sudden market changes without losing customer trust.

Conclusion

Restaurant brands that want sustainable growth must treat pricing as an evolving strategy, not a one-time decision. With Zomato vs Swiggy Restaurant Price Intelligence, restaurants can detect these differences early, correct menu gaps, and create consistent pricing value that supports both conversions and profitability.

By applying Zomato vs Swiggy Restaurant Pricing Analysis, restaurants can make smarter decisions at scale and maintain competitive positioning across every city and outlet. Contact Retail Scrape now to start automated restaurant price monitoring and scalable pricing intelligence.