What Quick Commerce Analytics India Reveals About 63% Data-Led Growth in Fast Delivery Apps?

Introduction

India’s fast-delivery ecosystem has undergone exponential acceleration over the past two years, driven largely by a demand shift toward instant purchases and micro-fulfillment models. This is where Quick Commerce Analytics India emerges as a decisive competitive advantage, offering structured insights into demand fluctuations, delivery bottlenecks, pricing variations, and regional availability patterns.

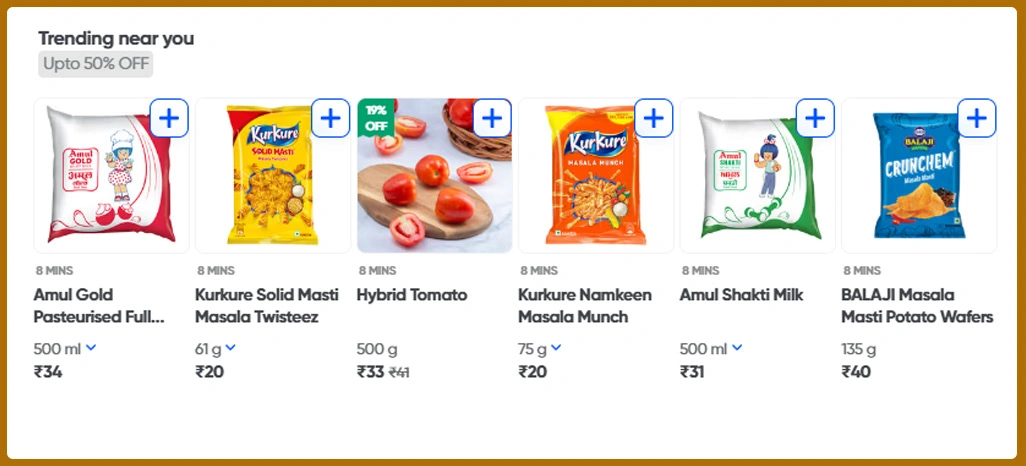

Businesses are now relying on Quick Commerce Datasets to decode real buying behaviour across neighborhoods and time slots, enabling more accurate forecasting and smarter on-shelf availability for high-velocity categories. The rapid growth of 63% in data-led decision-making across quick-commerce operations highlights how essential granular intelligence has become for companies seeking long-term consistency in a volatile market.

Fresh, structured scraped intelligence provides the extra layer of visibility needed to drive internal optimization. Whether for product planners, pricing teams, inventory managers, or digital retail strategists, the ability to transform platform-level raw feeds into actionable decisions is what allows modern Q-commerce brands to scale sustainably.

Strengthening Operational Visibility Through Structured Evaluation

As the ecosystem of fast-delivery platforms expands, category teams depend heavily on accurate signals that explain how inventory flows, where bottlenecks occur, and which micro-markets behave differently. Intelligence derived from Quick Commerce Data Scraping helps analysts review rating fluctuations, listing changes, and stock rhythm variations that influence real-time performance.

Brands also incorporate Scraped Data for Q-Commerce to evaluate demand patterns more precisely. The ability to monitor sudden drops in inventory or unexpected price adjustments allows decision-makers to refine execution at a faster pace. This structured view supports teams in detecting early warning indicators before they affect fulfilment outcomes.

Moreover, real-time evaluations help planners match inventory availability with expected order surges. The process ultimately leads to better decision-making, reduced wastage, more consistent delivery performance, and enhanced customer experience across regions.

Core Operational Insight Metrics:

| Metric | Purpose | Result |

|---|---|---|

| Pricing signals | Evaluate market shifts | Inform pricing actions |

| Availability trends | Understand stock cycles | Improve replenishment |

| Listing behaviour | Track platform placement | Strengthen visibility |

| Delivery pattern | Assess movement rhythm | Enhance task planning |

Improving Competitive Clarity Through Market Behaviour Tracking

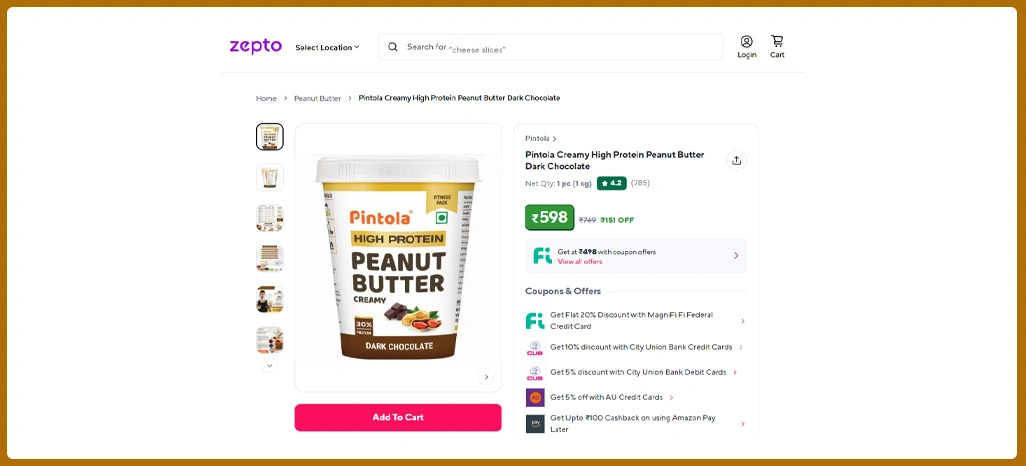

A rapidly evolving marketplace demands continuous monitoring of price gaps, visibility adjustments, and regional purchase patterns. The use of Swiggy Instamart Data Scraping provides granular breakdowns of discounting fluctuations, product rotation frequency, and comparative pricing behaviour across high-demand zones. These insights simplify complex decisions that previously relied on guesswork.

To support deeper accuracy, analysts integrate Swiggy Instamart Price Monitoring into strategic dashboards to detect market triggers early. When pricing shifts occur at competing delivery apps, teams can evaluate whether the change should influence their promotional budget or remain unaddressed based on margin objectives.

Further refinement comes through insights drawn from Zepto and Swiggy Price and Stock Insights, enabling brands to understand cross-platform differences. By comparing platform-specific availability patterns, brands can reorganize stock allocation more efficiently. This helps reduce sudden gaps in visibility or regional shortages that impact sales.

The combination of multi-platform monitoring and structured data analysis results in stronger competitive alignment and more efficient internal planning.

Key Competitive Insight Indicators:

| Indicator | Purpose | Application |

|---|---|---|

| Price gaps | Identify competitor changes | Refine pricing plans |

| Visibility ranking | Track listing behaviour | Improve placement |

| Availability signals | Detect stock issues | Adjust distribution |

| Seasonal trends | Understand demand peaks | Plan timely offers |

Enhancing Inventory Accuracy Through Real-Time Ecosystem Signals

Accurate inventory alignment is essential for brands operating within fast-moving delivery environments. Sudden shifts in product velocity or rapid category turnover require teams to evaluate on-shelf activity continuously. Using Zepto Grocery Data Scraping, analysts can track product rotation frequency, sudden out-of-stock events, and pricing transitions across local markets. This helps ensure that stock flow decisions match consumption patterns.

Inventory teams enrich their workflows further by incorporating Real-Time Stock Tracking for Quick Commerce, enabling them to match supply with dynamic demand windows. With instant access to high-frequency availability updates, planners can respond to replenishment gaps before they affect final delivery execution. This supports higher fulfilment accuracy, smoother logistics coordination, and improved customer satisfaction.

Another valuable layer of intelligence emerges from Market Intelligence Through Quick Commerce Data, which provides category-wide signals showing shifts in buyer interest or SKU-specific demand jumps. These insights guide planners in reorganizing stock distribution between warehouses to prevent shortages during high-order intervals.

Inventory & Fulfilment Optimization Metrics:

| Metric | Role | Outcome |

|---|---|---|

| Reorder timing | Calculates product velocity | Enhances stock flow |

| Demand pressure | Shows consumption intensity | Improves allocation |

| SKU visibility | Tracks listing consistency | Prevents missed sales |

| Price shifts | Indicates demand changes | Sharpens forecasting |

How Retail Scrape Can Help You?

Modern brands increasingly depend on structured intelligence to refine fulfilment accuracy, pricing consistency, and competitive positioning. With a strong capability to integrate Quick Commerce Analytics India into daily workflows, we help brands interpret platform-level behaviours with clarity.

Our approach includes:

- Tailored datasets mapped to market requirements.

- Structured feeds aligned with internal analytics systems.

- Continuous monitoring for fast-moving categories.

- Regional-level visibility for precise decision-making.

- Configurable refresh frequencies for dynamic tracking.

- Cross-platform coverage that supports strategic benchmarking.

These insights support improved forecasting, faster competitive reactions, and a more stable supply chain. With deeper clarity supported by Real-Time Stock Tracking for Quick Commerce, brands can confidently manage high-velocity categories in an increasingly competitive environment.

Conclusion

Constant shifts in pricing, demand, and availability require businesses to operate with stronger analytical clarity, making Quick Commerce Analytics India essential for teams building future-ready workflows. With structured intelligence improving visibility across categories, brands can handle rapid market changes more effectively and create stronger performance outcomes.

As competition intensifies, granular signals such as Scraped Data for Q-Commerce help category managers respond quickly to fluctuating trends and evolving buyer expectations. Connect with Retail Scrape today to power your next phase of data-driven growth.