What Insights Can Indian Real Estate Data Scraping Provide From 500K+ Active Properties Listings?

Introduction

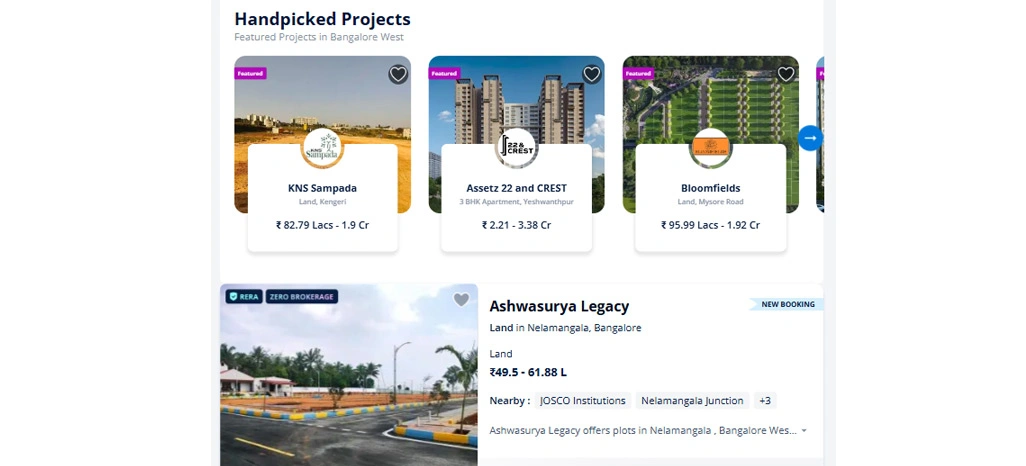

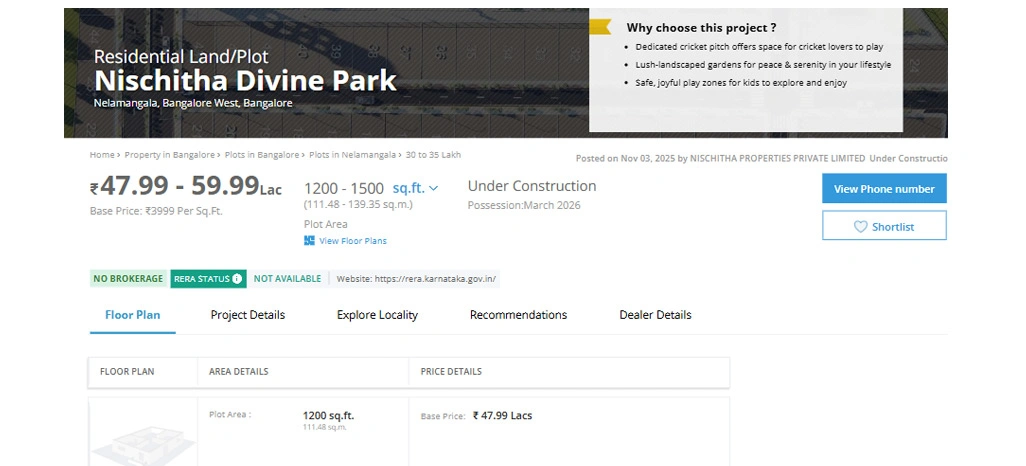

India’s real estate sector is undergoing a massive digital transformation, with over 500K+ active property listings available across portals, brokerage sites, and classified platforms. By using Indian Real Estate Data Scraping, businesses can systematically collect, structure, and analyze property-related information such as prices, locations, amenities, property types, and seller details from multiple web sources.

One of the most practical applications of this approach is the ability to Track Property Prices Across Indian Cities Using Web Scraping, enabling stakeholders to compare micro-markets, identify emerging hotspots, and monitor price volatility in real time. Instead of relying on fragmented reports or delayed surveys, decision-makers now have access to continuously updated market intelligence.

From major metros like Mumbai, Delhi, and Bengaluru to emerging Tier-2 hubs such as Indore, Surat, and Coimbatore, digital listings reveal clear patterns of supply and demand. Leveraging Real Estate Listings Data Extraction allows businesses to uncover hidden trends in buyer preferences, rental yields, and developer strategies effectively.

Data-Driven Signals for Smarter Investments

India’s residential and commercial property market is highly responsive to economic shifts, infrastructure upgrades, and buyer sentiment. Investors increasingly rely on structured listing intelligence to understand which micro-markets offer the best appreciation potential. With the support of Indian Real Estate Pricing Intelligence for Investors, market participants can assess underpriced zones, forecast future growth corridors, and avoid overheated localities that may face stagnation.

Recent market analysis indicates that property values across top metros grew between 8% and 12% annually from 2022 to 2024. Meanwhile, select Tier-2 cities such as Indore, Coimbatore, and Surat recorded appreciation as high as 18%, driven by IT corridor expansion and improved transit connectivity. These variations highlight the importance of consistent pricing intelligence rather than relying on generalized national averages.

Below is a snapshot showing how structured pricing intelligence reveals disparities across major cities:

| City | Avg. Price per Sq. Ft (₹) | YoY Growth (%) | Dominant Property Type |

|---|---|---|---|

| Mumbai | 22,500 | 10.4% | Apartments |

| Bengaluru | 7,800 | 12.1% | Villas |

| Hyderabad | 6,200 | 14.3% | Apartments |

| Pune | 6,900 | 11.7% | Row Houses |

| Ahmedabad | 4,800 | 15.6% | Apartments |

They also aid in portfolio diversification by spotting emerging neighborhoods before demand surges. When paired with interest rate trends, infrastructure investments, and job growth patterns, Indian Property Price Scraping enhances predictive modeling, helping to minimize speculative risk and boost capital efficiency across residential and mixed-use property segments.

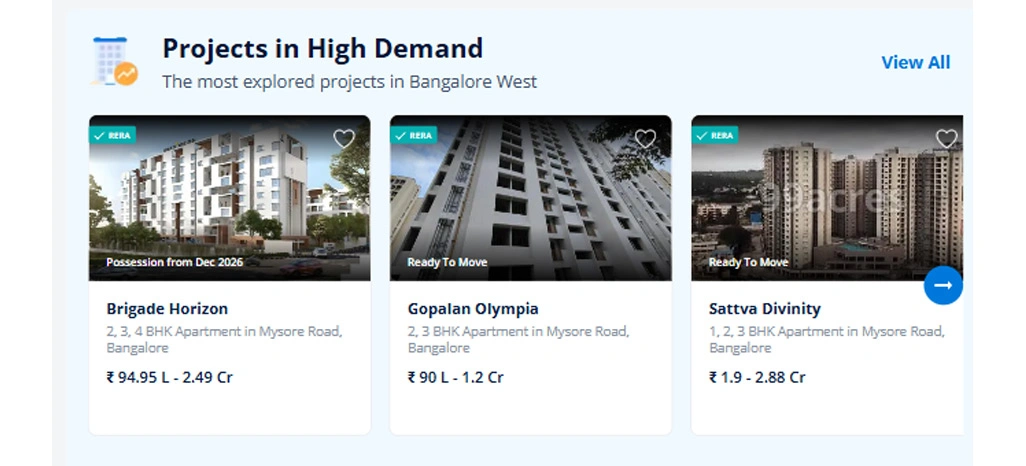

Benchmarking Market Position Against Competitors

The digital real estate ecosystem is becoming increasingly competitive as developers and brokers race to attract buyer attention through online portals. Understanding rival pricing strategies, unit configurations, and inventory movements is now essential for effective positioning. By applying Competitive Analysis Using Property Listing Data, organizations can benchmark their offerings against comparable listings and adjust pricing, amenities, or promotional tactics accordingly.

Industry data from 2024 suggests that homes featuring smart automation systems commanded price premiums between 9% and 14% over similar non-smart units. Properties offering immersive virtual tours also recorded 22% higher inquiry rates, reflecting the growing importance of digital-first marketing. These insights are especially valuable for developers planning new launches and brokers optimizing listing presentation strategies.

The table below demonstrates pricing differences among competing developers within the same micro-markets:

| Micro-Market | Developer A (₹/Sq. Ft) | Developer B (₹/Sq. Ft) | Price Gap (%) |

|---|---|---|---|

| Whitefield, BLR | 7,200 | 7,850 | 9.0% |

| Andheri East, MUM | 21,800 | 23,100 | 6.0% |

| Gachibowli, HYD | 6,000 | 6,750 | 12.5% |

| Hinjewadi, PUNE | 6,500 | 7,100 | 9.2% |

Ongoing competitive benchmarking enables smarter unit mix planning, optimized launch timing, and enhanced digital visibility, crucial for staying competitive in the online property space, while also allowing businesses to Extract Real Estate Data From Indian Web Platforms effectively.

City-Level Trends and Demand Forecasting

Beyond pricing and competitor behavior, structured listing intelligence plays a major role in understanding buyer demand and long-term urban growth patterns. By consolidating thousands of records into a unified Real Estate Property Dataset, analysts can examine seasonal demand shifts, supply absorption rates, and rental market dynamics with greater accuracy.

Between 2023 and 2025, rental listings in Bengaluru’s technology corridors increased by 27%, reflecting workforce migration and rising housing demand. In contrast, resale apartment inventory in central Delhi declined by 14%, signaling a preference shift toward suburban developments. Such movements highlight how urban expansion and lifestyle changes influence real estate supply distribution.

A city-wise trend overview is shown below:

| City | Total Active Listings | YoY Listing Growth (%) | Avg. Rental Yield (%) |

|---|---|---|---|

| Bengaluru | 98,000 | 21.4% | 3.8% |

| Hyderabad | 74,500 | 24.1% | 4.2% |

| Chennai | 62,300 | 16.9% | 3.5% |

| Noida | 58,700 | 18.7% | 4.0% |

| Kochi | 41,200 | 22.3% | 4.6% |

This intelligence helps predict oversupply risks, identify emerging rental hotspots, and pinpoint areas likely to see future price growth. Combined with demographic trends, job creation data, and transit project insights, Property Price Data Scraping India transforms city-level intelligence into a powerful tool for developers, investors, and policymakers.

How Retail Scrape Can Help You?

We deliver tailored scraping solutions designed to transform fragmented listings into structured intelligence. By integrating Indian Real Estate Data Scraping into your workflows, our solutions ensure you always work with clean, validated, and continuously updated datasets.

We help organizations:

- Monitor real-time listing updates across multiple portals.

- Identify pricing anomalies and regional variations.

- Compare developer inventories and market positioning.

- Track historical trends for forecasting and planning.

- Automate data collection to reduce manual effort.

- Build custom dashboards for strategic decision-making.

Our team combines advanced crawling technology with domain-specific data modeling to deliver insights that directly support investment, brokerage, and development strategies. From metro markets to emerging cities, we ensure your analytics remain comprehensive and future-ready. To further enhance decision accuracy, we also integrate City-Wise Real Estate Price Analysis India into customized reporting frameworks for deeper regional visibility.

Conclusion

The scale and diversity of India’s property market make data-driven intelligence indispensable. With Indian Real Estate Data Scraping, organizations can convert millions of digital listings into structured insights that guide pricing strategies, investment planning, and urban development decisions.

When combined with Indian Property Market Trends Data, this approach empowers stakeholders to act with confidence in a rapidly evolving market. Connect with Retail Scrape and take the next step toward smarter real estate decisions.