What Insights Does Food Data Scraping Provide on Domino’s vs Pizza Hut Price Strategies?

Introduction

In today’s evolving fast food landscape, Domino’s and Pizza Hut continue to lead the way, leveraging pricing tactics, menu innovations, and region-specific deals to compete for consumer attention. With Food Delivery Data Intelligence at the core, both brands are in a constant strategic battle to boost customer engagement and grow market share.

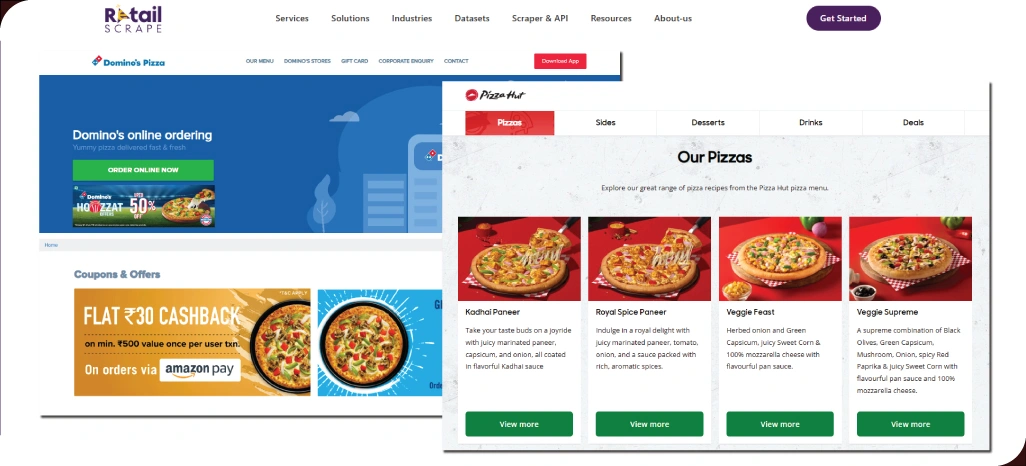

With the power of Food Data Scraping, businesses can access structured, real-time, and historical datasets to uncover actionable insights into promotional tactics, pricing trends, and customer preferences. By tracking everything from item-level menu changes to localized offers, scraping food data enables a deeper understanding of competitive positioning.

This blog explores the pricing intelligence extracted through data scraping, diving into the Domino’s vs Pizza Hut rivalry and the Competitive Pricing Strategies shaping their approach in 2025.

Understanding Strategic Approaches in Pizza Brand Pricing

In 2025, the pizza industry continues to evolve under the influence of global economic shifts and changing consumer preferences. Brands like Domino’s and Pizza Hut have made notable adjustments in their pricing strategies to maintain relevance and profitability in a competitive market.

These changes are not arbitrary—they reflect deliberate positioning tactics in response to:

- Global supply chain disruptions are impacting ingredient availability and cost structures.

- Surging demand for personalized pizzas is prompting more granular pricing models.

- Regional taste preferences have encouraged innovation in both product offerings and price points.

1. Brand-by-Brand Strategic Breakdown

Detailed analysis through Pizza Price Scraping For Market Insights reveals key distinctions in how Domino’s and Pizza Hut approach pricing in this dynamic landscape:

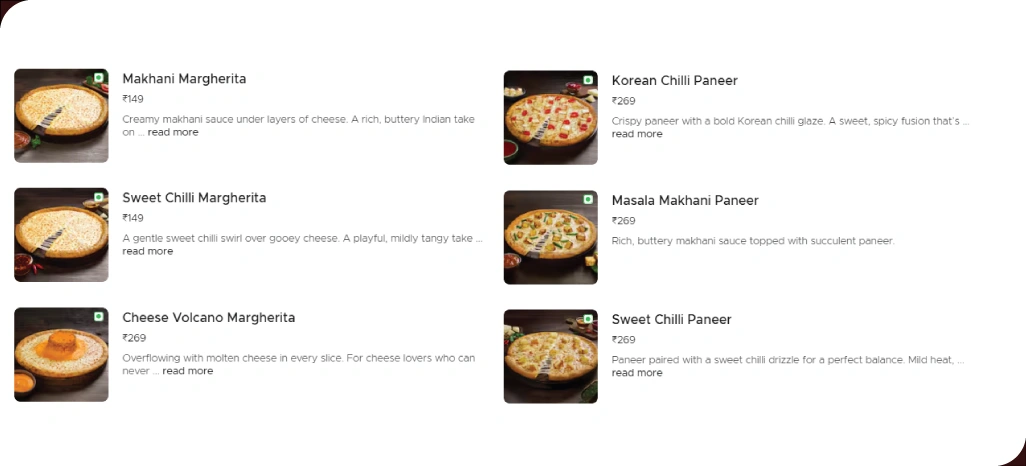

- Domino’s has shifted toward a tier-based pricing structure, where costs vary depending on crust types, toppings, and portion sizes. This suggests a strategy centered around menu personalization, where customers pay a premium for tailored experiences.

- Pizza Hut is focusing on value-driven bundling by offering affordable combo deals and family packs, targeting group purchases and volume sales. This strategy, supported by Pizza Hut Food Delivery Data Scraping, highlights a mass-market approach centered on accessibility and cost-effectiveness.

2. Strategic Takeaways Across Departments

These contrasting strategies are more than marketing decisions—they are cross-functional insights that impact:

- Marketing teams can realign messaging with consumer expectations and price sensitivity.

- Pricing analysts can better forecast elasticity and margin thresholds.

- Operations managers must ensure that product availability matches localized demand.

- Investors seek indicators of long-term sustainability and competitive advantage.

By examining such data, businesses gain a clear view of how pricing not only reflects customer preferences but also defines how each brand competes and grows in a fast-evolving sector.

Unpacking Pricing Patterns: Domino’s and Pizza Hut in Focus

Understanding price movements across digital menus offers a powerful lens into the strategic decisions made by major food chains. These menus are continuously evolving, making them tricky to monitor manually. This is where automated tools like Domino's Menu Price Tracking play a critical role in identifying subtle pricing shifts over time. Similarly, Pizza Hut Menu Price Tracking helps capture region-specific pricing trends and promotional patterns with precision.

Here's what the data reveals:

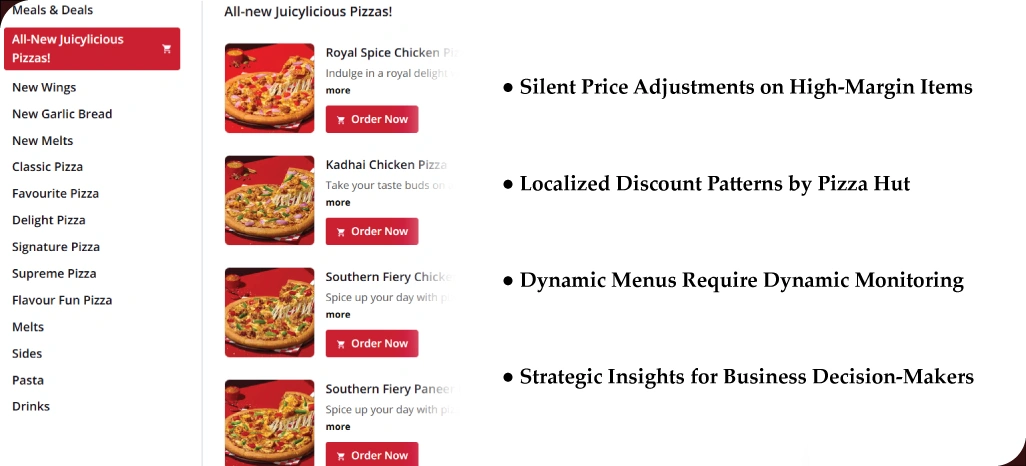

- Silent Price Adjustments on High-Margin Items

Over the last quarter, data indicates that Domino’s introduced a subtle 5–7% price increase on premium offerings such as cheese burst pizzas and gourmet toppings. This wasn’t part of a large-scale promotional campaign, suggesting a quiet inflation-aligned strategy aimed at preserving profit margins without deterring customers.

- Localized Discount Patterns by Pizza Hut

Pizza Hut, on the other hand, is leaning into a region-based pricing model. The data indicates that metro cities experience more frequent and deeper discounting than tier-2 and tier-3 towns. These variations suggest a deliberate push to remain competitive and drive order volume in urban, high-density zones.

- Dynamic Menus Require Dynamic Monitoring

Unlike static pricing models of the past, modern QSR menus are highly dynamic, updated regularly based on demand, cost, and competitor movements. This fluidity makes manual tracking nearly impossible. Automation tools are essential for capturing these shifts and interpreting their impact in real-time.

- Strategic Insights for Business Decision-Makers

These insights are particularly valuable for F&B consultants, competitive research analysts, and QSR strategists. With real-time access to granular menu data, they can identify market shifts early, benchmark against competitors, and align pricing decisions with broader business goals.

Strategic Comparison: A Data-Driven Look into Promotions and Pricing Tactics

Understanding the underlying patterns in fast food pricing reveals more than just cost differences—it uncovers each brand’s unique marketing intent. With data-backed insights, we can now decode how Domino’s and Pizza Hut structure their offers, giving us a sharper view of their competitive mindset.

1. Evolving Promotional Playbooks

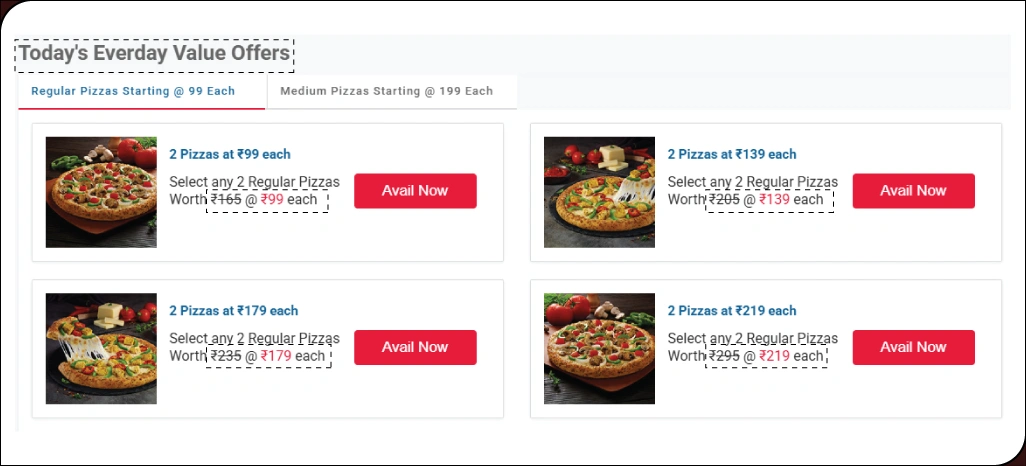

Promotions serve as the first touchpoint between brands and consumers. But their real value lies in long-term influence, not just short-term spikes. Here's what a recent Domino's vs Pizza Hut Discounts Analysis suggests:

- Domino’s has moved away from scattergun discounting. Instead of offering random coupon codes, the brand leans into combo-based savings designed to appeal to loyal customers or repeat users logged into their accounts. This signals a substantial shift toward nurturing existing relationships.

- Pizza Hut, in contrast, maintains a broad approach. Frequent BOGO (Buy One Get One) promotions, limited-time offers like “Afternoon Delights,” and lunch-hour deals indicate a strategy focused on attracting new footfall, whether in-store or through digital ordering platforms.

2. Targeting, Timing, and Tactical Frequency

One of the standout insights from this comparison is how both brands handle the when and who of their deals:

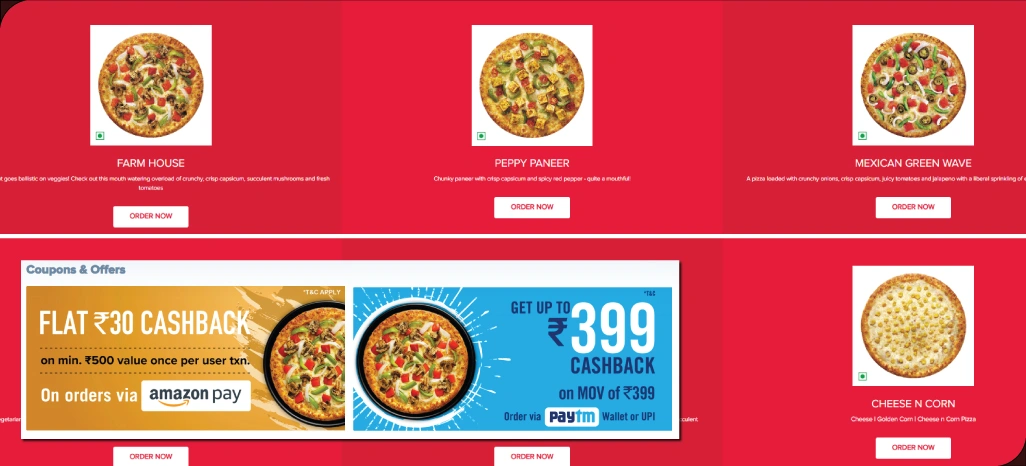

- Domino’s demonstrates consistent use of reward-based strategies, likely driven by customer behavior insights. Domino's Food Delivery Data Scraping reveals that discounts typically follow account logins or repeat orders, indicating AI-powered personalization aimed at boosting retention.

- Pizza Hut seems to operate on a volume-through-incentive model, pushing promotions in specific time slots and rotating them frequently to maintain a fresh engagement cycle with a broader audience.

3. Product Bundling Shifts and Hidden Value Changes

While most customers focus on the final price tag, subtle tweaks in bundled offerings often go unnoticed—unless you're backed by deep menu analytics.

- Using Pizza Menu Scraping For Competitive Intelligence, it's evident how product pairings are strategically changed. For instance, Pizza Hut recently dropped garlic bread from a popular combo offer without altering the headline price, quietly decreasing the overall value proposition without causing immediate churn.

These small shifts, when tracked over time, paint a bigger picture of how brands subtly adjust customer expectations.

How Regional Nuances Shape the Pricing Tactics of Leading Pizza Brands?

Understanding consumer behavior across different regions is crucial when analyzing pricing strategies of major QSR chains. Geographically based price variations reveal how brands adjust offerings based on local demand, purchasing power, and lifestyle preferences.

Here are some key observations derived from the Domino’s vs Pizza Hut Data Comparison:

- Tier-1 City Focus: In high-density urban centers, Pizza Hut often initiates menu pricing at a slightly lower threshold. This seems designed to appeal to budget-conscious customers, particularly students or families ordering in larger volumes.

- Domino’s Premium Play: Domino’s, by contrast, positions select offerings—such as the “Cheese Dominator”—at a premium price point in the same cities. This indicates a strategy geared toward customers who prioritize taste experience and premium toppings over quantity.

- Regional Customization Based on Demographics: The Domino's vs Pizza Hut Data Comparison highlights how both brands actively tailor their pricing structures to align with local socio-economic profiles. This adaptability allows them to better target consumer segments in each market and drive loyalty through regional relevance.

Adding more depth, Domino's Menu Scraping has shown that even within a single city, local outlets sometimes adjust prices and ingredients. In coastal areas, seafood-based toppings are typically priced higher, reflecting the elevated sourcing and logistics costs. On the other hand, Pizza Hut Menu Scraping reveals a more substantial presence of seasonal or location-specific menu items, indicating more agility in adapting to local flavor preferences.

For marketers, strategists, and QSR chains, these insights offer a powerful lens into how pricing is more than just numbers—it's an evolving response to regional demand dynamics and consumer expectations.

Understanding the Interplay of Value, Loyalty, and Customer Sentiment

While pricing is a key part of competitive analysis, it only reveals part of the picture. Proper consumer preference is driven by overall brand experience, including perceived value, Customer Sentiment Analysis, emotional connection, and service quality.

Here's how customer satisfaction shapes the rivalry between Domino’s and Pizza Hut:

- Delivery & Digital Experience: Domino’s consistently outperforms in delivery speed and mobile app usability, earning higher customer ratings for ease and convenience. This strengthens their position among tech-savvy and time-sensitive customers.

- Dine-in & Quantity Perception: Pizza Hut receives stronger consumer feedback in areas like portion size and dine-in atmosphere, appealing more to traditional, in-store diners who prioritize meal volume and ambiance over rapid service.

- Value Alignment Matters: Domino’s might position some of its menu items at a slightly higher price point, but it compensates with quicker delivery, user-friendly ordering, and overall service reliability, enhancing the perceived value. Pizza Hut, on the other hand, leans on delivering more food per dollar, which resonates with customers seeking quantity and occasional dine-in experiences.

- Loyalty Driven by Consistency: Customers are more loyal when their expectations are consistently met. Sudden or confusing price shifts often undermine trust. This is where sentiment plays a pivotal role.

- Customer Sentiment as a Strategic Indicator: When integrated into Pizza Menu Scraping For Competitive Intelligence, sentiment analysis highlights a preference for straightforward, transparent pricing. Offers that are clear and reliable tend to foster deeper trust than spontaneous discounts or hidden fees.

These insights from Consumer Satisfaction Domino's vs Pizza Hut don’t just help the brands themselves—they provide a valuable reference point for other QSR players. Understanding how service delivery, value perception, and customer sentiment interact enables smarter, customer-centric pricing strategies that go beyond the numbers.

How Retail Scrape Can Help You?

We empower businesses with advanced Food Data Scraping solutions designed to decode complex pricing models, monitor competitor menus, and identify trends that directly influence profitability. Whether you're targeting strategic pricing, customer segmentation, or promotional optimization, our data helps you make decisions backed by real-time insights.

Here’s what we can do for your business:

- Collect structured menu data across platforms in real-time.

- Track regional pricing variations and local promotional shifts.

- Monitor changes in combo deals, offers, and limited-time menus.

- Compare product value positioning across competing brands.

- Enable data-driven pricing experiments and performance analysis.

Our scraping infrastructure is tailored for high-volume, high-accuracy use cases. With access to Pizza Menu Scraping For Competitive Intelligence, your team can make faster, more strategic decisions backed by reliable market data.

Conclusion

The evolving fast food landscape demands sharper, faster decisions, and Food Data Scraping offers the clarity brands need to monitor pricing trends, optimize offerings, and stay ahead in a highly competitive market. By extracting real-time insights from menu data, businesses can uncover hidden pricing patterns that directly influence customer perception and ROI.

Whether you're benchmarking promotions, analyzing product value, or exploring regional pricing shifts, a thorough Domino's vs Pizza Hut Price Analysis can guide more brilliant strategic moves. Contact Retail Scrape to access accurate, scalable data solutions and transform raw pricing data into a competitive advantage.