Introduction

The UK grocery pricing landscape underwent a significant transformation in 2025. No longer reliant on outdated instincts or static historical data, retailers are now adopting a dynamic, real-time approach powered by data intelligence. Pricing decisions are increasingly responsive, calculated, and deeply informed by current market behavior rather than past trends.

Retailers are increasingly adapting to evolving consumer behaviors and rising market pressures. As inflation continues and shoppers actively compare prices across physical and digital shelves, businesses are compelled to reevaluate their pricing strategies. Grocery Data Scraping has become a critical tool in this shift, helping retailers make data-backed decisions to stay competitive and meet customer expectations.

At the core of this evolution lies UK Supermarket Data Scraping—a powerful solution enabling retailers to collect, compare, and analyze real-time pricing data from competitors across digital and physical touchpoints.

Data-Driven Pricing Is Reshaping Retail

In 2025, price transparency will become a standard expectation for UK shoppers. With access to mobile price trackers, discount aggregators, and eCommerce comparison tools, today’s consumers are more informed than ever. For supermarkets, relying on instincts or historical pricing doesn’t cut it anymore. Accurate, up-to-date data has emerged as the foundation of competitive grocery pricing.

Retailers embracing Real-Time Tesco Price Scraping gain timely insights that allow them to:

- Monitor competitor prices instantly, across categories and regions.

- Adapt pricing models dynamically to shifting market trends.

- Optimize margins by minimizing over-discounting or missed pricing opportunities.

- React swiftly to flash sales, local promotions, or unplanned events.

- Maintain pricing consistency across physical and digital storefronts.

By adopting a data-centric pricing model, supermarkets remain agile and customer-aligned across markets.

What Retailers Are Scraping and Why Does It Matter?

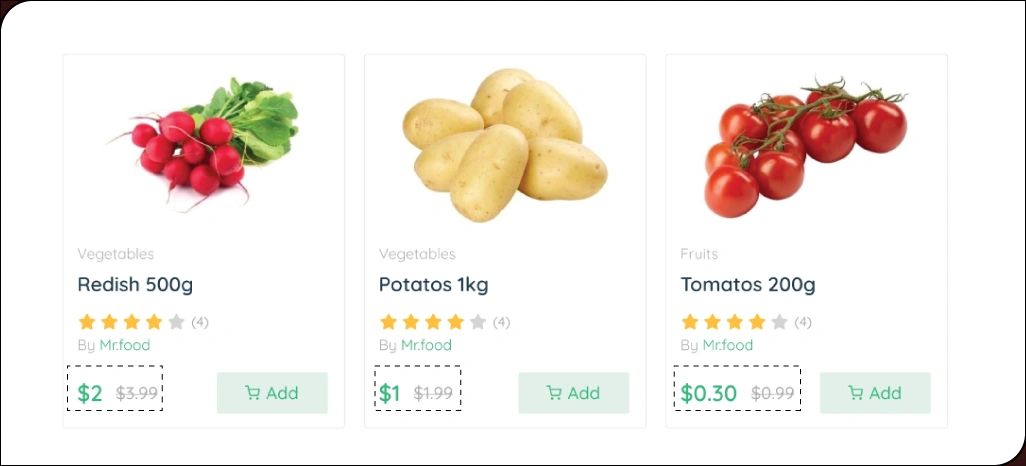

Grocery retailers are no longer just scraping product titles or basic listings—they’re zeroing in on critical pricing signals that influence how and when customers buy. These pricing signals reveal far more than what’s visible on the shelf.

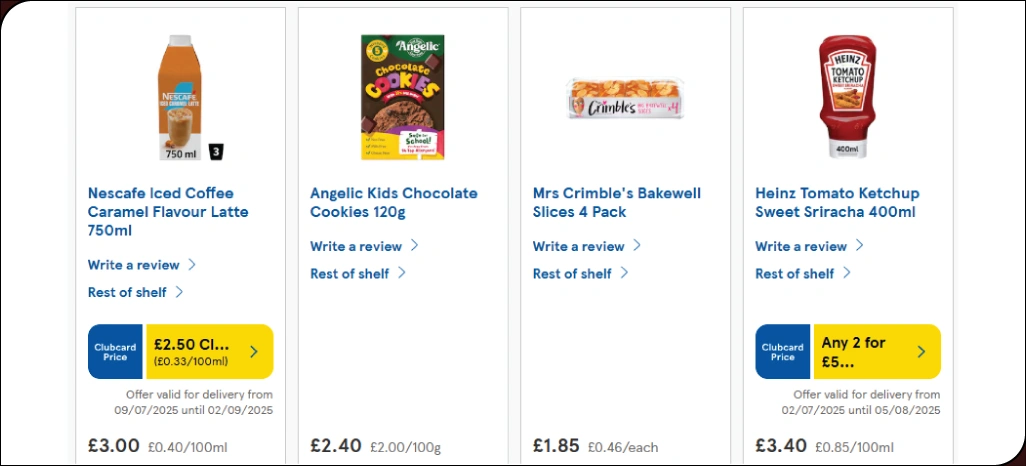

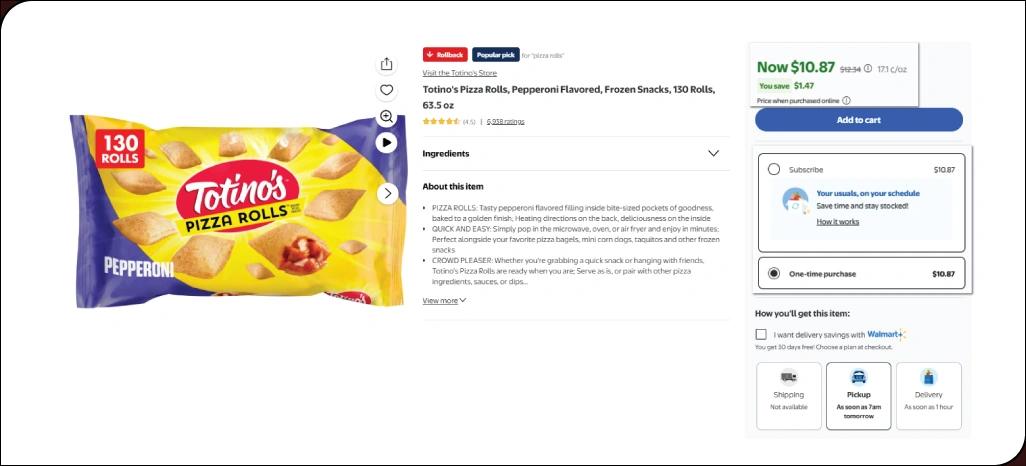

With tools like Tesco Price Data Scraping, retailers analyze a broader data set that includes:

- Standard and promotional pricing across SKUs.

- Bundle offers and price-per-unit comparisons.

- Delivery charges are linked to product types or basket sizes.

- Availability data to detect stockouts and optimize inventory.

- Member-specific or loyalty-tier pricing variations.

The insights from these datasets power real-time adjustments to pricing strategies, tailored to customer demand and local market behavior.

Competitive Intelligence Between Big Four and Discounters

The UK grocery landscape is becoming increasingly competitive, particularly between traditional chains and discount-led challengers. Companies like Tesco and Sainsbury’s now go head-to-head with Aldi and Lidl on both price and convenience. In this landscape, data is no longer a support function—it’s a strategic weapon.

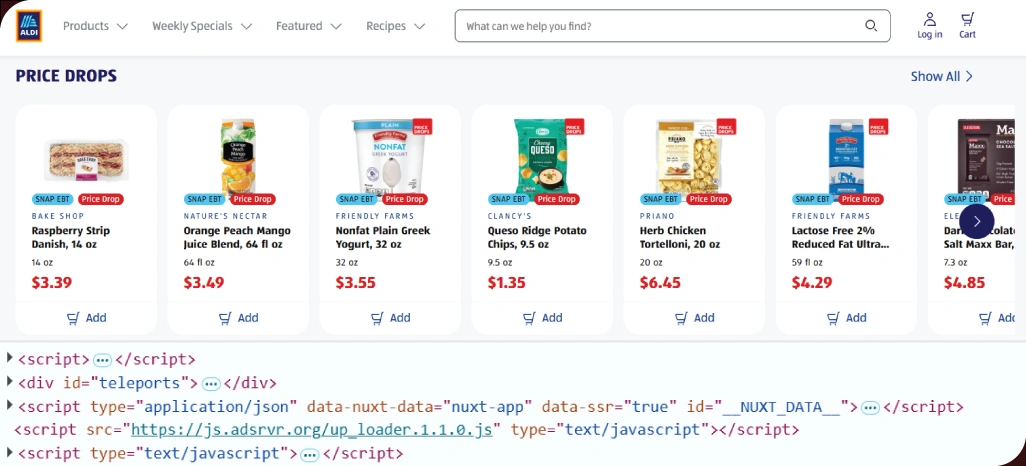

Using Aldi Price Data Scraping, retailers can:

- Track Aldi’s pricing drops to identify high-velocity SKU promotions.

- Decode regional pricing tactics designed to increase foot traffic.

- Detects patterns in seasonal or time-bound pricing.

- Adjust pricing proactively in stores near Aldi locations.

- Benchmark Aldi’s digital pricing against their online channels.

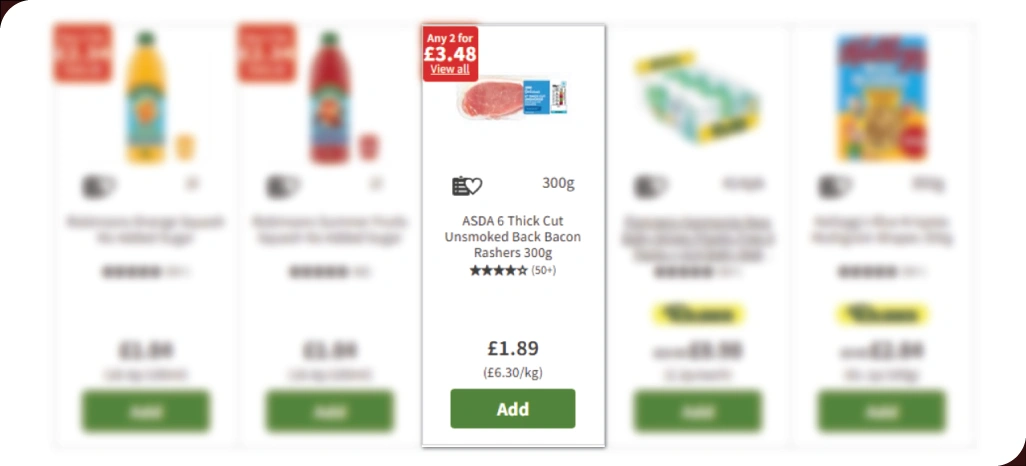

Likewise, ASDA Product Scraping Services reveal pricing adjustments in response to real-world events, such as weather changes or demand spikes, providing competing retailers with the insight to pivot quickly.

Smarter Pricing Through Regional Insights

As consumer preferences vary by location, pricing strategies are increasingly becoming hyperlocal. Retailers are embracing Hyperlocal Supermarket Price Scraping UK to fine-tune pricing by postcode, borough, and even specific store locations.

With Sainsbury’s Grocery Pricing Data, businesses can discover:

- Price variations are based on local income levels and buying habits.

- Effects of Local Transit Access on In-Store Pricing Strategies.

- The timing of flash discounts is aligned with commuter traffic peaks.

- The impact of local events on demand-driven price shifts.

- Real-time performance of pricing experiments by region.

These granular insights allow supermarket chains to design personalized pricing models that resonate more effectively with the communities they serve.

Delivery Pricing: The New Frontier of Cost Strategy

Modern grocery pricing extends beyond the product—it now includes the cost of getting goods to the consumer’s door. Delivery fees, timing, and availability all influence customer decisions, making delivery charges a strategic component of the overall pricing mix.

With Tesco Grocery Delivery Data Scraping, supermarkets gain a clearer view of:

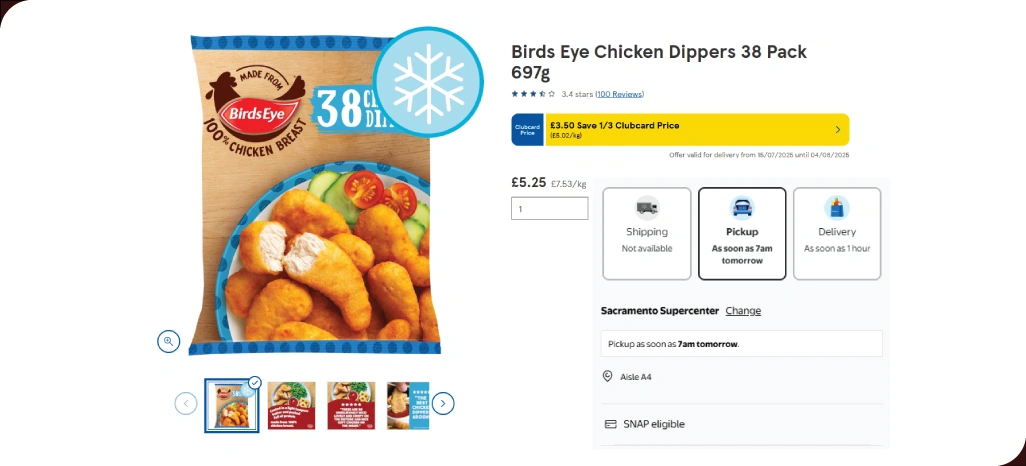

- How delivery charges change during weekends or holidays.

- The pricing logic behind free delivery thresholds.

- Impacts of severe weather or peak hours on delivery surcharges.

- Customer response to time-slot-based delivery pricing.

- Patterns in Express vs. Scheduled Delivery Cost Models.

Similarly, Sainsbury’s Grocery Delivery Data Scraping enables competitors to understand how pricing incentives are shaped by fulfillment logistics, empowering them to build more efficient delivery models.

Predictive Pricing is the New Competitive Edge

Retailers today aren’t just reacting to pricing changes—they’re predicting them. By using historical and real-time data patterns, grocers can forecast how competitors might price products during holidays, sporting events, or economic shifts.

Through Sainsbury’s Pricing Strategy datasets, grocers can:

- Analyze price adjustments before peak sales periods.

- Forecast promotional timing based on past behavioral patterns.

- Simulate competitive reactions to internal pricing changes.

- Develop proactive pricing playbooks to outperform market laggards.

- Reduce reliance on markdowns by anticipating consumer demand.

This forward-thinking approach enables retailers to win not only today’s pricing battles, but also tomorrow’s.

Intelligent Tools for Pricing Simulation and Testing

The scale and speed of pricing data in 2025 demand advanced tools. Retailers are increasingly turning to in-house pricing platforms or integrating with third-party intelligence systems that support real-time data input, simulation, and analysis.

For instance, the Aldi Pricing Intelligence Tool offers:

- Daily and weekly monitoring of Aldi’s pricing shifts.

- Simulation modules for testing different pricing responses.

- Visual dashboards for margin and volume forecasting.

- Alerts on abnormal pricing activity by competitors.

- Data inputs for marketing and campaign alignment.

Additionally, the Sainsbury’s Grocery Price Data Scraping API enables retailers to automate data feeds into pricing engines, ensuring their teams make informed decisions more quickly and with less manual input.

Competitor Mapping Through Full-Stack Pricing Comparisons

Retailers aren’t just matching base product prices anymore—they’re dissecting every pricing layer to assess competitive positioning. From loyalty bonuses to delivery add-ons, every detail counts in today’s pricing intelligence strategy.

Scraping Tesco prices for competitor analysis helps supermarkets decode:

- The full cost to the customer, including hidden fees or bundled offers.

- Terms tied to discounts, loyalty memberships, or time-based deals.

- Frequency of price changes and promotional refresh rates.

- Display logic (e.g., pricing hierarchy or promotional visuals).

- Category-wide pricing behavior (premium vs. value segments).

These insights fuel Competitive Moves With UK Supermarket Pricing Data, where pricing war rooms test and execute responses across digital and physical channels with remarkable agility.

Beyond Pricing: Gaining Product-Level Insights

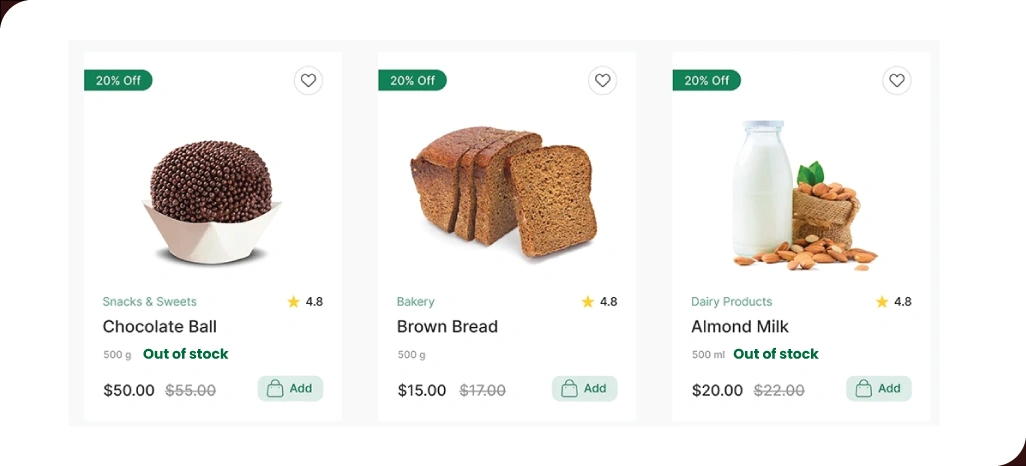

Scraping grocery data does more than optimize price—it shapes broader product strategies. Supermarkets can use scraped datasets to refine inventory management, assortment decisions, and marketing messages with greater precision.

By leveraging Grocery Data Scraping, decision-makers can:

- Identify high-performing SKUs and slow movers across regions.

- Analyze competitor stock availability and replenishment cycles to identify opportunities for enhancing stock management.

- Monitor shifts in customer preferences and seasonal buying patterns.

- Adjust product bundles or promotions based on real-time activity.

- Align marketing efforts with actual shelf or inventory behavior.

These product-level insights help align pricing with demand, keeping shelves stocked and ensuring customer satisfaction.

Delivery Intelligence as a Pricing Lever

Customer segments, geography, and cart behavior are increasingly used to customize delivery strategies. Supermarkets like ASDA are developing innovative delivery models to stay competitive, and others are closely watching their progress.

Using ASDA Grocery Delivery Data Scraping, pricing teams gain visibility into:

- Price fluctuations for delivery slots are based on demand.

- Dynamic delivery costs are triggered by weather or local events.

- Personalized offers tailored to your loyalty status or purchase frequency.

- Cart-value-based free delivery eligibility thresholds.

- Delivery pricing changes during service disruptions.

When combined with efforts to Scrape Tesco Prices For Competitor Analysis, this intelligence offers a comprehensive view of how pricing strategies evolve from the product page to final doorstep delivery.

How Retail Scrape Can Help You?

We help businesses turn complex pricing challenges into clear opportunities using the power of UK Supermarket Data Scraping. Our custom data solutions are built to support competitive benchmarking, pricing automation, and strategic market positioning across all major UK grocery retailers.

Here’s how we support your goals:

- Real-time data feeds from top UK supermarkets.

- Geo-specific pricing for postcode-level accuracy.

- Competitor tracking across Tesco, Sainsbury’s, ASDA, and Aldi.

- Integration-ready APIs for seamless workflows.

- Scalable architecture to manage thousands of SKUs.

Our services also include access to Hyperlocal Supermarket Price Scraping UK, which enables retailers and analysts to stay locally competitive. Let’s build a more brilliant pricing strategy—together.

Conclusion

In today’s hyper-competitive grocery market, leveraging UK Supermarket Data Scraping offers a clear advantage in crafting more innovative, more localized pricing strategies. Real-time insights allow businesses to stay aligned with evolving market dynamics and anticipate competitor moves with greater accuracy.

Whether you’re analyzing promotions, product listings, or pricing gaps, access to precise Tesco Price Data Scraping can sharpen your pricing decisions across regions. Contact Retail Scrape to schedule a complimentary consultation or request a customized demo and discover how our data solutions can refine your pricing strategy in 2025.