How Can Michigan Grocery Chain Data Scraping Reveal the 10 Largest Grocery Chains’ 2026 Growth Trends?

Introduction

Michigan’s grocery landscape is entering a pivotal phase as consumer preferences, regional expansion strategies, and pricing sensitivity reshape how leading chains operate. With 2026 approaching, grocery retailers and suppliers are seeking deeper visibility into store-level performance, competitive positioning, and localized demand behavior.

By analyzing store footprints, pricing movements, and assortment patterns, businesses can better understand how Michigan’s top grocery chains respond to economic pressure and shifting buying habits. Michigan Grocery Data Scraping plays a foundational role in unifying scattered retail information into a single analytical view, enabling consistent comparisons across locations and brands.

As competition intensifies among the state’s largest grocery players, data-backed decisions now influence everything from inventory planning to regional expansion. Strategic analysis supported by Michigan Grocery Chain Data Scraping allows stakeholders to convert raw digital shelf data into forward-looking insights. When aligned with Grocery Market Analysis Michigan 2026, retailers and analysts gain clarity on where growth is emerging, which formats are scaling faster, and how consumer loyalty is evolving across Michigan’s grocery ecosystem.

Regional Expansion Patterns Shaping Competitive Positions

Michigan’s grocery sector reflects clear geographic priorities that signal how leading chains are preparing for future demand. Store expansion activity across metro hubs, suburban belts, and secondary cities indicates where retailers expect population density, purchasing power, and repeat foot traffic to rise. Evaluating these movements requires consolidated visibility into chain-level rollout strategies rather than isolated store announcements.

Through US Grocery Chain Data Scraping, analysts can observe how national and regional brands differ in their Michigan footprint strategies. Some chains concentrate on high-volume urban clusters, while others favor mid-sized towns with lower operating costs. When this location intelligence is paired with Retail Grocery Growth Analysis Michigan, it becomes easier to quantify which expansion models generate sustainable returns.

Comparative benchmarking further sharpens insight. Using Top Grocery Chains Michigan Data Comparison, businesses can evaluate how store density correlates with pricing formats, private label penetration, and local brand affinity. This structured comparison avoids anecdotal assumptions and highlights measurable performance gaps between the state’s largest operators.

Illustrative Expansion Intelligence Table:

| Chain Category | Avg. Store Additions | Primary Zones | Strategic Focus |

|---|---|---|---|

| National Brands | 5–7% annually | Metro regions | High-volume sales |

| Regional Leaders | 3–4% annually | Mixed urban | Local loyalty |

| Discount Formats | 4–6% annually | Suburban areas | Cost efficiency |

To operationalize such analysis at scale, a Grocery Scraping API enables automated collection of store listings, address changes, and operational attributes across multiple chains. This creates a reliable dataset for long-term planning rather than one-time observation.

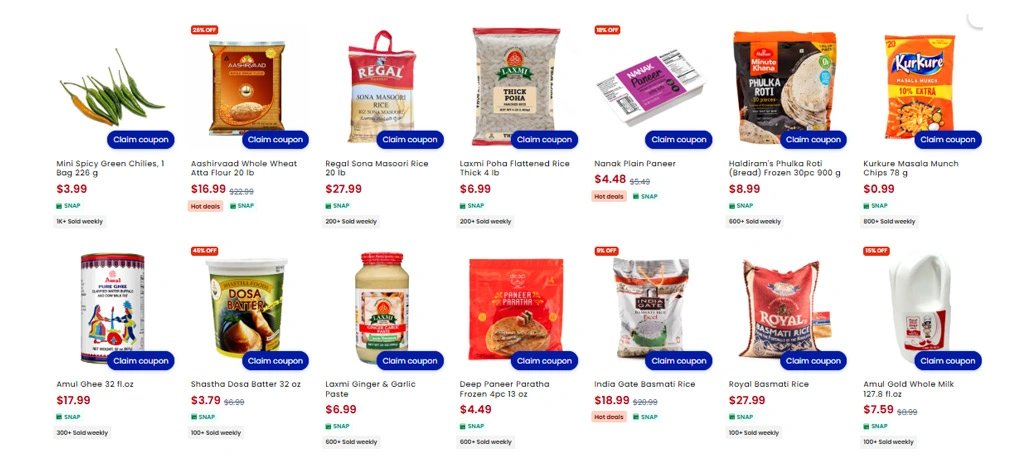

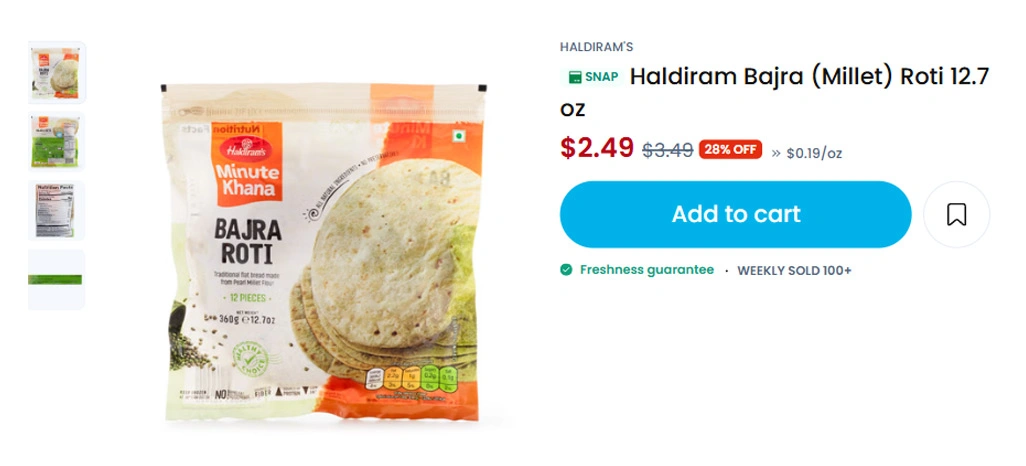

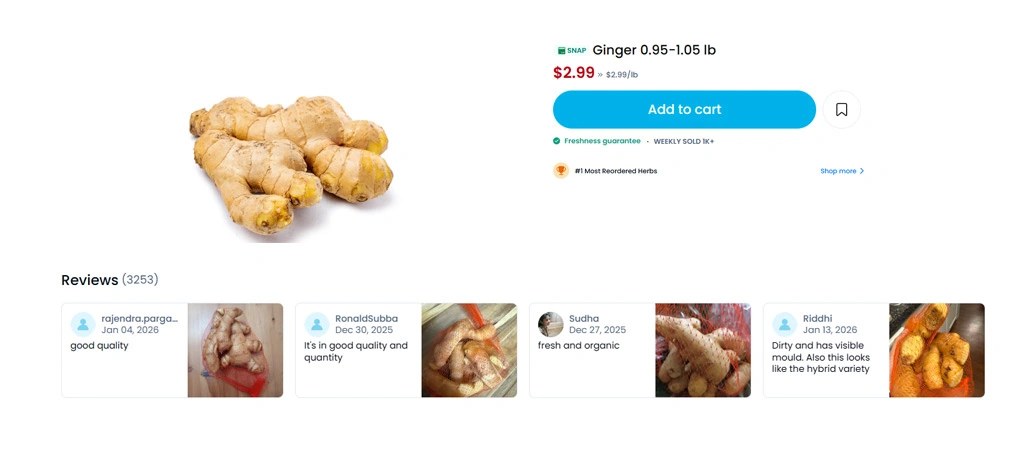

Pricing Movements Reflecting Shifts In Shopper Demand

Price behavior across grocery categories provides direct insight into consumer sensitivity and competitive intensity. Michigan’s retailers increasingly adjust prices at the regional and store level rather than relying on uniform statewide pricing. Tracking these movements reveals how chains respond to cost pressures while protecting customer loyalty.

By applying Data Scraping for Michigan Grocery Chain Trend Analysis, pricing changes can be linked to demand signals such as promotional frequency, assortment depth, and private label emphasis. This analysis highlights which retailers use aggressive discounting to drive volume and which rely on stable pricing supported by brand trust.

Accurate collection of shelf-level prices requires a robust Grocery Scraper capable of capturing real-time and historical data across multiple platforms. This enables consistent comparisons across chains, locations, and categories without manual intervention. When aligned with Grocery Chain Revenue and Store Count Data Michigan, pricing intelligence also helps explain why certain stores outperform others despite similar footprints.

Illustrative Pricing Behavior Table:

| Product Category | Avg. Price Shift | Promotion Depth | Observed Response |

|---|---|---|---|

| Packaged Foods | +4.8% YoY | High | Volume stability |

| Fresh Produce | +2.1% YoY | Low | Regional variance |

| Household Staples | +3.5% YoY | Moderate | Brand switching |

Price elasticity insights become especially valuable when evaluated longitudinally. Retailers that balance promotional depth with margin discipline tend to show steadier revenue performance over time.

Revenue Signals Emerging From Store Level Performance

Revenue outcomes increasingly depend on how individual stores perform within their local context. Michigan’s grocery chains show wide variation in revenue per location, driven by format type, pricing strategy, and surrounding competition. Evaluating these differences requires granular datasets that go beyond aggregated brand-level reporting.

A unified Michigan Grocery Chain Dataset With Pricing and Store Info enables analysts to map revenue performance against variables such as store size, assortment breadth, and pricing tier. This approach reveals which formats scale efficiently and which locations underperform despite strong brand presence. These insights are central to forward-looking assessments tied to Michigan Grocery Market Growth Data Intelligence 2026.

Store-level revenue analysis also supports smarter capital allocation. Chains can identify regions where expansion delivers diminishing returns and redirect investment toward higher-performing zones. This reduces risk while improving forecast accuracy.

Illustrative Revenue Performance Table:

| Store Format | Avg. Annual Revenue | Growth Trend | Primary Driver |

|---|---|---|---|

| Large Supermarkets | High | Moderate | Basket size |

| Discount Stores | Medium | High | Price-led demand |

| Neighborhood Stores | Low–Medium | Stable | Convenience |

By standardizing revenue benchmarks across formats, businesses can detect structural advantages rather than short-term spikes. These signals are especially valuable when planning remodels, relocations, or format experimentation.

How Retail Scrape Can Help You?

In a market defined by rapid change, accurate data becomes the backbone of strategic clarity. By applying Michigan Grocery Chain Data Scraping, we help businesses move beyond assumptions and toward measurable market understanding.

What we deliver:

- Clean, structured retail datasets tailored to your scope.

- Location-level visibility across leading grocery brands.

- Consistent monitoring of assortment and pricing movements.

- Scalable data pipelines designed for long-term analysis.

- Flexible delivery formats for analytics and BI systems.

- Compliance-focused data collection practices

By combining these capabilities with Grocery Market Analysis Michigan 2026, we enable stakeholders to anticipate trends rather than react to them.

Conclusion

Michigan’s grocery sector is evolving through expansion strategies, pricing recalibration, and localized performance optimization. When powered by Michigan Grocery Chain Data Scraping, businesses gain the precision needed to interpret competitive signals and align decisions with measurable growth indicators across the state.

As 2026 approaches, aligning strategy with Retail Grocery Growth Analysis Michigan becomes essential for brands seeking clarity in a crowded market. Connect with Retail Scrape today to transform grocery data into confident, future-ready decisions.