How Can a Step-By-Step Market Research Guide for Businesses Drive 35% Growth in the US and Australia?

Introduction

In today’s fast-moving economy, companies in the US and Australia are under constant pressure to understand customer behavior, competitor strategies, and pricing fluctuations in real time. Traditional research methods like surveys and static reports often fail to provide immediate answers, especially when market conditions change daily.

A strong Step-By-Step Market Research Guide for Businesses helps organizations turn raw competitive information into structured decisions. Whether it’s identifying new demand pockets, tracking regional product performance, or evaluating competitor discount patterns, the right approach ensures businesses don’t make decisions based on assumptions.

This is where Price Scraping for US Market Research Analysis becomes a critical method for obtaining real-world market insights without relying on outdated datasets. As a result, market research is no longer a periodic process—it becomes an ongoing business advantage that drives measurable revenue outcomes.

Creating Strong Regional Insights for Smarter Expansion

Growth in the US and Australia depends heavily on understanding how each market responds to pricing, promotions, and product availability. When companies rely on scattered reports or outdated research, they often misjudge demand, invest in the wrong product categories, or launch campaigns that fail to convert.

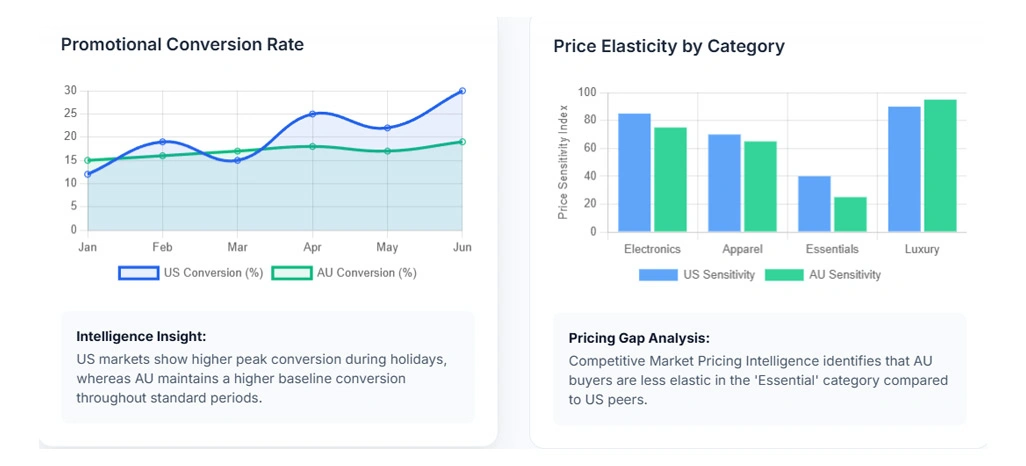

A reliable strategy begins with Market Research for US and Australian Businesses, which helps brands understand regional pricing expectations, seasonal behavior, and local competition. For example, US consumers react faster to flash deals, while Australian buyers often show higher loyalty toward brands offering consistent pricing.

According to Deloitte, data-driven companies are nearly 3x more likely to improve decision-making speed compared to competitors. This is where Competitive Market Pricing Intelligence Australian becomes valuable, enabling brands to evaluate promotional frequency and identify pricing gaps.

Regional Intelligence Drivers That Improve Growth:

| Market Research Factor | US Market Outcome | Australia Market Outcome |

|---|---|---|

| Pricing comparison tracking | Better conversion rates | Stronger seasonal pricing |

| Competitor discount analysis | Faster campaign updates | Improved loyalty strategy |

| Product demand benchmarking | Reduced inventory issues | Higher fulfillment accuracy |

| Category pricing intelligence | Better margin control | Stronger brand positioning |

| Promotion trend evaluation | Smarter offers | Higher customer retention |

To support faster competitor benchmarking, businesses also use Price Monitoring for Competitive Analysis, ensuring decisions are based on real market activity instead of delayed assumptions.

Eliminating Pricing Gaps Through Automated Tracking

Pricing uncertainty is one of the biggest reasons companies lose market share. Many organizations still rely on manual competitor tracking, which becomes impossible when hundreds of SKUs must be checked daily. This often results in missed discount opportunities, incorrect pricing strategies, and slow response to competitor actions.

To solve this, businesses are now shifting toward Market Research Using Price Scraping Tools, allowing them to automatically extract competitor pricing and product details from multiple platforms. This eliminates human error and ensures faster access to pricing intelligence.

Companies that implement Automated Price Scraping for Market Intelligence can build structured datasets that support forecasting, product benchmarking, and long-term pricing strategies. This is especially helpful for eCommerce brands operating across marketplaces where pricing changes daily.

How Automation Improves Pricing Intelligence:

| Research Issue | Manual Tracking Result | Automated Tracking Result |

|---|---|---|

| Competitor price changes | Delayed updates | Instant visibility |

| Monitoring large SKU catalogs | High operational cost | Scalable monitoring |

| Detecting promotion patterns | Missed campaign cycles | Daily trend reporting |

| Benchmarking category pricing | Limited coverage | Full category comparison |

| Price-based demand forecasting | Low accuracy | Data-backed insights |

Businesses also rely on Real-Time Price Tracking for Competitive Analysis to detect immediate price drops and respond without delays. Additionally, Web Scraping Price Data for Businesses supports deeper market datasets that improve planning accuracy and reduce revenue loss caused by slow competitor monitoring.

Converting Competitive Data Into Strategic Decisions

Collecting competitor information is not enough unless it leads to actionable decisions. Many businesses gather market data but fail to translate it into clear pricing and expansion strategies. This creates delays in execution and results in lost opportunities.

One key advantage of real-time market intelligence is faster decision-making. PwC reports that data-driven organizations are 23x more likely to acquire customers, while Accenture states that companies using advanced analytics can experience up to 20% faster revenue growth.

To streamline decision workflows, businesses now integrate Competitive Pricing Analysis Through Web Scraping API, allowing competitor prices to feed directly into dashboards and analytics models. This ensures teams can monitor competitor activity continuously rather than waiting for weekly reports.

Business Outcomes Driven by Market Intelligence:

| Insight Type | Strategic Business Benefit | Growth Impact |

|---|---|---|

| Competitor discount trends | Smarter promotion planning | Higher conversion |

| Regional price movement tracking | Location-based pricing accuracy | Improved margins |

| Stock availability analysis | Better demand forecasting | Reduced lost sales |

| Category pricing fluctuations | Stronger positioning strategy | Higher market share |

| Promotion frequency tracking | Competitive offer planning | Increased retention |

For businesses operating across multiple regions, Real-Time Price Monitoring in US and Australia ensures teams respond instantly to competitor pricing shifts. When businesses consistently track real-time movements, they reduce pricing mistakes, improve market adaptability, and build long-term scalability through structured competitive intelligence.

How Retail Scrape Can Help You?

Most businesses struggle because they treat market research as a slow process instead of a continuous strategy. By using a data-driven approach, organizations can apply a Step-By-Step Market Research Guide for Businesses to monitor competitor activity and market changes without delays.

We support decision-makers with:

- Advanced competitor monitoring across multiple retail platforms.

- Daily pricing visibility for large product catalogs.

- Automated product data collection with structured output formats.

- Category-level benchmarking for accurate pricing strategy.

- Promotion trend detection for better campaign timing.

- Scalable intelligence workflows designed for high-growth businesses.

In addition, we support Business Market Research With Price Optimization by providing consistent pricing intelligence that helps brands refine their positioning, improve margins, and adapt quickly to competitor moves.

Conclusion

In competitive markets like the US and Australia, growth is directly tied to how quickly businesses understand pricing behavior, customer expectations, and competitor movements. When organizations follow a structured research system, a Step-By-Step Market Research Guide for Businesses becomes a powerful framework that transforms scattered data into clear business direction.

Companies that invest in smarter intelligence methods also benefit from Market Research for US and Australian Businesses, ensuring their decisions align with regional buying patterns and pricing sensitivity. Contact Retail Scrape today to build your next research-driven growth strategy.