Introduction

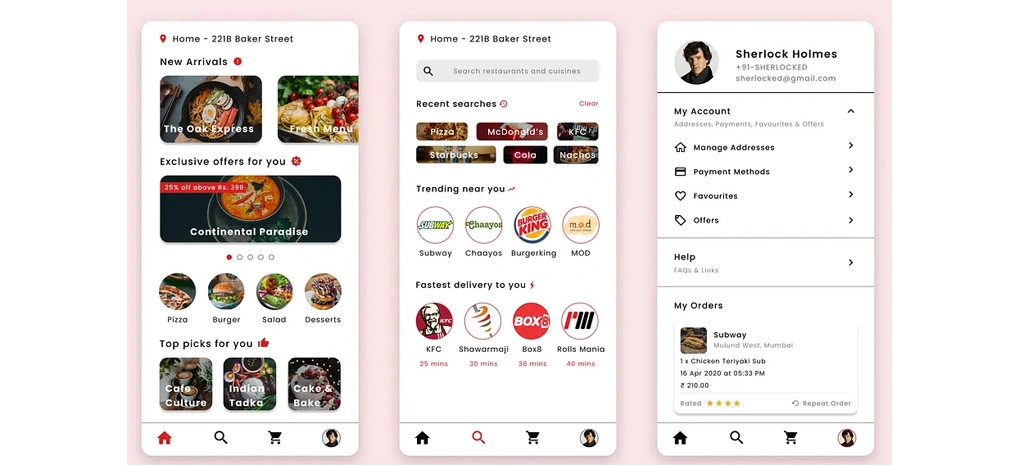

India’s food delivery ecosystem has evolved far beyond convenience. Platforms like Swiggy and Zomato are no longer just intermediaries between restaurants and consumers—they are real-time mirrors of changing consumer behavior, regional taste shifts, pricing sensitivity, and emerging food innovations.

In 2026, with millions of daily orders across metros and Tier-2/Tier-3 cities, Swiggy and Zomato generate massive volumes of structured and semi-structured data. When systematically extracted and analyzed, this data reveals emerging food trends far earlier than traditional surveys or reports.

This is where Swiggy & Zomato data scraping becomes a powerful intelligence tool.

This blog provides a deep analytical view of how scraping food delivery data uncovers what India is eating in 2026, how preferences are shifting, and how brands, restaurants, cloud kitchens, and investors can leverage these insights.

Why Food Delivery Data Matters More Than Ever in 2026

Consumer food behavior in 2026 is shaped by:

- Hyperlocal availability

- Rising health consciousness

- Inflation-driven price sensitivity

- Convenience-first consumption

- Experimentation with global cuisines

Traditional market research often lags by months. In contrast, scraped Swiggy & Zomato data offers near real-time insights into:

- What dishes are trending

- Which cuisines are gaining or losing popularity

- How pricing and discounts impact ordering behavior

- Regional differences in food consumption

Food delivery platforms have effectively become live food consumption dashboards.

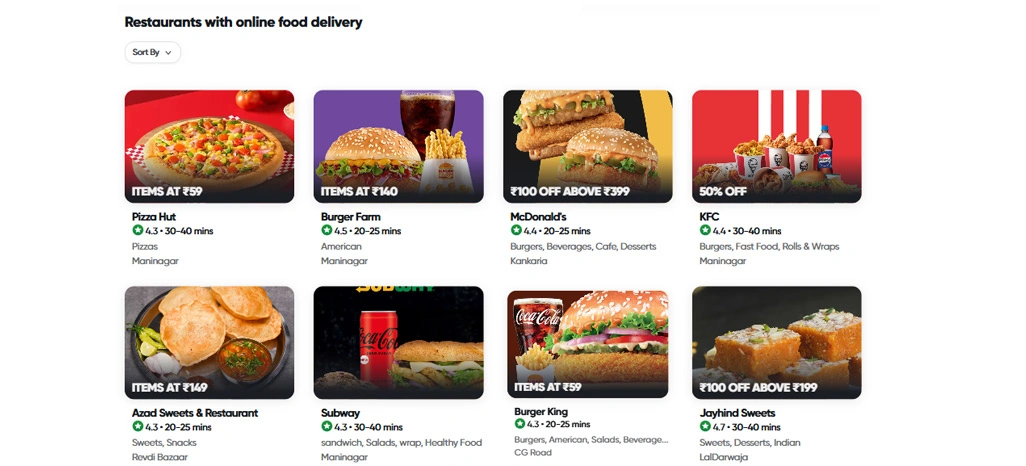

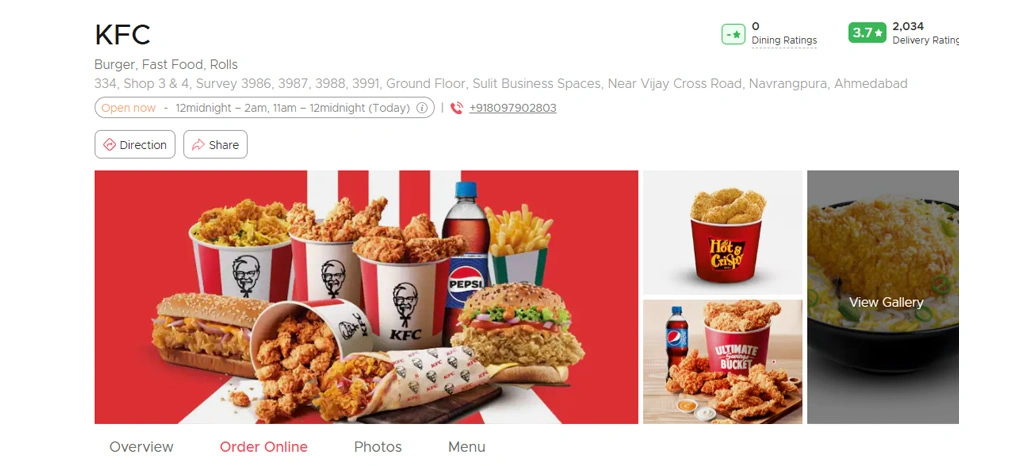

What Data Can Be Scraped from Swiggy & Zomato?

To uncover trends, it’s important to understand the breadth of data available on these platforms.

Key Data Points Extracted

- Restaurant name & brand type (local, chain, cloud kitchen)

- Cuisine tags

- Menu items & descriptions

- Item pricing & dynamic discounts

- Portion sizes & combos

- Ratings & review counts

- Delivery time & distance

- Bestseller tags

- City, locality & pin code

- Availability status (sold out / limited time)

When aggregated across cities and time periods, this data becomes a rich dataset for food trend analysis.

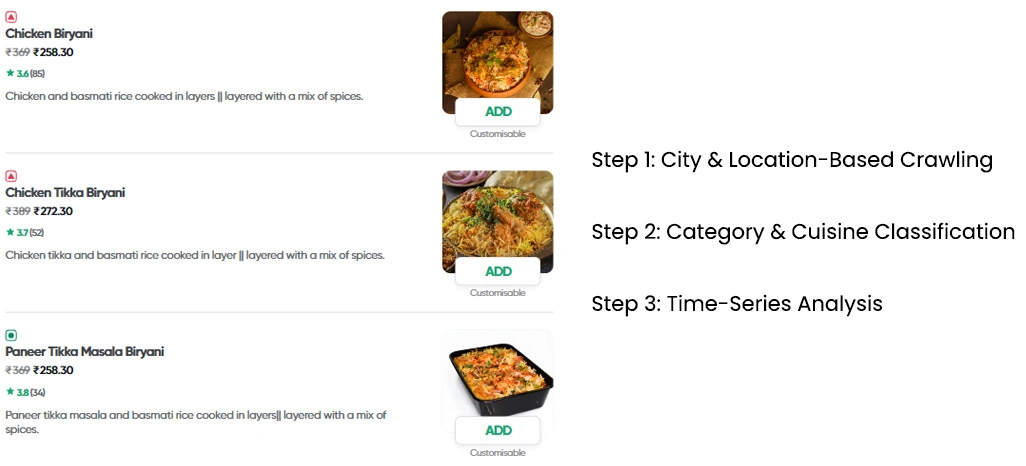

Methodology: How Data Scraping Reveals Trends

Step 1: City & Location-Based Crawling

Food preferences vary dramatically by geography. Scraping is done across:

- Metro cities (Mumbai, Delhi, Bengaluru)

- Tier-1 cities (Pune, Hyderabad, Chennai)

- Emerging Tier-2 markets (Indore, Surat, Kochi)

Location-aware crawling ensures trends are regionally accurate.

Step 2: Category & Cuisine Classification

Menu items are grouped into standardized cuisine and category buckets such as:

- Indian regional

- Fast food

- Healthy & diet

- Global cuisines

- Beverages & desserts

This enables trend comparison over time.

Step 3: Time-Series Analysis

By scraping data at regular intervals (daily/weekly/monthly), analysts track:

- Menu expansion or contraction

- Price increases or reductions

- Seasonal spikes

- Sudden popularity surges

Key Emerging Food Trends Uncovered in 2026

1. Rise of Regional Indian Cuisine Beyond Home States

One of the strongest insights from Swiggy & Zomato data scraping in 2026 is the pan-India spread of regional cuisines.

Observations:

- Kerala cuisine gaining traction in North India

- Maharashtrian snacks trending in Bengaluru

- North Eastern dishes appearing more frequently in metros

- Rajasthani and Gujarati thalis expanding beyond local markets

This reflects:

- Migration-driven taste transfer

- Increased cultural experimentation

- Cloud kitchens testing regional menus nationally

2. Health-Focused Menus Are No Longer Niche

In earlier years, healthy food was limited to salads and diet bowls. In 2026, scraped data shows health-first menus across cuisines.

Key Signals:

- High frequency of keywords like high-protein, keto, millet-based, low-carb

- Increased pricing tolerance for healthy meals

- Dedicated “Healthy Picks” sections expanding rapidly

Popular categories include:

- Protein bowls

- Millet rotis & dosas

- Sugar-free desserts

- Cold-pressed beverages

Health is now a default consideration, not a specialty segment.

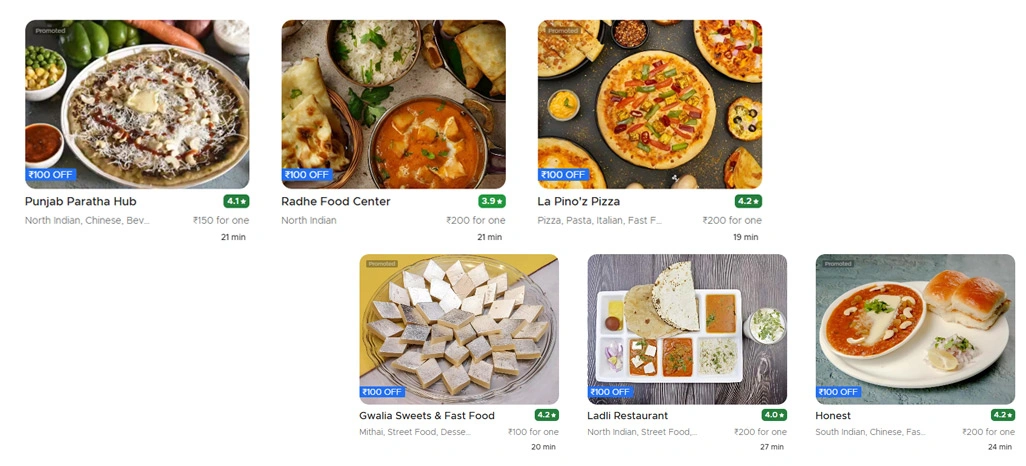

3. Value Combos Dominate Price-Sensitive Markets

Inflation and cost-of-living pressures have reshaped consumer behavior. Data scraping reveals:

- Growth in combo meals and family packs

- More “₹99–₹149” price brackets being promoted

- Discount-driven visibility boosts on listing pages

Restaurants that optimize value perception, not just price, outperform competitors in 2026.

4. Cloud Kitchens Outpace Traditional Restaurants in Menu Innovation

Scraped Swiggy & Zomato datasets show that cloud kitchens update menus 3–4x faster than dine-in restaurants.

Key Trends:

- Faster adoption of trending ingredients

- Rapid A/B testing of dishes

- Short-lived experimental menus

- Seasonal launches aligned with festivals or trends

This agility makes cloud kitchens trend accelerators on food delivery platforms.

5. Global Cuisines Are Being “Indianized”

Instead of authentic-only formats, 2026 data shows localized global cuisines winning consumer attention.

Examples:

- Indian-flavored tacos

- Desi-style ramen

- Butter chicken pizzas

- Paneer-loaded burgers

Scraped menu descriptions frequently combine global formats with Indian flavors, signaling hybrid taste preferences.

6. Dessert & Beverage Innovation Is Accelerating

Desserts and beverages show some of the highest menu churn rates. Insights from scraped data:

- Surge in fusion desserts

- Seasonal beverage launches

- Regional sweet adaptations

- Rise of low-sugar and vegan desserts

Beverages are increasingly used as high-margin upsell items.

7. Speed & Delivery Time Influence Ordering More Than Ever

In 2026, delivery time is a critical decision factor. Data correlations reveal:

- Restaurants with sub-25-minute delivery gain higher visibility

- Faster delivery increases order conversion even at higher prices

- Cloud kitchens located closer to dense areas dominate listings

Food is no longer just about taste—it’s about speed intelligence.

Pricing Trends Identified Through Data Scraping

Dynamic Pricing Is the New Normal

Swiggy & Zomato pricing fluctuates based on:

- Demand

- Time of day

- Weather

- Festivals

- Inventory availability

Scraped data shows:

- Peak-hour price inflation

- Discount-heavy off-peak windows

- Location-based pricing variations

Brands that monitor pricing daily gain competitive pricing advantage.

How Restaurants & Brands Use These Insights

Restaurants & Cloud Kitchens

- Menu optimization

- Price benchmarking

- Dish-level performance analysis

- Location-based expansion decisions

FMCG & Food Brands

- Ingredient demand forecasting

- New product development

- Flavor trend identification

Investors & Analysts

- Market demand signals

- Category growth tracking

- Platform dependency analysis

Aggregators & Analytics Firms

- Trend dashboards

- Competitive intelligence reports

- Predictive consumption models

Challenges in Swiggy & Zomato Data Scraping

While powerful, scraping food delivery data comes with challenges:

- Rapid UI & API changes

- Location/session dependencies

- Rate limits & access controls

- Data normalization complexity

- Frequent menu updates

This is why enterprise-grade scraping frameworks and APIs are essential.

Future of Food Trend Intelligence

By 2026 and beyond, food delivery data scraping will evolve into:

- AI-powered demand prediction

- Personalized food trend modeling

- City-wise consumption heatmaps

- Ingredient-level analytics

- Sustainability-driven menu analysis

Data will move from descriptive insights to predictive intelligence.

Conclusion

Swiggy & Zomato data scraping has emerged as one of the most powerful ways to understand real consumer food behavior in 2026. From regional cuisine expansion and health-focused menus to value-driven pricing and rapid cloud kitchen innovation, scraped food delivery data provides unfiltered, real-time insight into what India eats and why.

When analyzed at scale, this data helps restaurants innovate faster, brands plan smarter, and investors spot trends earlier than ever before. However, extracting and transforming this data into reliable intelligence requires robust infrastructure, location-aware crawling, and advanced normalization techniques.

This is where Retail Scrape plays a critical role. By enabling enterprise-grade Swiggy & Zomato data scraping and analytics, Retail Scrape empowers businesses to convert raw food delivery data into actionable food trend intelligence. In a fast-changing consumption landscape, Retail Scrape helps organizations stay ahead—not by guessing trends, but by reading the data behind every order.

In 2026, the future of food insights belongs to those who listen to the data—and platforms like Retail Scrape make that possible at scale.